MicroStrategy CEO Michael Saylor stated Bitcoin’s quick-phrase volatility is largely unproblematic the moment traders have an understanding of the fundamentals of cryptocurrency.

In an interview with The block Recently, one particular of the biggest Bitcoin whales in the globe, MicroStrategy CEO Michael Saylor, the moment yet again expressed his really bullish see on BTC regardless of the bearish conflicts the cryptocurrency marketplace is developing in the previous final time all around.

He claimed that Bitcoin is the safest point in an currently quite chaotic globe, evaluating the cryptocurrency sector alone BTC is really worth a lot more than 19,000 other altcoins, even the king of cryptocurrencies is really worth owning a lot more than any other stock and asset in the globe.

MicroStrategy CEO @saylor states that bitcoin’s quick-phrase volatility is drastically appropriate

Of @AdamMorganMc https://t.co/jB2UqNb5s9

– The Block (@TheBlock__) June 5, 2022

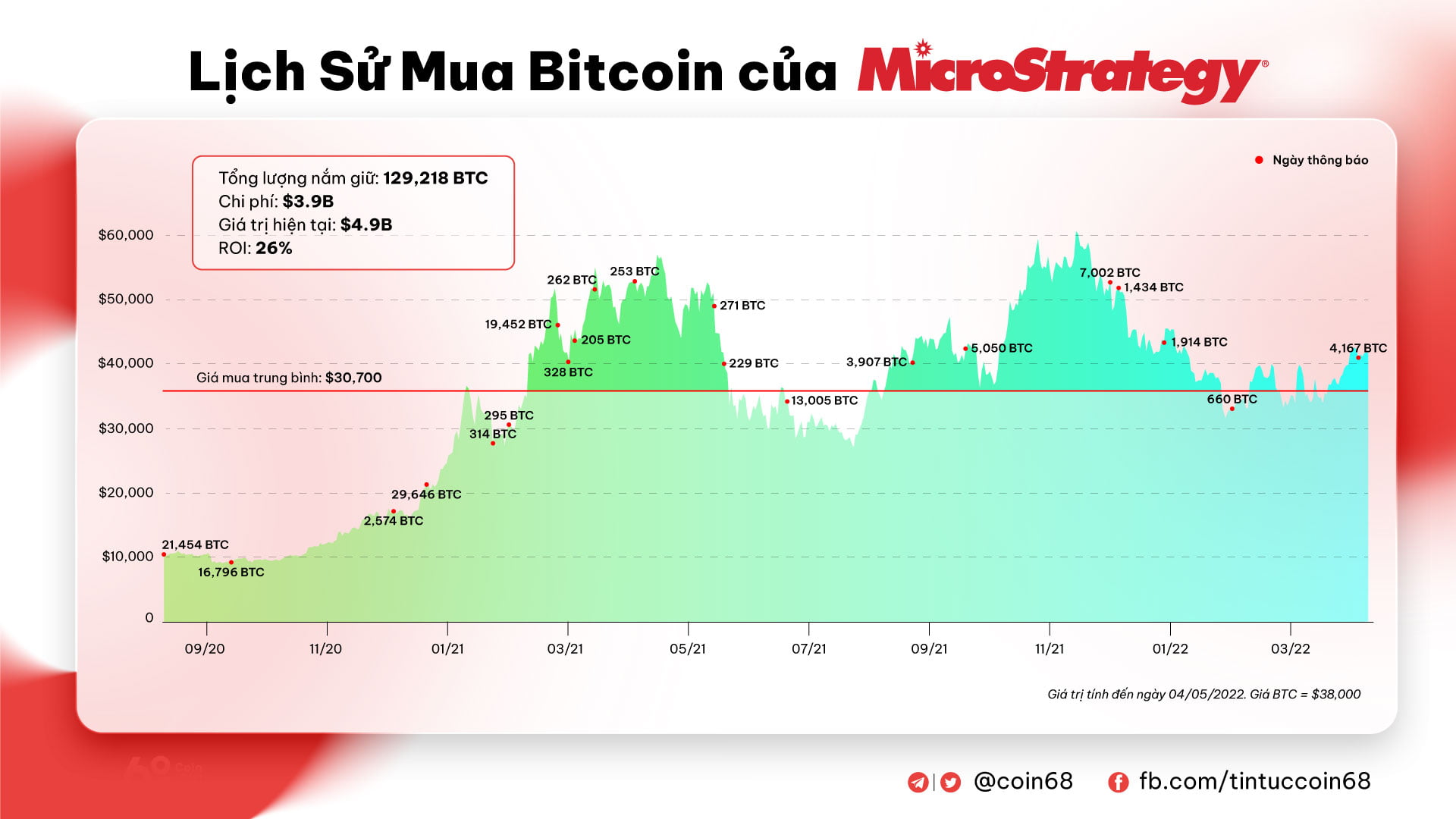

MicroStrategy currently holds a significant place in Bitcoin, now all around 129,218 BTC, and CEO Michael Saylor has develop into the most ardent Bitcoin advocate globally due to the fact including his determination to include BTC to his stability sheet firm in August 2020. .

MicroStrategy’s most current order was produced on April five, with a order of four,167 Bitcoins really worth somewhere around $ 190.five million through its subsidiary MacroStrategy and a $ 205 million loan from Silvergate Bank when BTC was in circulation, trading at $ 45,714.

In complete, MicroStrategy purchased 129,218 BTC at an common rate of $ thirty,700. With Bitcoin trading volatility of significantly less than $ thirty,000 in the previous couple of weeks, MicroStrategy’s whales are in a “stranded” state even however they have no programs to promote any BTC as Michael Saylor previously stated.

He stated Bitcoin will have to decline by up to 95% just before the firm considers stock. Because if the rate of BTC falls as well reduced, it will set off a MicroStrategy margin contact on the Silvergate loan as the worth of the collateral falls. Michael Saylor only observed if the worth of Bitcoin falls beneath USD three,562 Only then will Microstrategy run out of BTC to repay the loan.

MicroStrategy has a phrase loan of $ 205 million and ought to hold $ 410 million as collateral. $ STR it has 115,109 BTC that it can pledge. If the rate of #BTC drops beneath $ three,562, the firm could send other ensures. See slides eleven-twelve in the Q1 2022 Presentation. #HODLhttps://t.co/9WHsIB6Usx

– Michael Saylor⚡️ (@saylor) May 10, 2022

Even so, he stated the firm will not promote any of its Bitcoin holdings if the worst-situation situation happens, but as an alternative Microstrategy could use some other collateral as collateral. However, Microstrategy is almost certainly in a actually tough place to remedy the over difficulty.

Because the company’s most significant asset at the minute is MSTR stock, which hit an 18-month reduced and dropped to 60% in the final month. This stems from the reality that the near correlation among Microstrategy and Bitcoin has brought on MSTR to move “in phase” with BTC.

The rate of bitcoin plummeted in May as the cryptocurrency marketplace, as nicely as monetary markets in basic, stalled. After the preliminary detrimental rate surge as the macroeconomic setting was worsened by the Fed’s ineffective increases in inflation manage prices, cryptocurrency charges continued to plummet as Terra’s blockchain swiftly collapsed.

This spread dragged Bitcoin beneath $ thirty,000 with 9 consecutive weeks of red candles. While a lot of researchers contemplate this clear proof of a cryptographic winter, Michael Saylor says he is unconvinced by this kind of evaluation.

“I don’t know if it’s a long-term bear market, but if it’s a bear market, I’ve had it three times in the past 24 months.”

In addition, it was stated that he did not want to be captured by the rate sentiment in a quick time, even the CEO of Microstrategy did not bother to emphasis on typical observation of the rate chart.

“If you never system to hold Bitcoin for 4 many years, you are not in fact an investor, you are a trader. And my tips to traders is not to trade on BTC, but to invest in them “.

Synthetic currency 68

Maybe you are interested: