After a hiatus due to worries about the detrimental results of liquidity bombs, MakerDAO has officially relaunched the Direct Deposit Module (D3M) system. The very first spouse of this comeback is the lending platform Aave.

On MakerDAO’s Twitter web page, the protocol explained it would relaunch D3M, with credits in the kind of DAI injected into the lending markets on Aave.

🌊 MakerDAO reactivates the @AaveAave Direct Deposit Form (D3M)

Through a wholesale credit score line referred to as DAI, D3M facilitates the interaction involving Maker’s credit score engine and Aave’s lending marketplace, making sure a secure loan price for Aave’s DAI consumers. pic.twitter.com/gZ8fxXFGqA

— Creator (@MakerDAO) February 28, 2023

After a time period of proposals and votes on the MakerDAO neighborhood, the D3M alternative will be implemented to stability provide and demand, making sure curiosity price stability for the DAI stablecoin.

Previously, in May 2022, MakerDAO announced it was suspending D3M due to liquidity troubles on lending platforms like Aave or Compound. This stage was deemed important at the time, in purchase to reduce the ripple result and needless struggling.

> See additional: MakerDAO has stopped “pumping money” for Aave out of concern of Celsius hazards

This move demonstrates that DeFi protocols have at first returned to typical operation, following several occasions in 2022 this kind of as the collapse of stablecoin exchange UST or FTX.

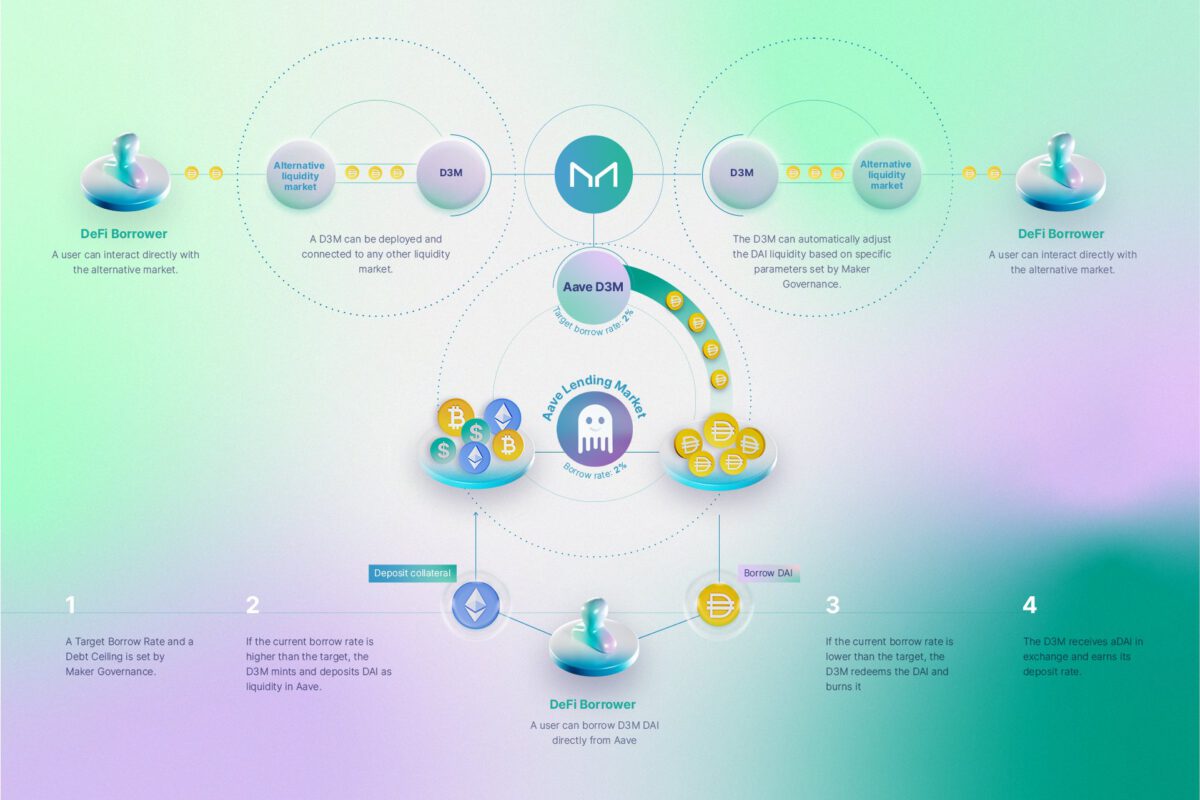

D3M will be the coordination layer, assisting to stability the quantity of collateral and the quantity of DAI lent to the market place. In individual:

- If loan demand is large, the curiosity price is over the target degree, D3M troubles additional DAI to stability the curiosity price.

- Conversely, if the curiosity price is beneath the target degree, D3M will roll back to cut down the provide of DAI, so bringing the curiosity price down to the target threshold.

From there, consumers on Aave can simply accessibility DAI loans with a a lot additional secure curiosity price than the normal volatility.

However, D3M’s latest debt ceiling will be extremely minimal, $five million with a target curiosity price of two%.

The proposed reactivation of Aave D3M has been authorized and distributed as a result of the final executive vote of MakerDAO.

This new implementation of Aave D3M has set an original debt ceiling of five million DAI and a target lending price of two%.

— Creator (@MakerDAO) February 28, 2023

If the market place gets additional energetic and optimistic in the close to long term, MakerDAO’s proposal to increase the debt ceiling is fully possible, so assisting the movement of capital to lending platforms like Aave develop into smooth and plentiful.

D3M with a debt ceiling of five million DAI distributed to @AaveAave protocol.

five million fresh DAI produced and provided a @AaveAave DAI market place of the protocol.

🌊🌊🌊 pic.twitter.com/prTVJI9i4O

— Creator (@MakerDAO) February 28, 2023

At the time of this creating, the quantity of capital employed for D3M has quickly reached the $five million ceiling.

Synthetic currency68

Maybe you are interested: