- Michael Saylor confirms Strategy’s daily Bitcoin purchases this week.

- BTC and MSTR stock rise as a result.

- Institutional confidence in Bitcoin strategy increases.

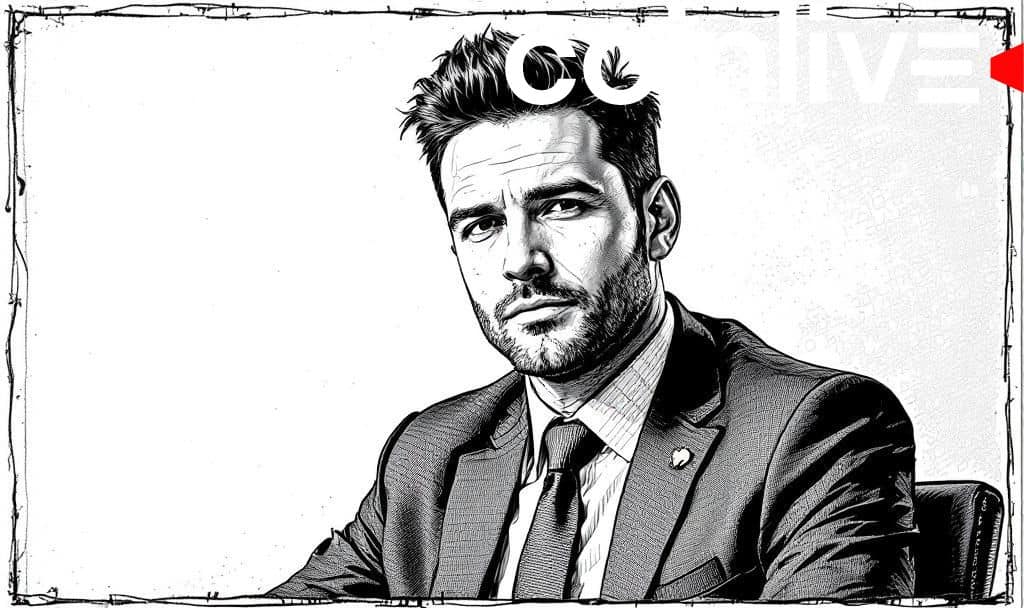

Michael Saylor confirmed that Strategy purchased Bitcoin daily this week, maintaining accumulation amid market volatility.

This sustained buying strategy reinforces confidence in Bitcoin’s value, positively affecting BTC prices and Strategy stock, while boosting market sentiment and liquidity.

Michael Saylor, Executive Chairman of Strategy, confirmed through his official X account that his company has been purchasing Bitcoin daily. Rumors of a sale were dismissed, solidifying the company’s position as a pivotal Bitcoin holder.

Saylor emphasized that Strategy’s BTC acquisition is continuing amid Bitcoin’s volatility. The company, once known as MicroStrategy, has bought significant amounts, driving market chatter about institutional influence in the crypto space.

Strategy’s actions led to a noticeable increase in Bitcoin’s price and a parallel rise in MSTR stock value by 18%. The company’s commitment to acquiring Bitcoin has reinforced investor confidence in both BTC and Strategy.

This activity underscores a strong institutional endorsement of Bitcoin, potentially influencing broader market sentiment. The ongoing purchasing has also reduced BTC sell pressure on major exchanges, reflecting a shift in liquidity.

Historical patterns suggest that Strategy’s previous announcements have driven similar price surges, with recent actions poised to mirror past impacts. Traders and market analysts are closely watching these strategies as systemic market drivers.

Experts like CZ from Binance and Raoul Pal from Real Vision have noted the broader implications. They highlight Saylor’s use of dollar-cost averaging strategies, providing a model for other investors in volatile markets, enhancing confidence in Bitcoin.

Michael Saylor, Executive Chairman, Strategy – “Strategy bought Bitcoin every day this week. BTC’s volatility comes with the territory. We are not selling. We are accumulating.” source

For those looking to track the financial markets and the impact of such decisions on Bitcoin, the TradingView Media and Charting Platform offers insightful data analysis and charts.