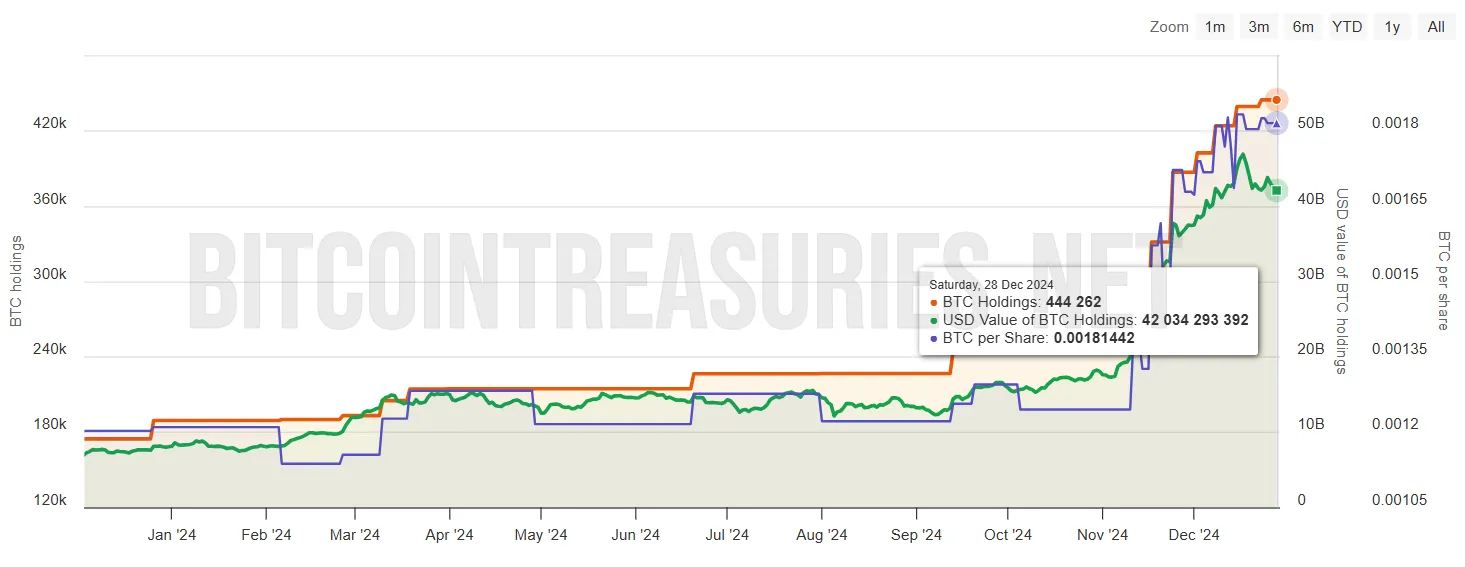

Michael Saylor, co-founder of MicroStrategy, has reignited speculation about the company’s next move to own more Bitcoin.

On December 28, Saylor used social network

A Sign of Upcoming Bitcoin Buying?

In the post, Saylor said the graph had “worrying blue lines,” leading many to speculate that another massive buying spree could be coming. In recent weeks, similar messages from Saylor have often preceded official announcements of major investments in Bitcoin.

“Worrying Blue Lines on SaylorTracker,” Saylor said.

MicroStrategy is on a Bitcoin buying spree, amassing over 192,042 BTC at an estimated cost of $18 billion. During this time, the price of Bitcoin has increased from $67,000 to $108,000, while MicroStrategy’s stock price has increased more than fivefold this year, now trading around $360 — up 400% on indexes since the beginning of the year up to now.

MicroStrategy’s stock performance and presence in the Nasdaq-100 have been impressive. The shift from its core business of enterprise data analytics to a strong focus on Bitcoin accumulation has made the company the largest public owner of the cryptocurrency. However, this bold strategy has faced many mixed opinions.

Some market participants said Saylor’s announcement to buy Bitcoin created volatility. Critics assert that when the transactions are announced, day traders often short Bitcoin, leading to a drop in price and a plunge in MicroStrategy’s stock price.

“The problem with Saylor’s buys is that he announces them, then day traders immediately start shorting BTC because they know the big buyers are done buying. Bitcoin then plummeted, and MSTR stock fell, not rose,” said one crypto trader said.

Furthermore, it is believed that this shopping pattern is affected by the plan to stop buying Bitcoin in January, a period when transactions will be suspended.

However, early signs suggest that Bitcoin buying will not stop anytime soon. Instead, MicroStrategy is preparing for its next steps, including increasing authorized shares of Class A common stock and preferred stock. The proposal seeks to expand class A shares from 330 million to more than 10 billion shares and preferred shares from 5 million to 1 billion shares.

Market observers believe that this move will significantly increase the likelihood of future stock issuance, allowing the company to allocate more capital to Bitcoin purchases.