Michael Saylor, Chairman of the Board of Directors of MicroStrategy, has outlined a Bitcoin strategy that positions the United States as a global leader in the digital economy.

The move comes as his company expands its Board of Directors from six to nine members, bringing in leading cryptocurrency advocates to strengthen its strategic focus on digital assets.

Saylor Supports Bitcoin Reserves

On December 20, Saylor explained that his vision revolves around deploying the Strategic Bitcoin Reserve (SBR) to address economic challenges, strengthen USD dominance, and create bullish opportunities. unprecedented growth in the digital assets sector.

“A strategic digital assets policy can strengthen the USD, neutralize the national debt, and position the United States as a global leader in the 21st century digital economy — empowering millions businesses, driving growth and creating trillions in value,” Saylor write on X.

Saylor’s proposal outlines how a solid digital assets policy could spark a capital markets renaissance, unlocking trillions in value. He envisions a $10 trillion digital currency market driving demand for US Treasuries while growing digital assets.

He also believes that expanding this market could raise the value of the digital economy from $1 trillion to $590 trillion, with the United States leading the way.

“Establishing a Bitcoin reserve has the potential to create $16–81 trillion in value for the U.S. Treasury and provide a path to offset the national debt,” Saylor said.

Despite these bold claims, critics like venture capitalist Nic Carter remain skeptical. Carter argued that the SBR concept lacks clarity and could destabilize markets rather than strengthen the dollar.

He pointed to Bitcoin’s volatility, citing its recent price drop from over $108K to $92K, as evidence that it may not be a reliable reserve asset. Additionally, Carter believes that such a move could weaken the USD’s global position instead of strengthening it.

“I don’t support the Strategic Bitcoin Reserve, and you shouldn’t either,” Carter declare.

New MicroStrategy Board Member Brings Crypto Expertise

According to one file 20 SEC, the Bitcoin-focused company’s board elected new board members. New additions include Brian Brooks, former CEO of Binance US and a prominent figure in crypto regulation; Jane Dietze, Chief Investment Officer at Brown University; and Gregg Winiarski, Chief Legal Officer at Fanatics Holdings.

The new board members bring diverse expertise from finance, technology and emerging markets, consistent with MicroStrategy’s broader strategic goals. Brooks, in particular, is known for his regulatory and cryptocurrency knowledge. He has held leadership roles at leading cryptocurrency companies, including Coinbase and BitFury Group, and also served as Acting Comptroller of the Currency.

Meanwhile, Dietze also served as a member of the board of directors of crypto asset management firm Galaxy Digital, while Winiarski has experience with a private global digital sports platform.

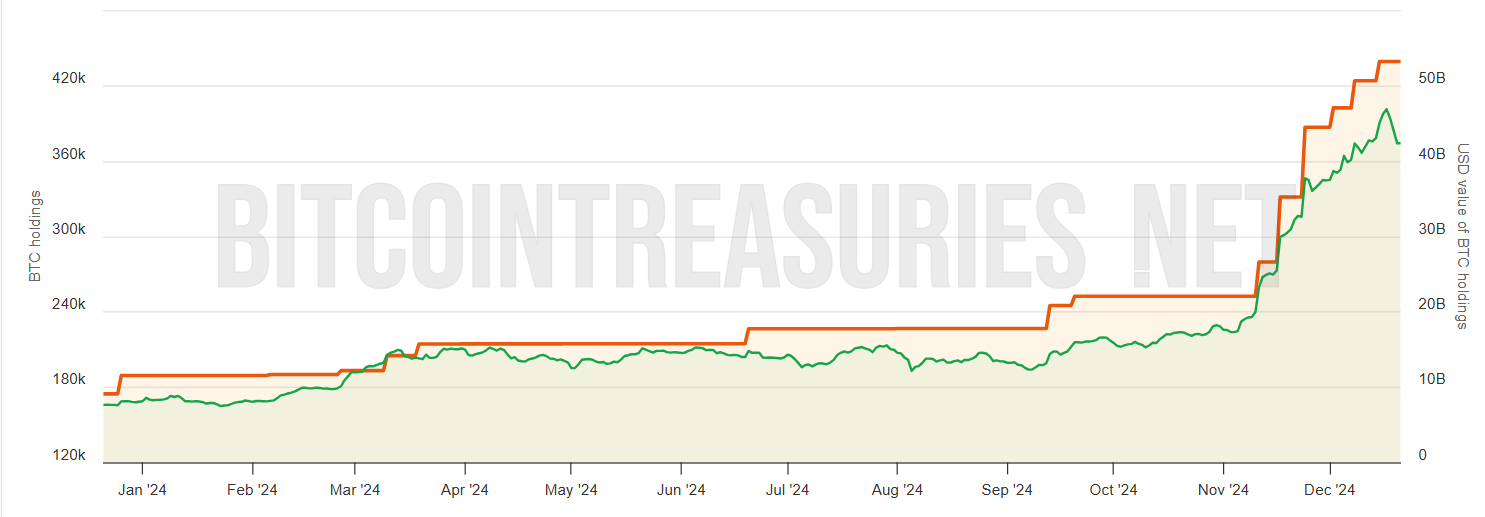

MicroStrategy is the largest public company holding Bitcoin. According to Bitcoin Treasuries data, the company currently has 439K Bitcoin, worth more than $43 billion.