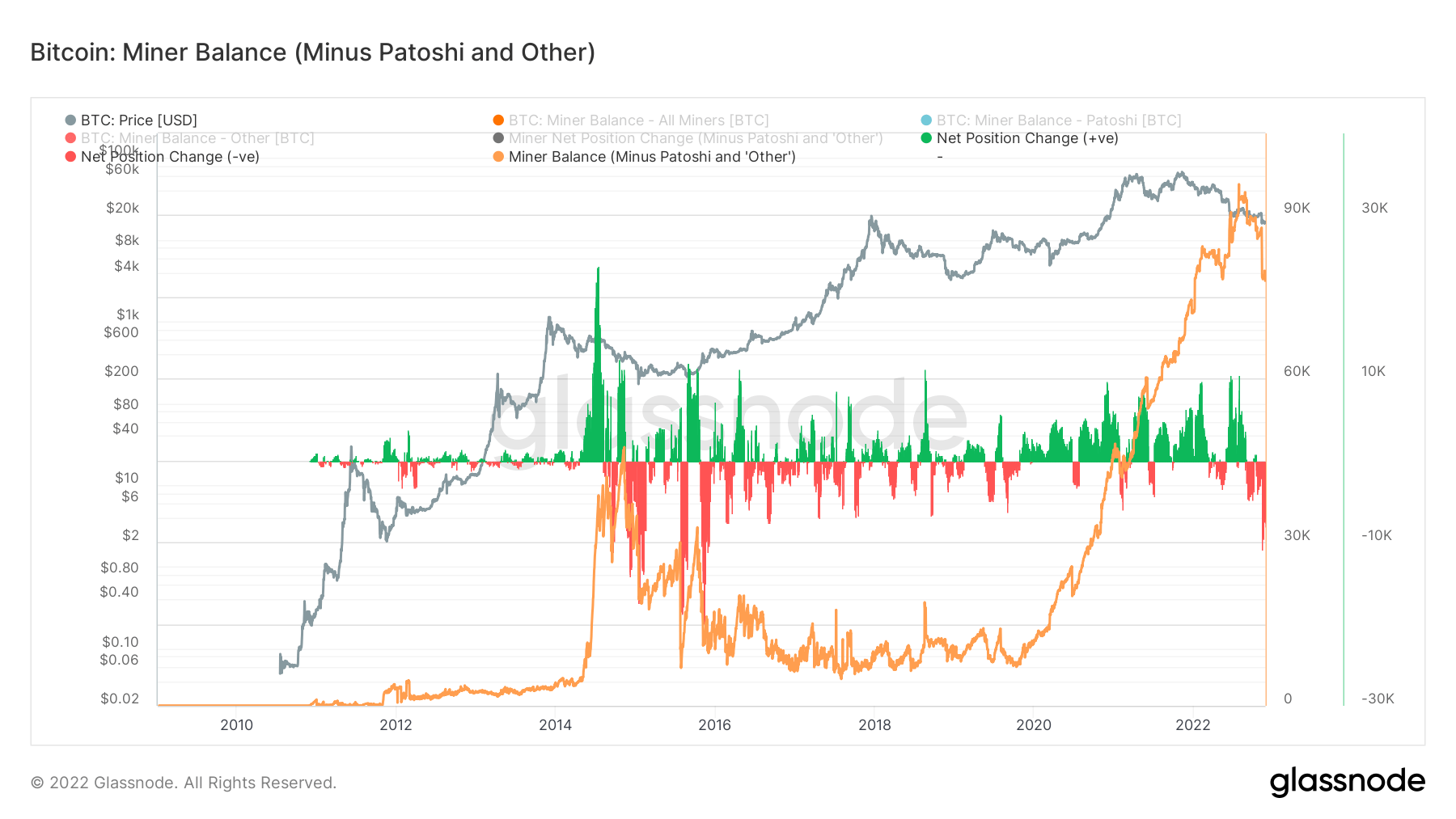

Miner balances on wallets commenced the 12 months at one.82 million BTC and are now back to exactly where they had been, in accordance to on-chain information tracked by Glassnode. The cumulative sum of Bitcoin by miners in 2022 has exceeded the volume offered, wiping out any raise in miner stability.

The stability of mixed Bitcoin mining wallets spiked substantially in July 2022, reaching a two-12 months substantial, seemingly recovering from the May drop relevant to the collapse of Bitcoin. Terra Luna. However, the exact same crisis brought on by the Terra Luna incident has returned to cryptocurrencies following FTX grew to become insolvent.

The hash fee has also commenced to decline in the previous weeks, which is a signal that miner curiosity is dwindling.

Net place alter across all miners’ BTC addresses has dropped to early January ranges, suggesting that if the promote-off continues, evidence-of-operate miners could be in difficulty. worse in the potential.

2022 is going to be a hard 12 months for evidence-of-operate mining, due to soaring vitality charges and a steep drop in bitcoin costs. As a consequence, miners had to promote huge quantities of the cryptocurrencies they held, creating sizeable net income movement.

Although the indicators stage to a dark time period for Bitcoin miners, traders continue to be hopeful on the on-chain information signaling cycle bottoms. The information displays that lengthy-phrase holders accumulate at highs involving August and October. Despite the constructive lengthy-phrase sentiment in the direction of Bitcoin rate, there are indications of LTH promoting positions. their. On-chain analytics instrument CryptoQuant displays that lengthy-phrase traders have entered a phase of capitulation.

Another probably bullish indicator is the latest wave of moves to custodial wallets. The common crypto consumer is moving their balances out of exchanges due to the continued failure of centralized exchanges. While this displays a lack of believe in in the direction of centralized exchanges, it is a constructive signal that retail traders are receiving into the lengthy-phrase game for cryptocurrencies.