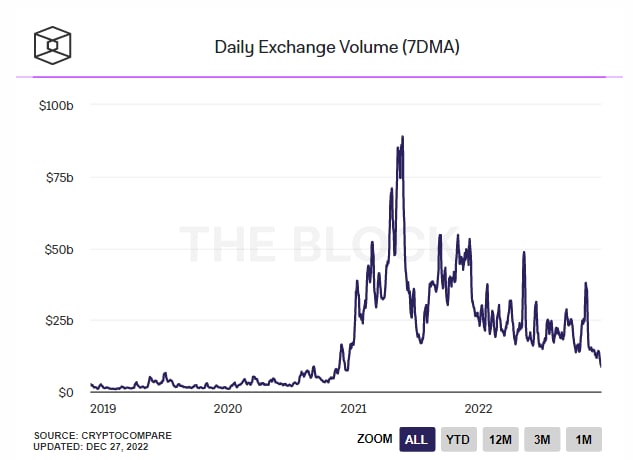

Daily spot trading volume drops under $9 billion, its lowest considering the fact that December 2020, just after FTX unpredictable catastrophe.

The day-to-day trading volume of the spot marketplace on cryptocurrency exchanges plummeted, surpassing the $ten billion mark in December 2020, in accordance to The block.

Spot trading volume fell to $9.two billion on Dec. 25, prior to continuing to plunge to $eight.five billion on Dec. 27.

The final time the marketplace reached a day-to-day volume under USD ten billion was on December 17, 2020, just when the rate of Bitcoin passed the USD twenty,000 peak. So far, Bitcoin has also cleared the $twenty,000 mark, but has began a downtrend and is trading all over . $sixteen,661.

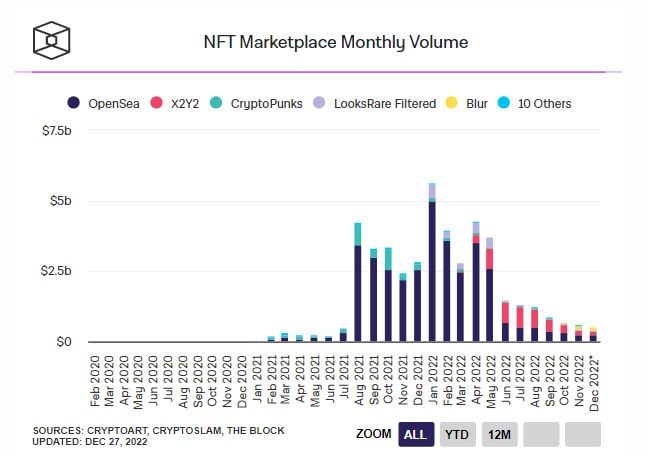

NFT’s overall performance is no improved both, product sales have continued to decline considering the fact that April.

As reported by Coinlive final month, the cryptocurrency marketplace is struggling to “recover” just after the bitter consequences left by the FTX exchange and its subsidiary Alameda Research. Both of these units are a hand created by former CEO Sam Bankman-Fried and have been after a big player with important influence on the all round marketplace.

According to information analyst Kaiko, the market’s means to soak up substantial orders (about two% of the rate of Bitcoin) has turn into exceptionally weak. Users also seem to be to be retiring and not going into trades at the present stage.

Synthetic currency68

Maybe you are interested: