Microstrategy CEO Michael Saylor thinks Bitcoin will emerge as an asset class with a complete marketplace capitalization of $ one hundred trillion, a one hundred-fold boost from now. Bitcoin is taking gold as a retail outlet of worth and is not anxious about rules.

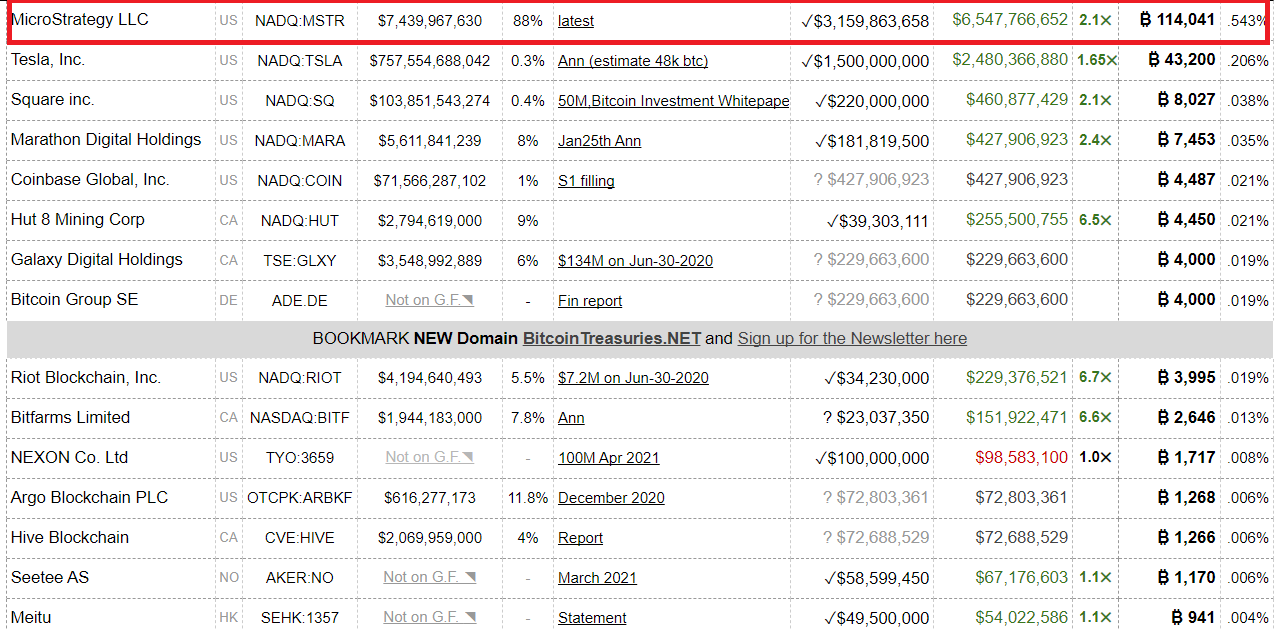

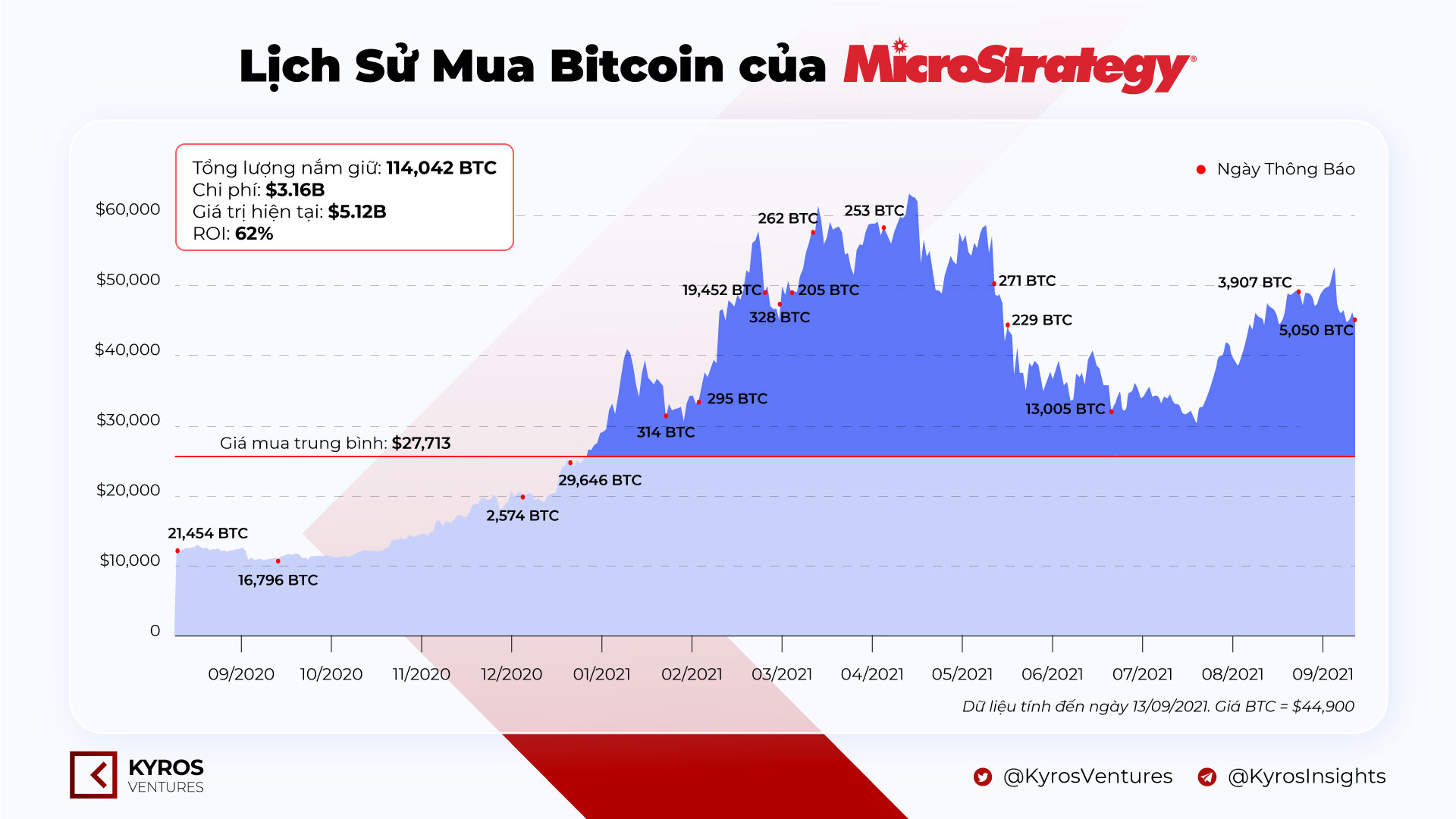

Michael Saylor spoke about Bitcoin’s potential prospective customers in an interview with CNBC on November twenty. He talked about the broad adoption of Bitcoin, cryptocurrency regulation, marketplace volatility, and the battle amongst gold and BTC in the race to come to be the world’s primary safe and sound-haven investment asset. His firm now holds 114,041 BTC.

With huge development above the previous 12 months, the two Michael Saylor and MicroStrategy can be mentioned to have “big wins” thanks to Bitcoin. When asked if he would proceed to accumulate BTC at latest charges or wait for the subsequent drop. “We will continue to accumulate forever,” he replied bluntly.

On the topic of Bitcoin versus gold, Saylor thinks Bitcoin will change gold as a retail outlet of worth for most traders going forward. He mentioned the benefits of Bitcoin fully mind-boggling gold, this kind of as ease of transfer, very low price of storage.

“It is clear that Bitcoin is winning and gold is slowly losing strength.” Crypto gold “will replace traditional gold in this decade.”

Faced with developments in the occasion that President Biden passed the law with provisions to tax cryptocurrencies, Saylor shared that he has no challenges with the ongoing rules. The head of Microstrategy stays in favor of Bitcoin with the note that the crypto rules underneath discussion in Washington will have an influence on the safety tokens, the DeFi sector and all other use scenarios of the cryptocurrency, they do not have to be BTC.

“Bitcoin is the only ethical, technical and legal safe haven in the entire crypto ecosystem.”

When it comes to extended-phrase expectations of a reasonable price tag target for Bitcoin and a path to $ one million well worth of BTC a day. Saylor manufactured a rather daring statement about his prediction.

“By the finish of the decade, Bitcoin will beat gold, so it will flip currency indices, influence bonds, true estate, stocks a minor, and emerge as a beneficial asset class. Total marketplace capitalization of $ one hundred trillion. or one hundred occasions the latest worth.

– See far more: Former Goldman Sachs CEO Believes Bitcoin (BTC) Bullish Cycle Will Not End at Year End

He went on to stage out that when Bitcoin reaches this milestone, BTC will signify five% to seven% of the planet economic climate. The USD can change 150 currencies. Everything else will almost certainly disappear. And then Bitcoin grew to become the planet financial index. How nations will react to the over situation and how Bitcoin’s background can be hampered by governments. Saylor states:

“I think Bitcoin is the unstoppable crypto asset.”

Saylor explains that there will be 3 nationwide lessons. Communist nations, like North Korea, will not let individuals to very own house or something, they can ban it. The subsequent consists of nations with weak currencies. They will have management of the capital, they will let individuals to very own cryptocurrencies but they do not want you to trade or invest in. Finally, there are Western nations with powerful domestic currencies, this kind of as the US dollar.

“Owning Bitcoin in China is not illegal. They just don’t want you to move billions of dollars out of their economy. However in the US BTC will be treated as property, but you will have to pay taxes when you sell them ”.

Synthetic Currency 68

Maybe you are interested: