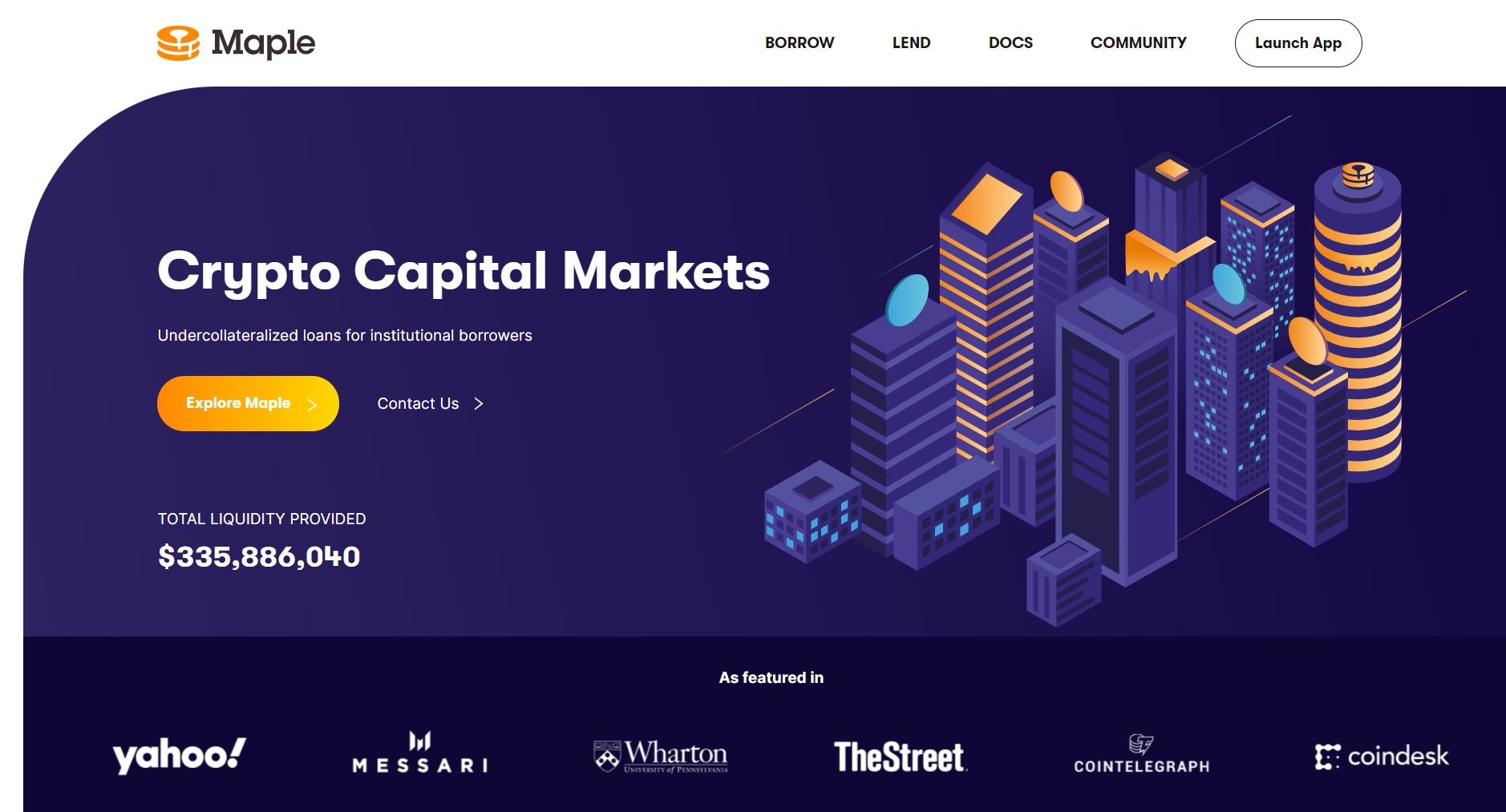

Maple Finance stated it has developed a exclusive crypto loan pool for huge institutions to borrow revenue in the type of cryptocurrency.

On the evening of November 18, Maple Finance, a DeFi protocol specializing in lending and lending, announced that it has manufactured the to start with syndicated loan in the DeFi sector. The to start with organization to borrow revenue from Maple was Alameda Research, a crypto investment fund affiliated with the FTX exchange.

In the standard fiscal sector, syndication is a phrase utilised to refer to lots of organizations (normally banking institutions) that function with each other to lend revenue to the exact same small business. This type of loan will decrease the threat to the loan company in the occasion of the borrower’s insolvency.

Alameda Research has pledged to borrow $ 25 million from Maple Finance’s corporate loan pool, which is also the project’s only institutional consumer so far. The Maple Finance loan curiosity fee is set in the eight-ten% / 12 months assortment

On the other hand, the institutions that lend by means of Maple Finance are at present CoinShares, Abra and AscendEX. The issue for acquiring corporate credit score from Maples is that the organization is not native to the United States and should undergo a thorough KYC and AML due diligence course of action. Maple Finance at present has a program to maximize the complete pool quantity to $ one billion inside the up coming 12 months.

Synthetic Currency 68

Maybe you are interested: