XRP price has remained in an accumulation phase over the past month, growing only a modest 2.2% over the past 30 days. Despite forming a golden cross pattern earlier this month, signaling potential upside momentum, whale activity suggests a lack of accumulation, which could further reduce upside potential.

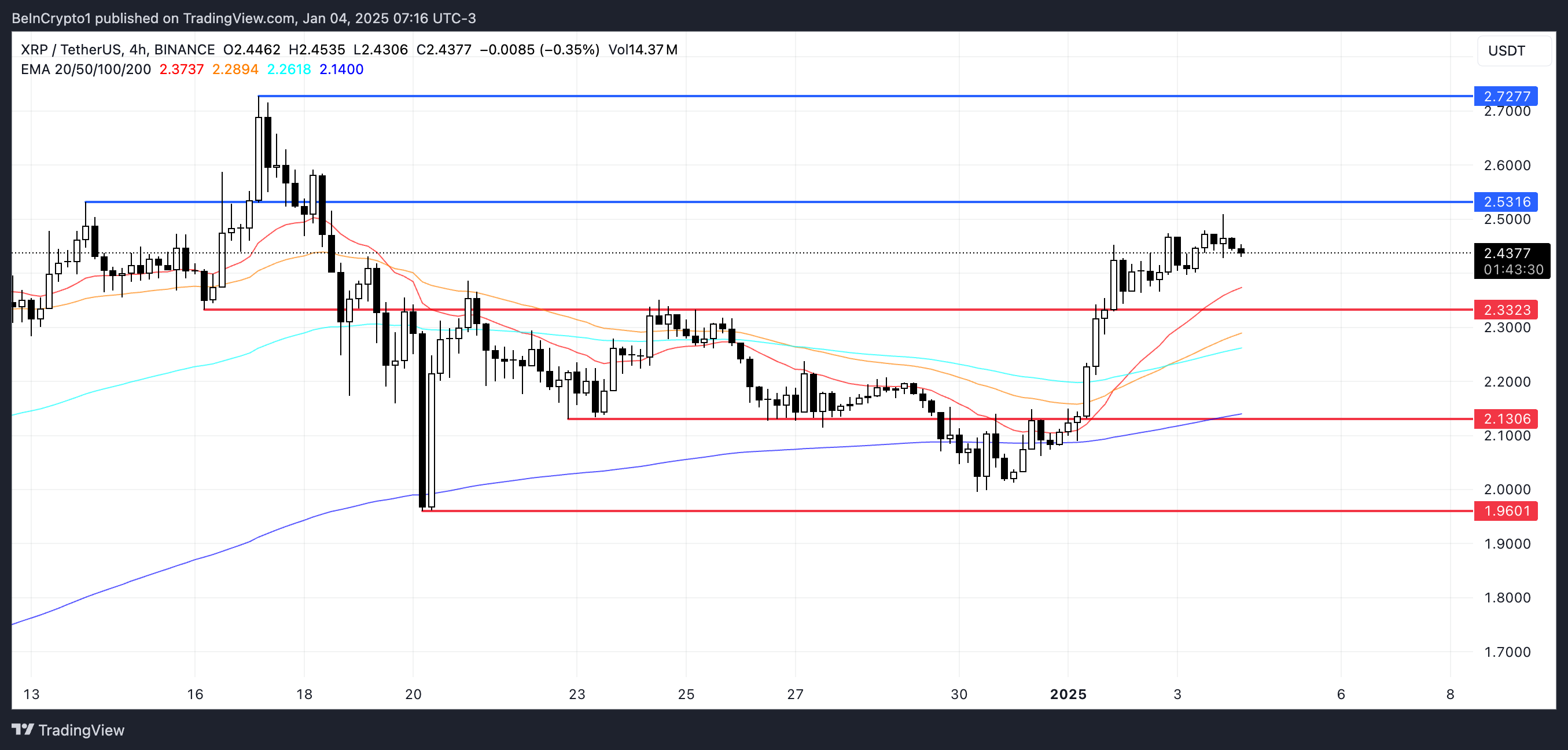

The XRP Chaikin Money Flow (CMF) index remains positive, highlighting continued buying pressure, however the indicator has eased slightly from its recent peak. These factors suggest that XRP’s price bet will depend heavily on whether it can overcome resistance at $2.53 or face selling pressure at support at $2.33.

XRP Whales Pause Accumulation

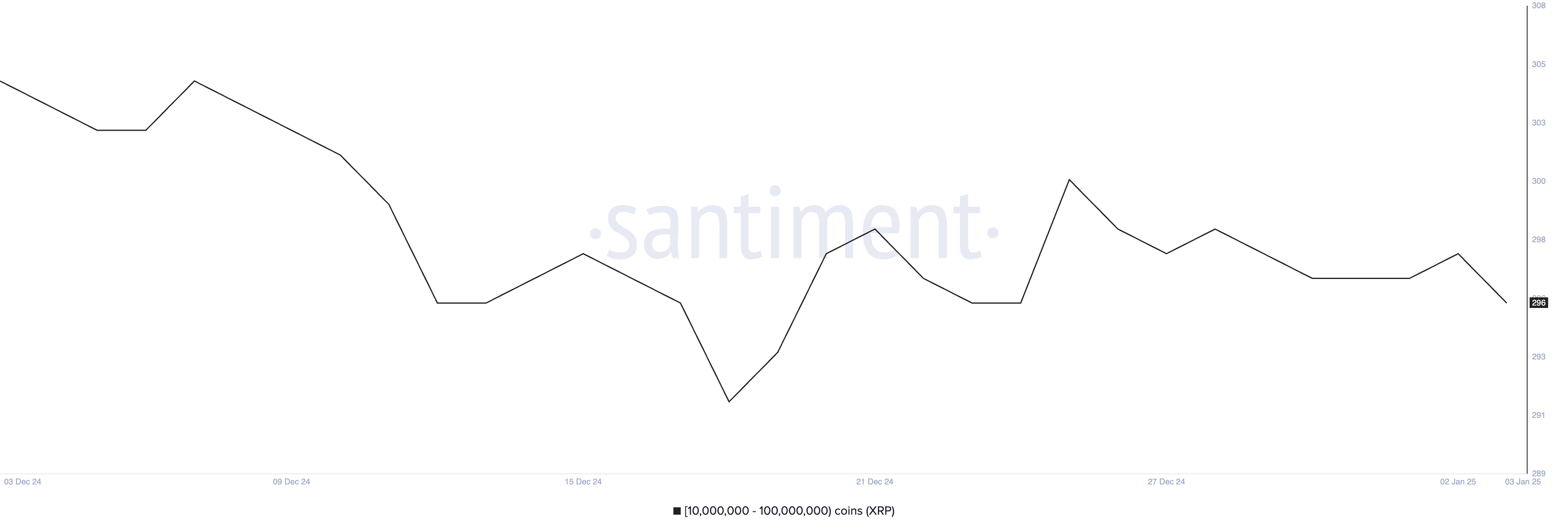

The number of XRP whales owning between 10 million and 100 million XRP has dropped to 296, the lowest since December 24. After peaking at 301 on December 25, the number of these large holders began to decline. The head decreases steadily.

This is a significant change in whale activity, as their number had reached a monthly peak of 305 on December 7, with the XRP price surpassing $2.50.

Tracking whale activity is important because these large owners can greatly influence the market. Their accumulation often signals confidence in a coin and can push prices up, while a decrease in their number often indicates selling pressure or reduced interest.

The recent decrease in the number of whales suggests negative sentiment among major investors, which could affect XRP price in the short term. Unless whale activity stabilizes or reverses towards accumulation, XRP may struggle to regain momentum.

XRP CMF Hits Monthly High

The Chaikin Money Flow (CMF) index for XRP is currently at 0.28, maintaining a positive position since January 1, when it was almost zero. CMF has shown an upward trend in the new year, signaling the Capital increases when buying pressure overwhelms selling pressure.

This positive CMF index reflects increased investor confidence and suggests that XRP is attracting interest from market participants.

CMF is a momentum indicator that measures the flow of money into and out of an asset based on price and volume. Values above zero indicate net buying pressure, while values below zero indicate net selling pressure. Although XRP’s CMF peaked at 0.33 a few hours ago and has dropped slightly to 0.28, it is still in positive territory.

This suggests that while buying momentum may have eased slightly, the overall trend still favors price stability or a slight increase in the short term, as long as CMF does not continue to decline.

XRP Price Prediction: Possible 19.6% Correction

XRP price is currently trading in a tight range, between resistance at $2.53 and support at $2.33. The formation of a golden cross pattern on January 1 has fueled the recent price increase, signaling strong bullish momentum.

However, indicators such as the decline in whale accumulation and the slight decline in CMF suggest that the current bullish momentum may be losing strength.

If the support at $2.33 fails to hold, XRP price could face increased selling pressure, leading to a decline towards $2.13. A break below this level could push the price further down to $1.96, marking a potential 19.6% correction.

Conversely, if the uptrend regains momentum and XRP price breaks above the $2.53 resistance, the next target could be $2.72, offering a potential 10.6% upside.