Coinbase and Binance are enjoying a slice of marketplace share immediately after the collapse of FTX in spite of the several complications that are possessing a solid effect on each exchanges.

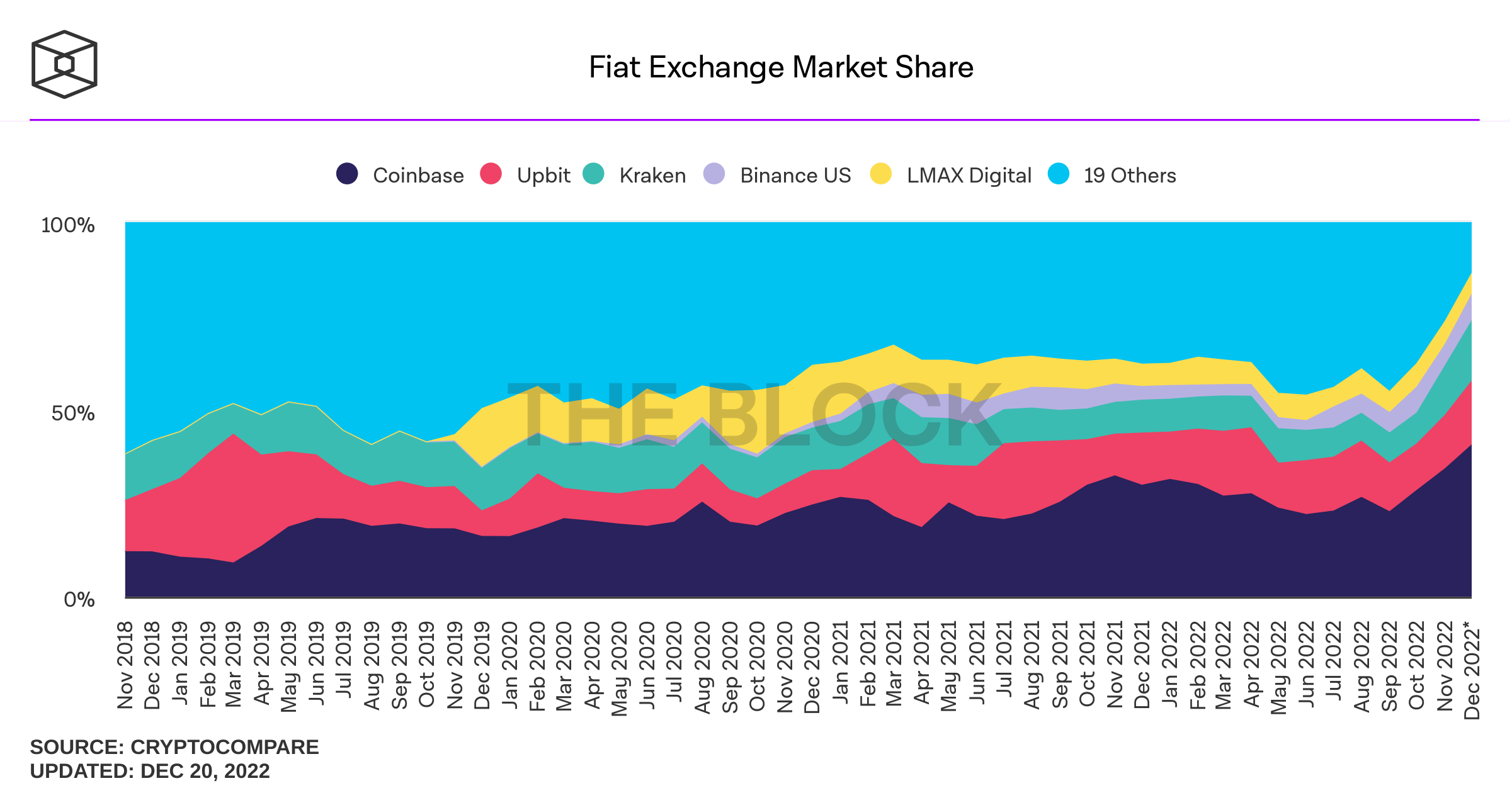

Despite the complications in industrial operations, the revenues of the floor in 2022 could lessen by 50% in contrast to the figure reached in 2021, primary the stock to touch a new very low, falling by 87% immediately after 1 12 months, Coinbase’s marketplace share on the The fiat exchange marketplace is nonetheless just about doubling, increasing to forty% from 22.eight% in September 2022.

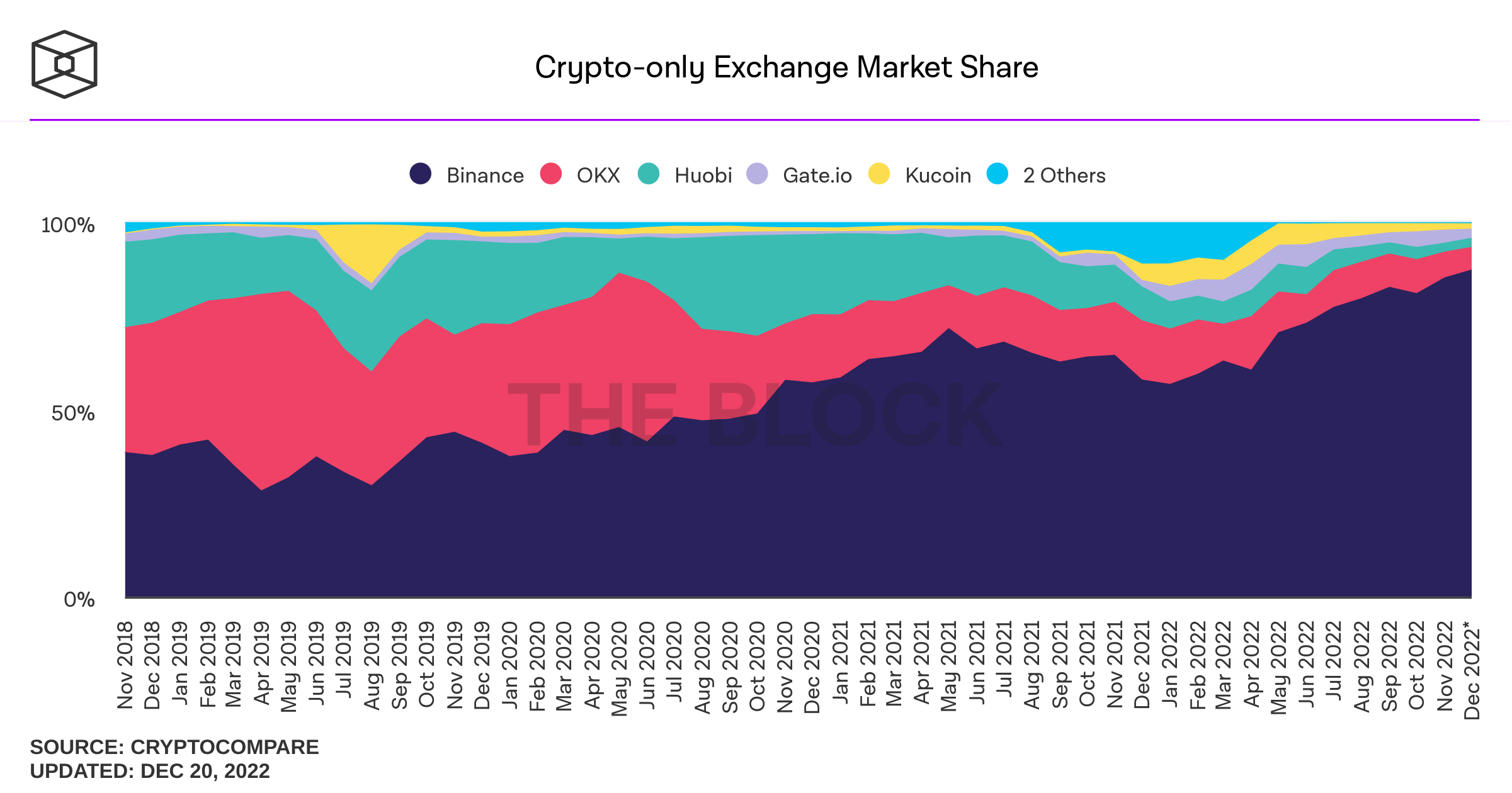

Next is the Binance exchange, led by a thirty% improve in trading volume on the exchange in November 2022 immediately after the FTX bankruptcy, Binance’s marketplace share in cryptocurrency-only exchanges enhanced by 87% in December 2022 from 82.seven% in September 2022.

As for Binance’s situation, if the exchange did not encounter a series of FUDs in early December 2022, stemming from illiquidity rumors, several income laundering allegations, and difficulties from US authorities, for the corporations For assessment, maybe Binance’s ownership stats are even additional spectacular.

Because for the duration of the time period of the FUD meeting, the quantity of income withdrawn from Binance constantly skyrocketed, partially affecting the exchange’s marketplace share.

The recent consequence is not as well surprising since in advance of the bankruptcy, FTX was the 2nd biggest exchange in the marketplace, so it is essential for end users to move to substantial-high quality exchanges in the publish-crisis sector this kind of as Coinbase and Binance.

However, the marketplace share growth of important exchanges is possible to be even additional explosive and this is also 1 of the important trends advised in CoinDesk’s Top ten Crypto Trend Predictions 2023 List.

Synthetic currency68

Maybe you are interested: