The most up-to-date rally in the cryptocurrency industry seems to have troubled the quick side, top to an maximize in liquidation prices.

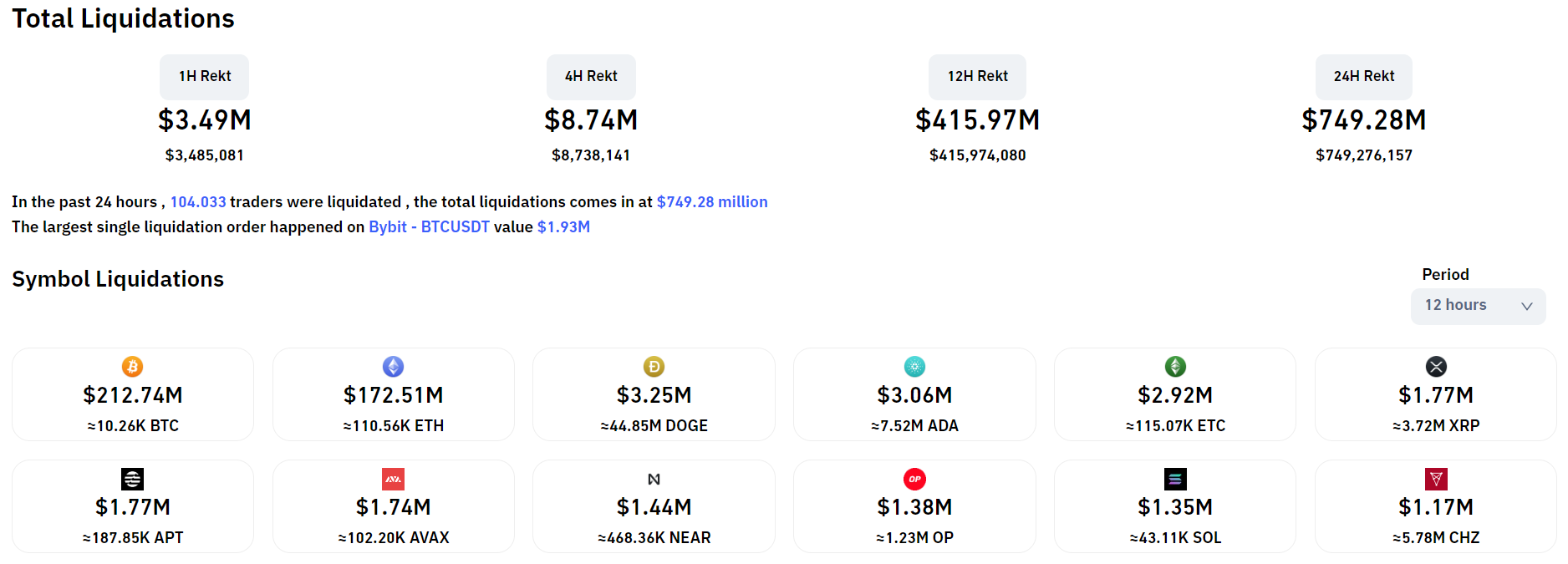

According to Coinglass information, a lot more than $ 415 million well worth of derivative orders in the industry have been burned in the previous twelve hrs, of which 81% came from quick orders.

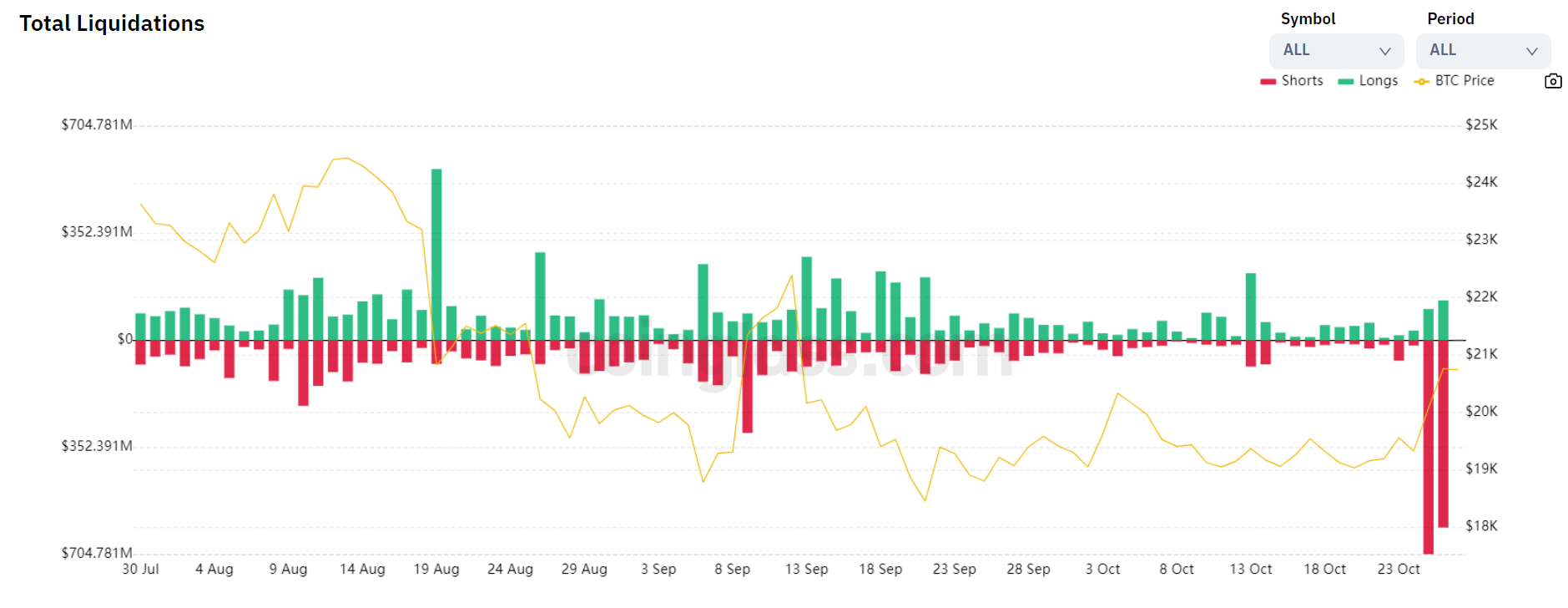

This is the continuation of a series of days of significant liquidation, which started with the powerful recovery of the cryptocurrency industry considering that the evening of 25 October. As reported by Coinlive, as of the morning of October 26, the crypto derivatives section had just about $ 800 million in liquidation. Combined with today’s numbers, the fire purchase fee in the previous 48 hrs has reached above $ one.three billion.

Statistics also demonstrate that FTX is the platform behind most of the liquidation orders, with $ one billion coming from right here, entirely overpowering the other platforms. There are some opinions that there is a chance that the exchange information reporting API has been corrupted, top to this kind of a substantial variety. FTX has not but issued a statement on the matter.

Bitcoin (BTC) and Ethereum (ETH) are the two coins with the highest liquidation worth, as the existing bull industry is even now led by these two top names.

BTC plunged back to $ 21,000 on the evening of October 26 for the 1st time considering that September 13, whilst ETH was 1 of the most bullish altcoins to strategy the $ one,600 mark.

Synthetic currency 68

Maybe you are interested: