One of the greatest Bitcoin holders in the planet, MicroStrategy, just launched a improved money report for the third quarter of 2022.

The computer software firm reported complete third-quarter income of $ 125.four million, up from $ 122.one million in the 2nd quarter and shut to an estimated $ 125.eight million. The reduction from holding Bitcoin was only $ 727,000, down appreciably from $ 918 million in the preceding quarter.

Please join the @MicroStrategy management crew at five p.m. ET as we talk about Q3 2022 money success and reply concerns about our small business and outlook for #BusinessIntelligence And #Bitcoin. $ STRhttps://t.co/lAMyZ5Rmtt

– Michael Saylor⚡️ (@saylor) November 1, 2022

The third quarter is also the 1st quarter that Phong Le holds the place of CEO, taking in excess of from Michael Saylor as of August eight, although posting a massive reduction in the 2nd quarter. Even so, MicroStrategy maintains its Bitcoin HODL approach.

Since it determined to go all-in with BTC, the firm has invested just about $ four billion to typical the rate of Bitcoin. As of now, MicroStrategy holds 130,000 BTC, really worth somewhere around USD two.67 billion with an typical acquire rate of USD thirty,634 / BTC. During the whole third quarter, the firm acquire only 301 BTC from August two to September 19 at $ 19,851 / BTC, equivalent to the single bottom-fishing of $ ten million BTC on June 29.

Executive Chairman Michael Saylor echoed his optimistic see, arguing that Bitcoin would advantage most from clear advice and regulation.

Overall, the third quarter was not as volatile as the final quarter, specially soon after the traditional LUNA-UST slump. As a outcome, MicroStrategy misplaced significantly less and Michael Saylor remained HODL regardless of the odds.

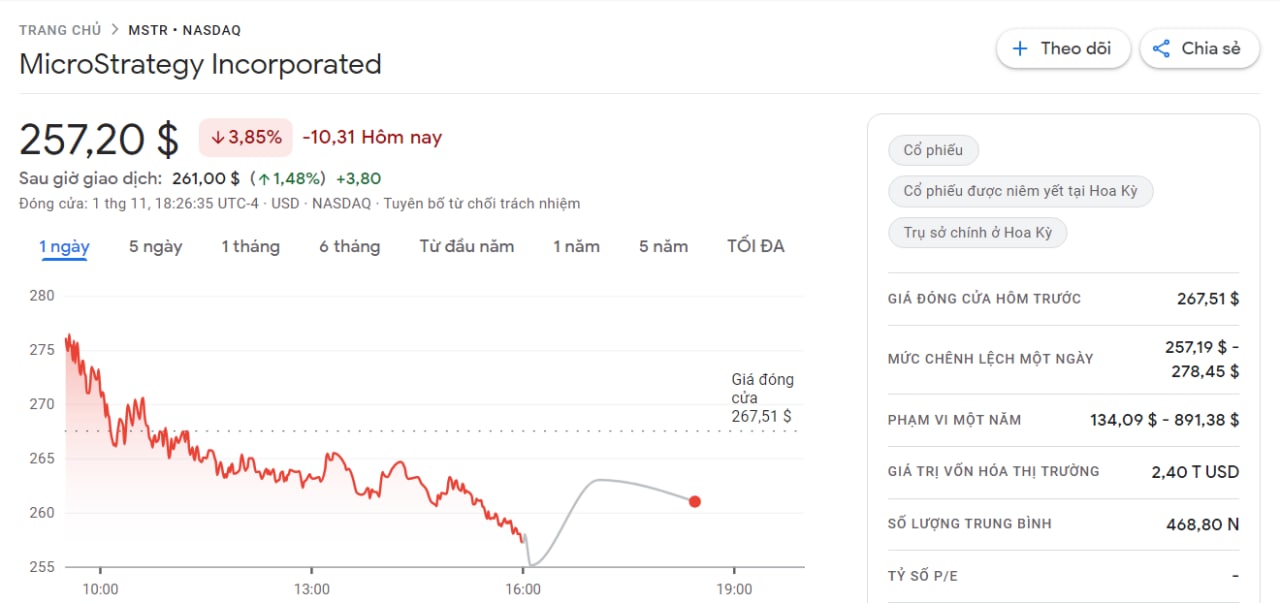

Following the release of the third quarter money success, MicroStrategy stock was up about two.three% to $ 263. The stock was down about 51% yr to date, somewhat a lot more than Bitcoin’s 56% decline in the exact same yr. benchmark.

Synthetic currency 68

Maybe you are interested: