MakerDAO could broaden its attain closer to the regular monetary room if its proposed integration with a Pennsylvania-based mostly financial institution is authorized this week.

Specifically, MakerDAO is voting on a proposal that would deliver a regular financial institution into the ecosystem for the to start with time, making it possible for the financial institution to borrow towards its very own assets making use of the options accessible in DeFi. The proposal gives for the creation of a one hundred million DAI fund for Huntingdon Valley Bank (HVB).

This will in essence enable Maker start out lending in the serious planet by a totally serviced regular institution even though meeting banking specifications.

The to start with integration of ensures from a US-based mostly financial institution into the DeFi ecosystem is approaching.

Maker Governance votes to include RWA-009, a holding construction to the DAI debt ceiling of one hundred million proposed by Huntingdon Valley Bank, as a new sort of ensure in the Maker Protocol pic.twitter.com/fOdusdjCFS

– Maker (@MakerDAO) July 4, 2022

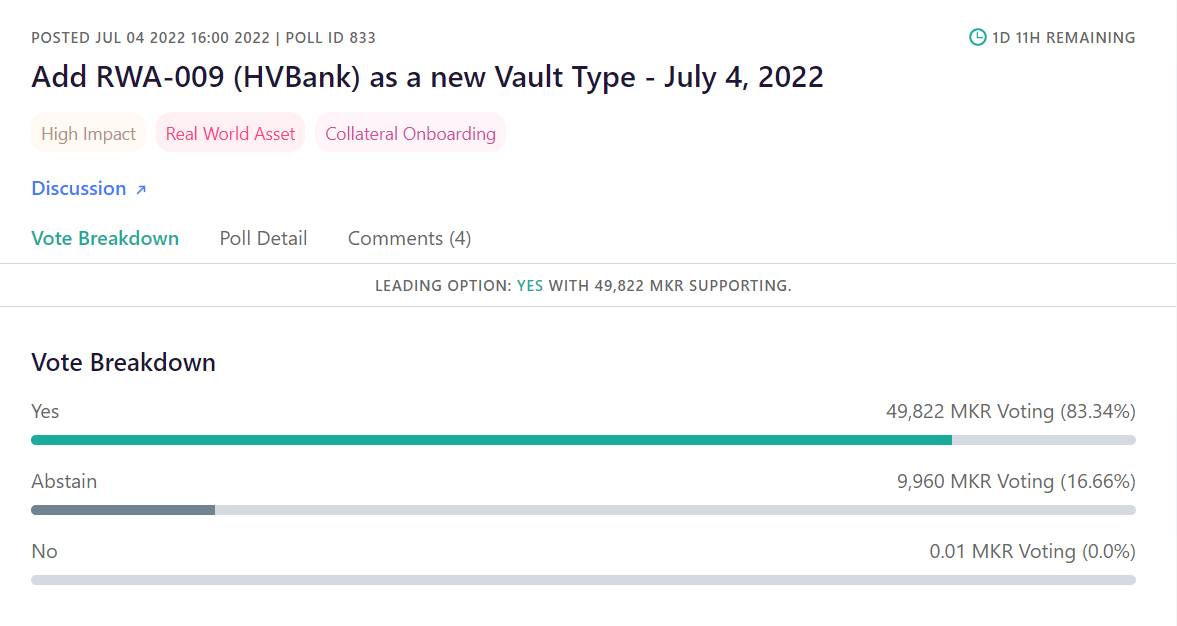

At the time of creating, there are presently 83.34% in favor and sixteen.66% towards this proposal.

The deal with HVB is crucial to Maker for the reason that the platform is not presently licensed to situation USD-denominated loans straight to borrowers. However, the particular partnership with HVB will enable MakerDAO move closer to realizing this target.

In October 2021, MakerDAO also reached a substantial milestone in the regular market place when Société Générale Bank utilized for a “historic” twenty million DAI loan on the platform. Not only that, the ambition to set foot in actuality was also reinforced by Maker by the financing of mortgages in the serious estate market place at the starting of final 12 months.

Returning to the most important subject, the interaction course of action amongst MakerDAO and HVB is described in the following buy. First, MakerDAO in Delaware will produce a believe in fund (MBPTrust) to hyperlink HVB’s present capital with Maker’s provided DAI stablecoin. The believe in will make sure that DAI minting / burning from Maker’s vault is completed effectively and will take care of company problems with HVB.

This application proposed a legal framework in which Huntingdon Valley Bank enters into a Master Purchase Agreement with a believe in for the advantage of MakerDAO.

For more studying, we endorse the following threads:

– Maker (@MakerDAO) July 4, 2022

Initially, HVB will hold 50% of the loans issued by the over plan, but will inquire MakerDAO to slowly decrease the ownership fee to a minimal of five%. The rest will be below the management of MBPTrust.

Additionally, HVB will advantage from proficiently raising the legal loan restrict to more than $ seven million per borrower. Assuming the HVB integration is profitable soon after some time, MakerDAO believes the identical MBPTrust model can be applied to apply it to other regular banking institutions.

The proposed integration with the HVB financial institution comes a number of days soon after yet another determination to align itself far more with regular finance. As a consequence, MakerDAO voted in favor of investing $ 500 million in US Treasury bonds.

Synthetic currency 68

Maybe you are interested: