Having MakerDAO increase the curiosity fee on DAI stablecoin financial savings by up to one% really should assist “minimize capital outflows” from DeFi to conventional fiscal markets.

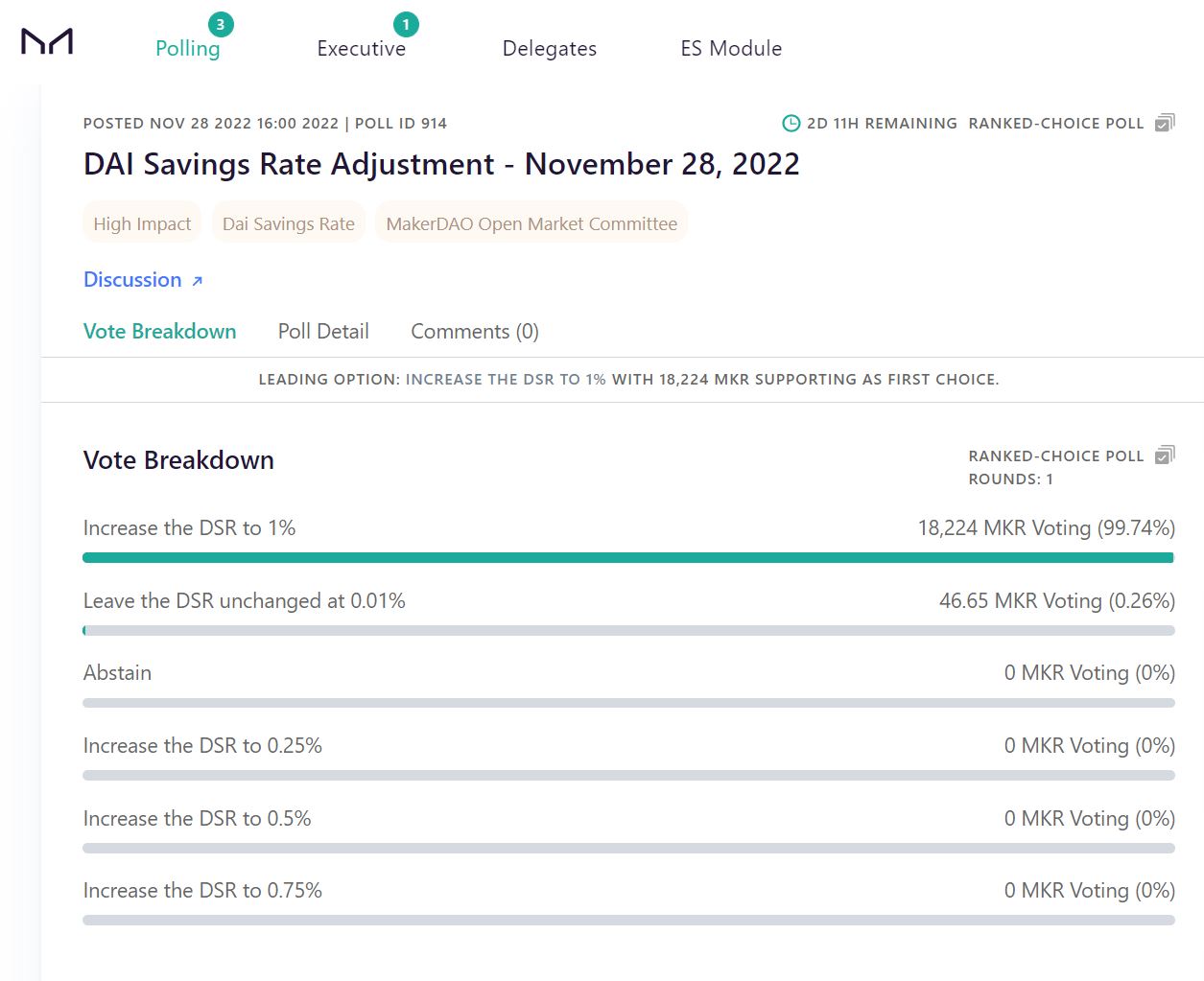

The MakerDAO neighborhood is now voting on a proposal to improve the yearly reward for the DAI stablecoin, which incorporates a variety of increments this kind of as initial%, .75%, .five%, .25% or unchanged with respect to the degree .01% present.

The neighborhood of MKR owners has begun voting considering the fact that November 28th, voting is anticipated to finish on December 1st. At the time of creating Coinlive, a 99% of votes agreed to raise interest rates to 1%. But the final results can be modified when the neighborhood utilizing preferential voting chooses a distinct increase.

The voting time period will near at 11pm on December 1st (Vietnam time).

The vote comes as curiosity in DeFi plummets amid cooling demand for cryptocurrency lending. Meanwhile, curiosity fee in conventional markets it improved drastically thanks to the aggressive choice of the US Federal Reserve to increase curiosity charges, foremost to capital flight from DeFi.

Maker kicked off its income development technique by donating a portion of $seven.seven billion operational reserves, which are diversified across investment portfolios to stay away from the chance of relying heavily on USDC. Generally, the cooperation with Coinbase when agreed to transfer $one.six billion in custody to the exchange to obtain Annual yield of one.five%. Or allocating investments to conventional assets this kind of as government bonds.

.@MakerDAO is now creating 50% of its revenues from authentic-planet assets, mainly MIP65 ETF quick-phrase bonds and GUSD premiums.

Double the revenues in the final handful of weeks and that is just the starting.

I’m beginning the thread to reward DAI holders for boosting development. pic.twitter.com/FqZNjuNXWs— Sebastien Derivaux (@SebVentures) November 4, 2022

MakerDAO contributors have recommended that a portion of the new income really should be “redistributed” to DAI holders, creating the stablecoin much more interesting to cryptocurrency traders. On the other hand, this would be a substantial overhead for MakerDAO if the proposal is thriving.

Synthetic currency68

Maybe you are interested: