MicroStrategy CEO Michael Saylor believes common monetary markets are not nonetheless prepared for Bitcoin-backed bonds (BTC).

In a midweek interview with Bloomberg, Michael Saylor explained he’d like to see a day when Bitcoin-backed bonds will be offered as home loan-backed securities, but he also warned the industry is not prepared for it nonetheless. The following ideal concept is a phrase loan from a significant financial institution.

Financial markets are unprepared for Bitcoin-backed bonds, in accordance to MicroStrategy’s Michael Saylor, the staunchest supporter of providers including cryptocurrency to their stability sheets. https://t.co/ppREEviuAt

– Bloomberg (@small business) March 30, 2022

The comment comes two days following MicroStrategy subsidiary MacroStrategy announced it took out a $ 205 million Bitcoin home loan to invest in much more Bitcoins. This loan marks the 1st time MicroStrategy has borrowed towards its big Bitcoin pool.

MacroStrategy, a subsidiary of @MicroStrategyclosed a $ 205 million bitcoin-backed loan with Silvergate Bank for invest in #bitcoin. $ STR $ YEShttps://t.co/QYw2ZgeE3U

– Michael Saylor⚡️ (@saylor) March 29, 2022

Comments from MicroStrategy’s CEO also comply with El Salvador’s current determination to postpone issuance of a $ one billion Bitcoin bond on March 23. According to El Salvador’s finance minister, Alejandro Zelaya, the determination to postpone voting on the bond was due to common monetary instability in worldwide markets due to the conflict amongst Russia and Ukraine.

Additionally, he shared that El Salvador’s Bitcoin bonds are relatively riskier than his company’s home loan.

“This is a combined sovereign debt instrument, as opposed to a pure“ game ”based mostly right on Bitcoin. As a outcome, MicroStrategy’s loan carries its personal credit score possibility and is fully unrelated to BTC’s volatility. “

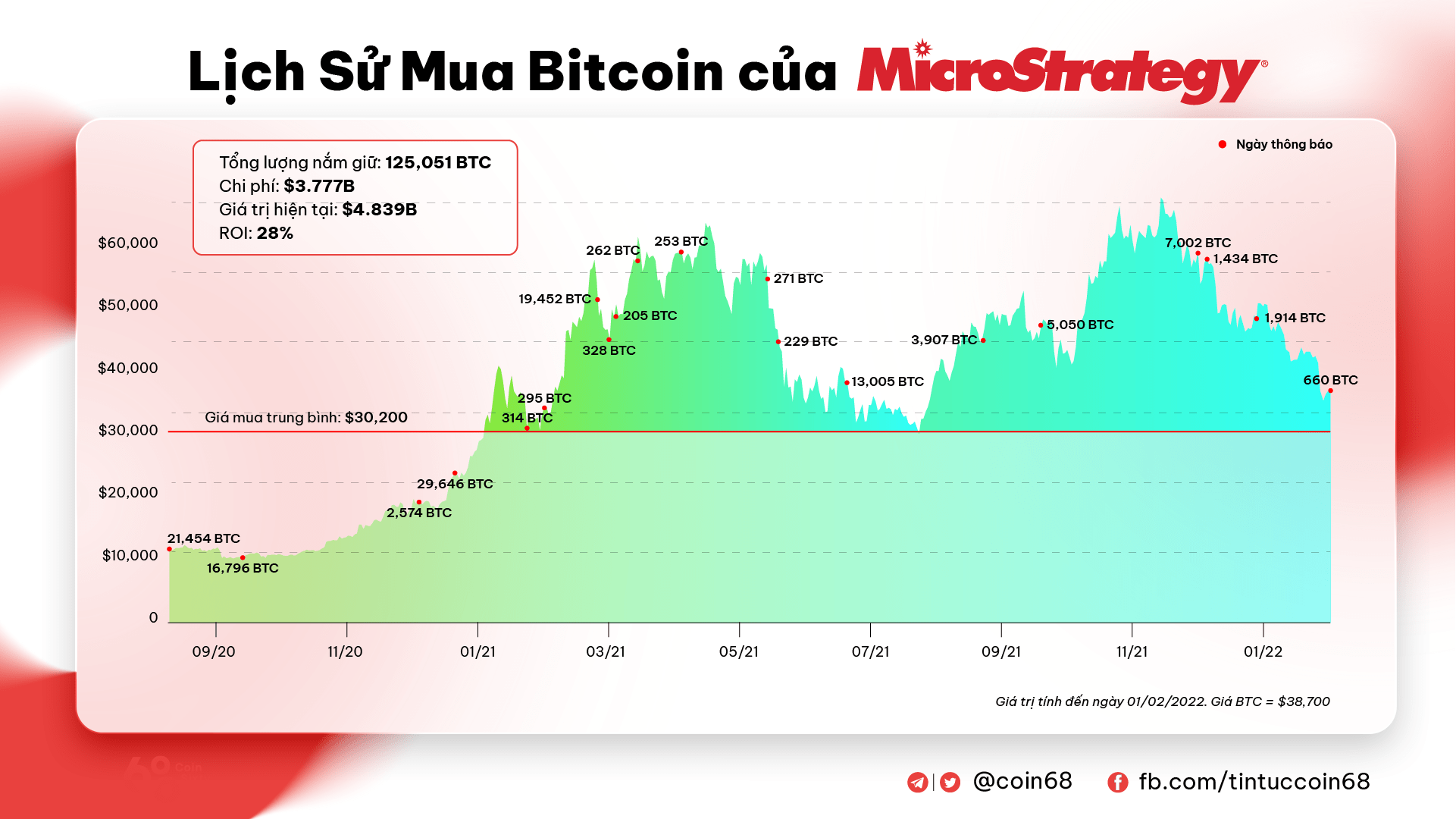

Even so, Michael Saylor insists he is really bullish on the prolonged-phrase possible of Bitcoin-based mostly bonds. From an original $ 250 million investment in BTC in August 2020, MicroStrategy has now amassed 125,051 BTC, or $ five.five billion at press time, a almost 60% return on the original investment.

Saylor’s stock has steadily transformed MicroStrategy into a organization that holds the greatest quantity of BTC in the planet. Also assisting the company’s stock is that MSTR is more and more establishing a closer correlation with BTC’s selling price movements.

Synthetic currency 68

Maybe you are interested: