MicroStrategy is reporting a $900 million revenue from its enormous Bitcoin stash thanks to the October “Uptober” of the world’s biggest cryptocurrency.

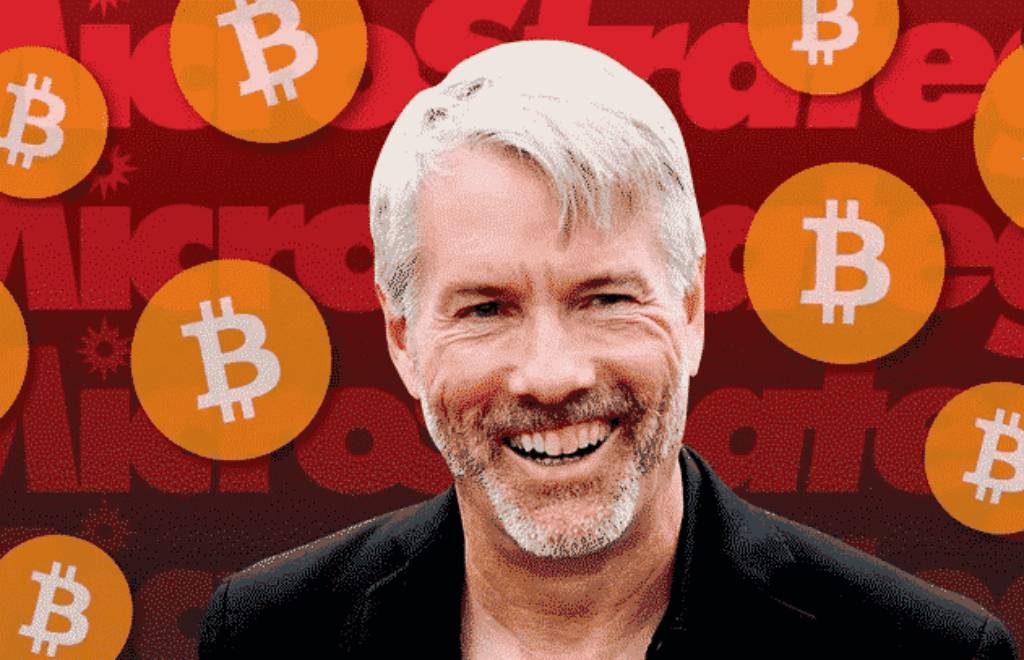

Early on the morning of November two, MicroStrategy CEO Michael Saylor stated in his third-quarter 2023 monetary report that his business invested $five.three million in October 2023 to buy an supplemental 155 BTC.

Therefore, the complete volume of Bitcoin held by MicroStrategy has enhanced 158,400 Bitcoins with an normal buy rate of around 29,586 USD/BTC, equivalent to The expense is $four.69 billion.

In October, @MicroStrategy acquired one more 155 BTC for $five.three million and now holds 158,400 BTC. Join us at five:00 pm ET as we go over third quarter 2023 monetary success and response queries about the outlook for #BusinessIntelligence AND #Bitcoin. $MSTR https://t.co/w7eRUcGobi

— Michael Saylor⚡️ (@saylor) November 1, 2023

With the rate of Bitcoin increasing over USD 35,500 on the morning of November two, the worth of the company’s investment portfolio rose to new heights. five.64 billion bucks – reported to MicroStrategy revenue of in excess of 900 million buckswhich indicates a revenue of 19.22%.

Looking back in background, when the cryptocurrency market place hit bottom in December 2022, MicroStrategy misplaced up to 45% of its investment in Bitcoin. However, the business stays steadfast in not promoting and continues to obtain even in 2023 in March ($150 million), April ($29.three million), June ($347 million), July ($14.four million bucks) and September ($147 million). ) – for a complete of 682 million bucks.

CEO Saylor also shared a statistical table exhibiting that given that his business started investing in Bitcoin in August 2020, MicroStrategy’s MSTR stock rate has enhanced by 242%, Bitcoin rate has enhanced by 192% , far surpassing other possibilities. massive tech businesses or valuable metals.

Let’s contemplate a #Bitcoin Strategy. pic.twitter.com/tRgIEBVdRp

— Michael Saylor⚡️ (@saylor) November 1, 2023

The executive director also shared:

“We remain steadfast in our intention to buy and hold Bitcoin, especially as the asset is gaining traction among large institutions.”

Bitcoin in October 2023 recorded an improve of additional than 28% reaching the highest rate array given that May 2022, the era of the LUNA-UST collapse, with the major purpose currently being that a lot of Wall Street giants opened proposals to produce a Spot Bitcoin ETF.

Coinlive compiled

Join the discussion on the hottest concerns in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!