If you have realized Solidly, you will have to have some knowing of the ve (three,three) token model. This could be a “trading” in the marketplace in the close to long term. In truth, there have been some “on the go” tasks to be created in accordance to this strategy from Solidly, the most vital of which is Hermes Protocol on Metis DAO – an Ethereum degree two undertaking.

In today’s short article we will get to know Hermes and his “mother” undertaking: Maia DAO.

one. What is Maia DAO?

Maia is a neighborhood-owned decentralized reserve currency protocol created on the Metis Andromeda network.

You can have an understanding of merely, Maia is a fork of Wonderland (Wonderland is a fork of Olympus DAO). This usually means that Maia is also aiming for a long lasting liquidity answer, the Maia protocol appropriates all the worth it consists of.

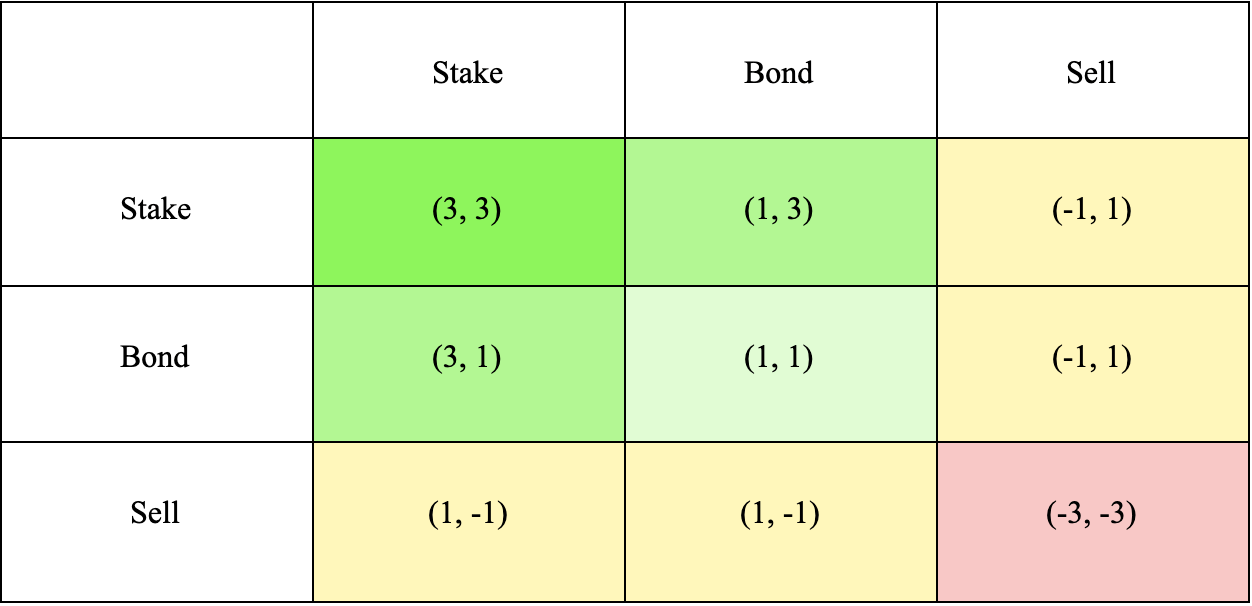

Maia also functions in accordance to game concept (three,three). In Maia there will be three actions that you can do with the corresponding score:

- Stake (+two)

- Bond (+one)

- Sale (-two)

Theoretically, the staking and bonding actions will advantage the development of the undertaking as it accumulates worth inside of the protocol and deflates the MAIA coin. On the contrary, the product sales actions will negatively have an impact on the undertaking.

Let’s presume Bob and Alice are on the similar protocol. When they each bet MAIA => MAIA the cost increases, the protocol also accumulates worth. When Bob bets, Alice binds, albeit not as effectively as in the preceding situation, but fundamentally, the protocol continues to increase. Conversely, if each promote (-three, -three), the protocol will reduce worth and crash.

The purpose why staking only has a score of +two, but when Bob and Alice are betting at the similar time, the score is (three.three) is simply because when staking, you need to have to acquire MAIA => MAIA increases the cost. Therefore, if two men and women are staking at the similar time, it will not only be (two.two) but it will be (three.three). Contrast with the situation of two men and women promoting with each other.

Note: When you join the protocol, you will not experience the phrase “bond”. The Maia Protocol employs the phrase “Minting” in location of “Bonding”. However, as the project’s white paper nonetheless employs “bonding” when it comes to game concept, so I nonetheless use “bonding” in this short article.

two. How to join the Maia Protocol

Because the protocol largely revolves close to three actions, so you can make revenue primarily based on these actions only.

two.one. Stakeout

Staking is the primary technique employed by Maia to accumulate worth in the protocol. You can order MAIA and then stage it to the undertaking web-site to acquire rebase rewards. In concept, the amount of MAIAs you personal ought to improve more than time. If the hold is lengthy adequate, even if the cost of MAIA fluctuates in a downtrend (worst situation)you can nonetheless have a superior revenue.

When you bet on MAIA, you will acquire the equivalent sMAIA token. The sMAIA stability will instantly improve following every single rebase. sMAIA could acquire / promote or participate in other DeFi protocols.

two.two. Coinage (bond)

It is a secondary technique that Maia employs to accumulate worth. Users can acquire MAIA at a discounted cost by way of bonding. If you feel that in the close to long term (when the bond will expire), the MAIA cost will rise, you can commit to owning MAIA at a discounted cost in the long term. Basically, your money will be accumulated in the protocol, you have the chance to make a revenue primarily based on your predictions.

two.three. Sale

This is unquestionably a thing the protocol discourages, as it decreases the worth of each the MAIA token and the protocol. However, from an investor’s stage of see, it is important to get revenue at the appropriate time. Therefore, will not neglect to “sell”.

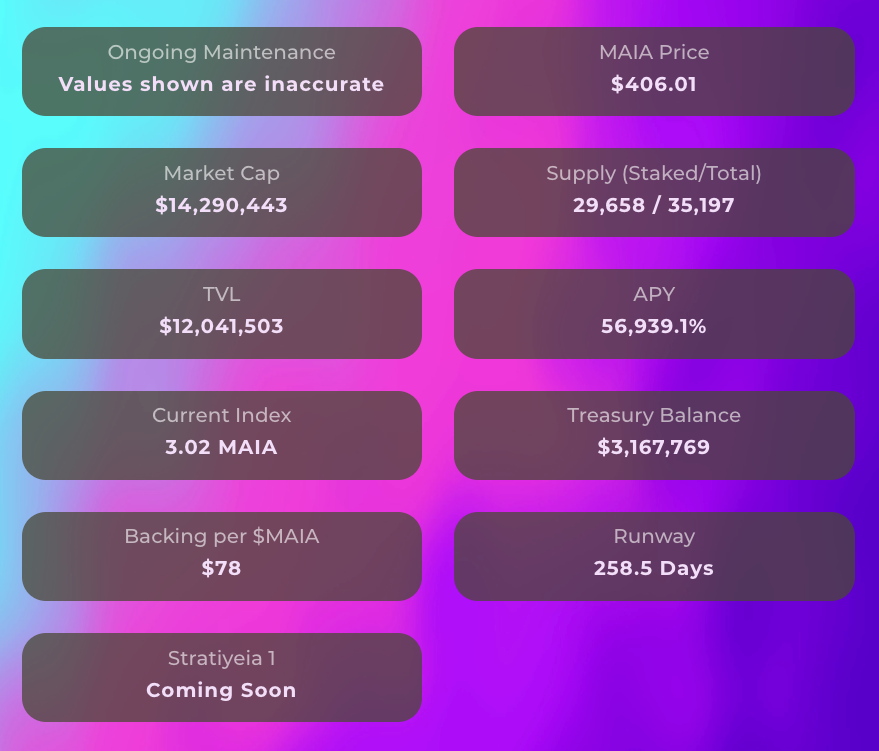

Currently, the Maia protocol is reaching TVL at $ twelve million with Treasury at $ three.one million, mAIA token at $ 406. To me these are acceptable numbers for a new ecosystem like Metis DAO.

three. Hermes Protocol

Hermes is a byproduct of Maia Protocol, presently does not have a token (You can experiment to acquire retroactive options)created on the basis of the strategy of the tick (three,three) of Andre Cronje.

You can discover much more about ticks (three,three) in this paragraph.

Hermes is an AMM created on the basis of the Metis DAO that gives its end users with a lower-value, lower-slip trading answer. The protocol is geared in the direction of incentivizing commissions as a substitute of income extraction schemes. Liquidity Providers (LPs) will acquire a reward in accordance to the mechanism: a hundred% of the commissions will be distributed weekly primarily based on the votes of the holders of veHermes.

Some characteristics of Hermes

- Low value (.01%)

- Commissions will be paid by way of trading actions, not native tokens

- Interface compatible with Uniswap V2

- It supports the creation of uncomplicated liquidity pools

- Incentive with commissions as a substitute of symbolic inflation

- There is a mechanism for building a “war” comparable to Solidly

- Hermes can be blocked from one week to four many years. The longer you block, the much more veHerme you get

According to the undertaking, HERMES will be the token of the protocol, distributed by way of an airdrop:

- six% – MAIA stakers snapshot (1st time)

Date: April two, 2022

Distribution: one,200,000 veHERMES

- four% – MAIA stakers snapshot (2nd time)

Date: to be defined

Distribution: 800,000 veHERMES

- three% – Hermes LP Snapshot (1st time)

Date: February 15, 2022

Distribution: 600,000 veHERMES

- two% – Hermes LP Snapshot (2nd time)

Date: to be defined

Distribution: 400,000 veHERMES

As this kind of, you can staking MAIA or participate in the provision of liquidity on HERMES to acquire the airdrop.

four. End

Being at the forefront of “trends” is normally an chance to make superior revenue. Ve (three,three) has been really productive on Fantom in specific and the DeFi neighborhood in common, so we have the basis for expecting a comparable item on Metis DAO to resonate.

What do you consider of MAIA and HERMES? Don’t neglect to depart remarks and go over in the Coinlive neighborhood.

Poseidon

Maybe you are interested: