The price of Mantra (OM) has seen incredible growth, increasing by 183.20% in the last 30 days. On November 18, OM hit a new all-time high, and is currently trading around 10% below that level.

Despite the impressive performance, technical indicators suggest its trend is losing momentum. The possibility of OM breaking resistance to test new highs or facing a correction depends on how the current unclear signals develop.

The Trend of OM Is Fading

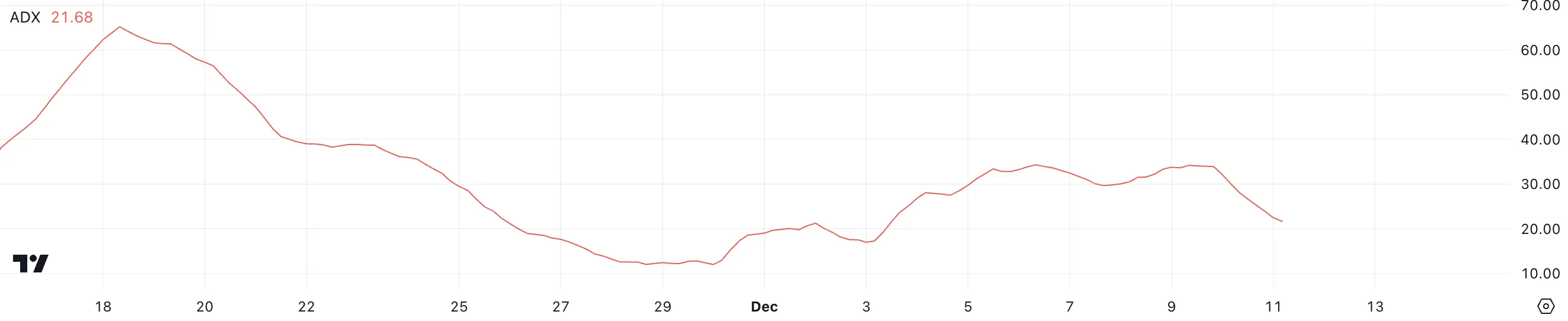

Mantra’s Average Directional Index (ADX) is currently at 21.6, a sharp decline from 35 just a day earlier. This drop shows that the strength of OM’s uptrend is weakening, even though the price is still rising.

A lower ADX reading suggests that while the trend remains in place, the momentum needed to sustain significant gains may be lacking. If ADX continues to decline, the uptrend could falter, leaving OM vulnerable to a correction or reversal.

ADX measures the strength of a trend, with values above 25 representing a strong trend and below 20 indicating a weak or no trend. At 21.6, OM’s ADX is in the intermediate zone, signaling that the uptrend is losing momentum but has not completely dissolved.

For OM price to maintain its upward trajectory, ADX needs to rise back above 25, reflecting a recovery in momentum. If ADX stabilizes around current levels, prices could converge or progress more slowly, highlighting the need for renewed buying interest to maintain the uptrend.

Ichimoku Cloud Shows Cautious Next Steps for Mantra

Currently, OM’s Ichimoku Cloud is showing mixed signals. Price is above the cloud, which typically indicates an uptrend, but the cloud itself is flat, indicating limited momentum.

The blue line (Tenkan-sen) has moved below the red line (Kijun-sen), which is a negative signal. However, the green cloud ahead suggests that Mantra prices may remain on an upward trajectory if the RWA (Real Asset) story regains its traction.

The Ichimoku Cloud is a comprehensive indicator that provides a view of trend direction, momentum, and support/resistance levels. Prices above the cloud signal positive conditions, while prices below the cloud indicate negative sentiment. With OM trading in the cloud but momentum weak, trends could converge.

To confirm a stronger uptrend, the price needs to remain above the cloud while Tenkan-sen crosses back above Kijun-sen, signaling a rebirth of positive energy. If the price falls below the cloud, a trend shift to negative is possible, aiming for lower support levels.

OM Price Forecast: A New High Coming?

OM’s Exponential Moving Averages (EMAs) are currently pointing to an uptrend, with the shorter EMAs above the longer EMAs.

However, the narrowing gap between the EMAs shows weakening momentum, signaling that the trend may change soon. This reflects growing uncertainty in the market as buyers and sellers compete for dominance.

If the uptrend continues, OM could rise to test resistance at $4.29, and a break above this level could push the price to $4.53, marking a new all-time high and established Mantra as one of the pioneers among RWA fellows.

Conversely, if a bearish trend emerges, OM price could test support at $3.41, representing a potential 16% decline. The EMA’s narrowing gap shows the importance of closely monitoring price movements to spot signs of a breakout or downturn.