On the evening of December 28, investment company MicroStrategy announced the resumption of Bitcoin getting exercise following a extended hiatus.

As a end result, involving November one and December 24, 2022, MicroStrategy bought an supplemental two,500 BTC at a price of $44.six million. Instead, the enterprise informed the SEC that it offered $46.four million well worth of MSTR shares to interested traders, most possible with income to offset the quantity of BTC it purchased.

Thus, up to now, MicroStrategy holds up to 132,500 BTC, well worth $four.03 billion. However, with an common obtain cost of up to $thirty,397, the enterprise is dropping a lot more than 45% of its investment.

MicroStrategy has enhanced its #Bitcoins Holdings of ~two,500 #BTC. From twelve/27/22 @MicroStrategia holds ~132,500 bitcoins bought for ~$four.03 billion at an common cost of ~$thirty,397 per bitcoin. $MSTRhttps://t.co/lcMeULcGQk

— Michael Saylor⚡️ (@saylor) December 28, 2022

This is also the firm’s most up-to-date obtain of Bitcoin because September 2022, when they extra 301 coins to their BTC vault to “round up”.

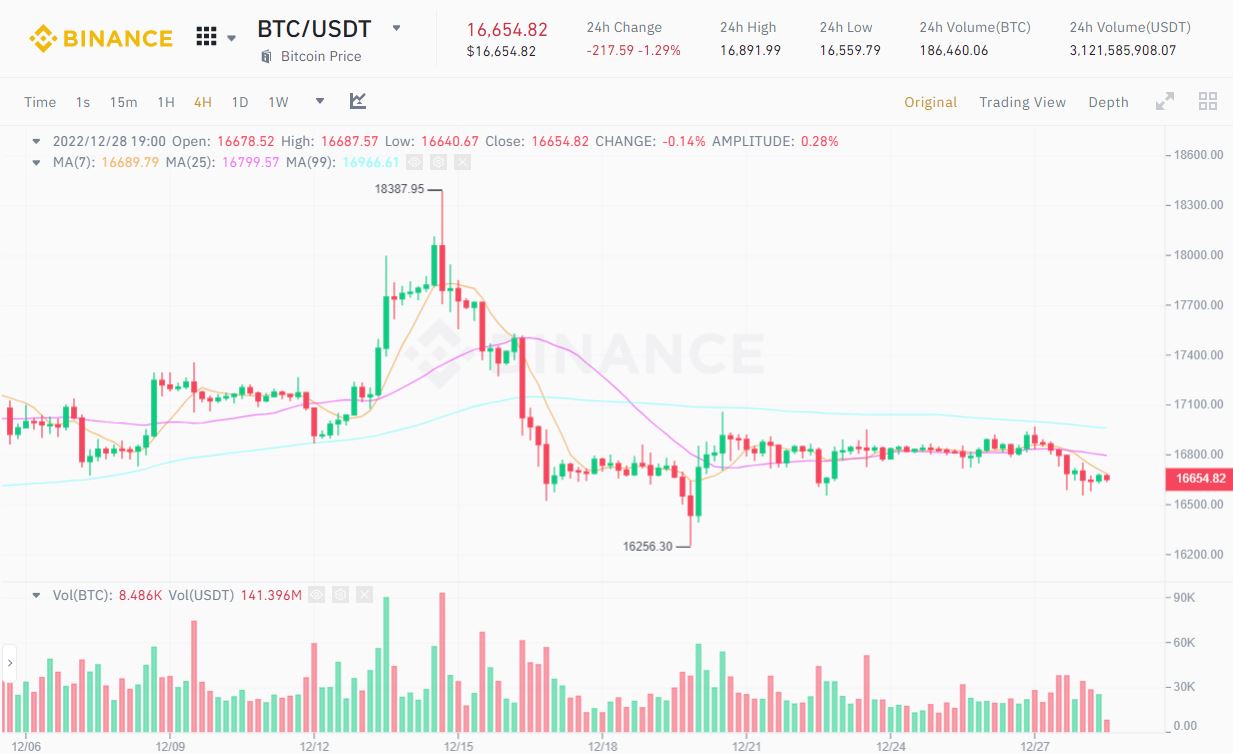

It can be witnessed that regardless of the significant decline of the cryptocurrency marketplace in 2022, with Bitcoin alone dropping pretty much 64% of its worth, MicroStrategy is even now established not to modify its extended-phrase investment method in Bitcoin. This place was maintained even as MicroStrategy reported a $918 million reduction in the 2nd quarter of 2022, prompting enterprise founder Michael Saylor to accept his resignation as CEO to get up the place of President.

However, in the most up-to-date transaction, the enterprise uncovered that it purchased two,395 BTC involving Nov. one and Dec. 21, then offered 704 BTC on Dec. 22, just before getting back 810 BTC on Dec. 24. It is not clear what the explanation for this kind of getting and promoting of MicroStrategy is, specifically when BTC for the duration of final Christmas did not have significantly volatility. However, the enterprise advised the SEC that it will incorporate the reduction from the BTC sale on its stability sheet to acquire a tax break.

There is a humorous statistic that if you opt for to invest ETH as a substitute of BTC, MicroStrategy can even now double the quantity invested, as a substitute of dropping like now.

Synthetic currency68

Maybe you are interested: