MicroStrategy, the world’s largest Bitcoin owner, has announced plans to raise $2 billion through the issuance of perpetual preferred stock.

The move is intended to expand the company’s Bitcoin reserves and strengthen its balance sheet, in line with its ambitious growth strategy.

MicroStrategy Tests New Limits With Bitcoin Fundraising Strategy

In a January 3 announcement, MicroStrategy has clarified that the issuance was unrelated to its previous plan to raise $21 billion from equity and a similar amount from fixed income instruments.

Perpetual preferred stock can be funded through a variety of mechanisms such as conversion of Class A common stock, issuance of cash dividends or stock repurchases. This issuance provides investors with regular dividends without a maturity date, making it a unique tool for raising capital.

Dylan LeClair, Metaplanet’s director of Bitcoin strategy, emphasized the innovative nature of the move. He found that the issuance gives investors exposure to Bitcoin’s inherent volatility while providing MicroStrategy with a cost-effective way to raise capital.

“Volatility is the PRODUCT, and BTC Profit is the Key Performance Indicator. Unlimited optionality is the most exciting product that MSTR can sell to the fixed income market,” LeClair stated.

Meanwhile, the company expects to launch the issuance in the first quarter of 2025, depending on favorable market conditions and other factors. However, MicroStrategy has not committed to implementing this plan.

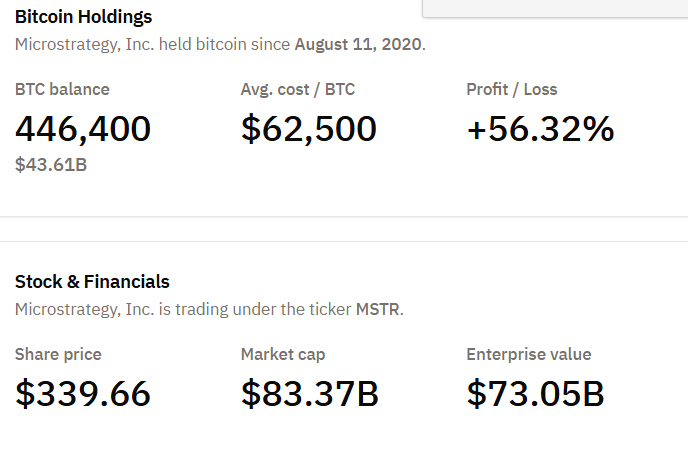

MicroStrategy’s ongoing Bitcoin purchases have significantly improved its market position. The company’s stock value skyrocketed and reached a spot on the Nasdaq 100 index. Furthermore, the company’s innovative approach to raising capital — issuing debt and equity to finance buy Bitcoin — has earned it recognition as a pioneering “Bitcoin treasury company.”

However, this strategy has challenges. Issuing new shares to increase capital may dilute the ownership of existing shareholders, which may reduce profits per share. Kobeissi letter emphasized challenger in a detailed analysis, warning that failure to secure additional capital could jeopardize MicroStrategy’s Bitcoin acquisition strategy.