The volume of Ethereum (ETH) held by miners has hit an all-time large in the USD exchange price, but they are even now reluctant to promote regardless of ETH’s reasonably solid recovery.

The Ethereum stability presently owned by the miners is the biggest stability considering that the launch of the Ethereum network five many years in the past. According to information presented by the Santiment examination platform, when converted to USD, the index reaches an all-time large of $ one.85 billion.

#Ethereum is up to $ three,480, the highest selling price of the coin in sixteen days. In individual, miners’ balances continued to skyrocket. 532.75 k $ ETH is the biggest stability held by miners considering that July 13, 2016. The worth of these coins is $ one.85 billion, effortlessly an #AllTimeHigh. https://t.co/zf2g4ypqiJ pic.twitter.com/atPnYLhAgc

– Santiment (@santimentfeed) October 5, 2021

Santiment pointed out that 532,750 ETH is the biggest stability held by miners considering that July 13, 2016. This volume represents about .45% of the complete excellent provide of Ethereum, presently 117.eight million ETH. . Miners usually promote mineral assets to cover expenses, which includes hardware and electrical energy expenses. However, the reluctance to promote signal displays that miners are dissatisfied with the existing selling price degree and are seeking to count on even more ETH development.

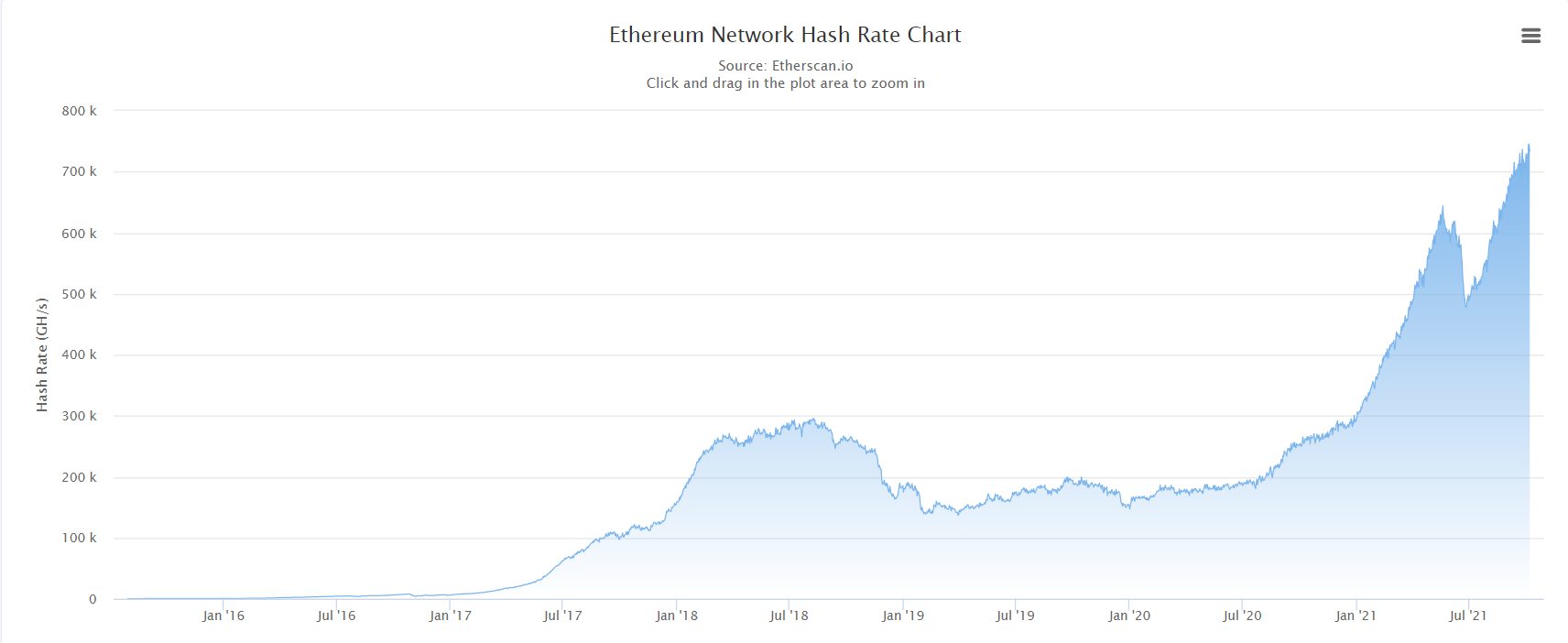

Ethereum’s hashrate, usually noticed as a reflection of the state of the network and protection, declined all through the miners’ exodus from China along with Bitcoin in May. Ethereum’s hashrate dropped to 477 TH / s at the finish of the day. June but has entirely recovered in the previous 3 months and reached new highs. Now up 150% considering that the starting of the yr.

China-based mostly Ethereum mining pools have also come out of the race ahead of China’s most recent crackdown, with SparkPool and BeePool closing in latest weeks. Curiously, there was no major drop in Hashrate, even reaching an all-time large of 745 TH / s on October 5th.

In addition to the provide tightening, a huge percentage of ETH also participated in the Eth2. contract. Currently about six.seven%, or seven.9 million ETH, is blocked for staking. At the existing selling price of about $ three,577, the stake worth in ETH two. has grown to about $ 28 billion.

Synthetic Currency 68

Maybe you are interested: