Shares of MicroStrategy’s MSTR, which invests a massive volume of income in Bitcoin, have fallen by 60% in the previous month.

The decline of Bitcoin in unique and the cryptocurrency market place in common has negatively impacted public organizations with publicity to this sector, such as MicroStrategy.

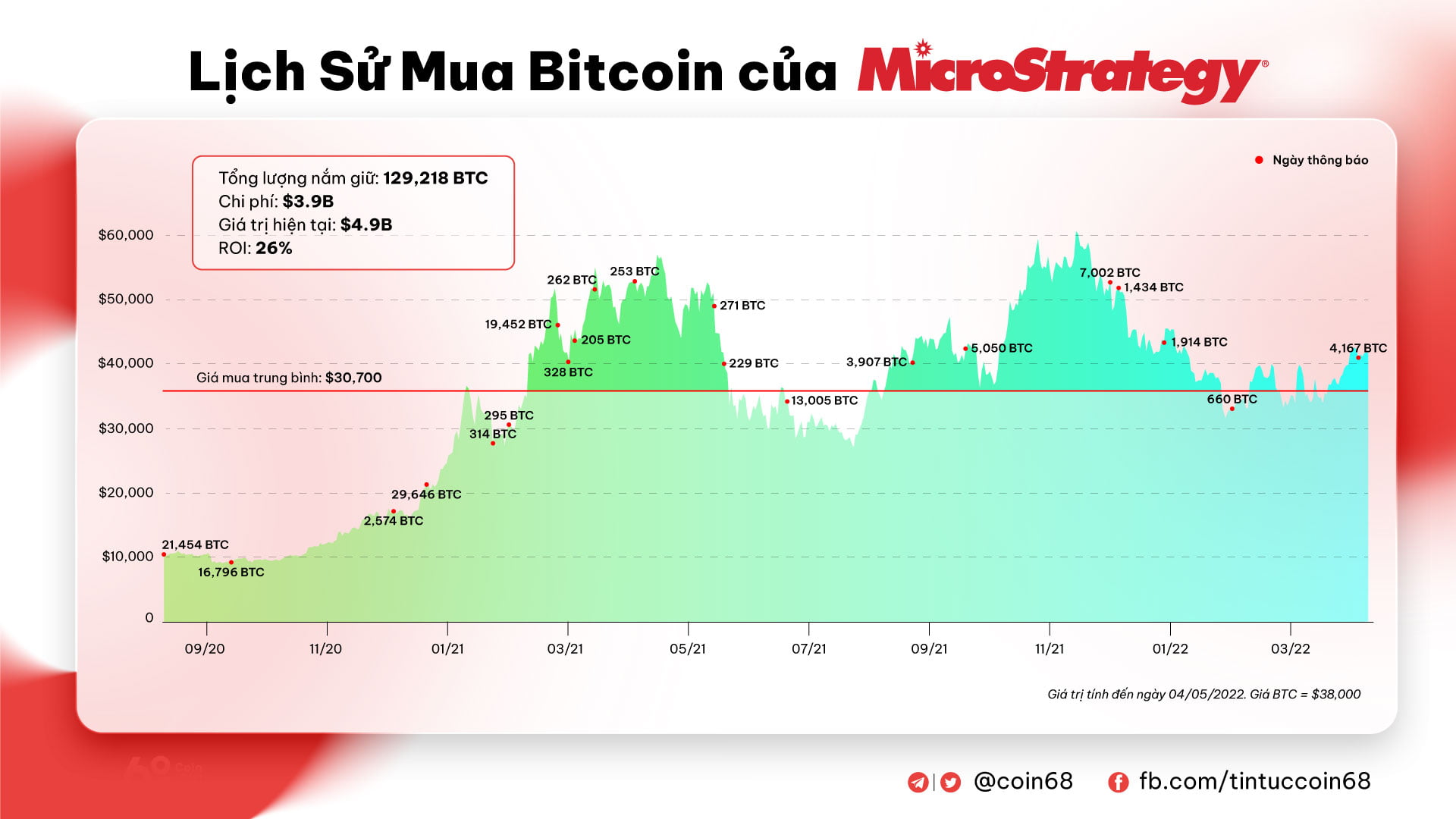

As of early May, MicroStrategy holds 129,218 BTC, which the firm has accumulated because 2020 with an normal buy cost of $ thirty,700. Therefore, at $ 29,600 in Bitcoin at press time, the firm is dropping income from its investment, which was manufactured up of a number of debt bond troubles to increase capital rather than use it.

MicroStrategy CEO Michael Saylor has repeatedly denied reviews that he will promote significantly less Bitcoin to decrease the curiosity payment obligation for bondholders at the exchange. He unveiled that it was only when BTC’s cost fell under $ three,600 that the firm cleared the loan collateral. Another adverse level in MicroStrategy’s Bitcoin investment “gamble” is that the firm is leaving its enormous BTC “inactive”, making no more advantage, though Saylor stated it will lend income.

Bitcoin’s current volatility correction, which brought the world’s greatest cryptocurrency to its December 2020 lower, mixed with MicroStrategy’s bad overall performance and macro information dragged the equity market place decrease. US stocks fell, triggering hefty losses to the company’s share cost. At the finish of the trading session on May 24 (US time), the MSTR share cost fell the moment to $ 168, the lowest degree because November 2020, which is 18 months in the past. It can be viewed that the rates of BTC and MSTR have a tendency to go hand in hand.

Compared to one month in the past, the MSTR cost also fell additional than 60% from its peak of USD 427. With this kind of a drop in the share cost, CEO Michael Saylor is very likely to be pushed by shareholders to critique the company’s small business approach.

Shares of a further publicly traded cryptocurrency firm, Coinbase, have also persistently bottomed out in the previous just after announcing bad overall performance success, as properly as becoming embroiled in a downward wave in the cryptocurrency market place. However, with a profitable 2021, America’s greatest cryptocurrency exchange has turn into the 1st cryptocurrency firm in background to enter the Fortune 500 listing.

Synthetic currency 68

Maybe you are interested: