Bitcoin and main altcoins have corrected right after a streak of development to new 2023 highs.

Volatility of the most important cryptocurrencies on the industry as of 08:00 on November 15, 2023. Source: Coin360

Volatility of the most important cryptocurrencies on the industry as of 08:00 on November 15, 2023. Source: Coin360

On the evening of November 14 and the morning of November 15, Bitcoin (BTC) fell from the USD 36,700 assortment to USD 34,800, with income volume skyrocketing.

Previously, the world’s greatest cryptocurrency has had a series of sturdy rallies and development because late October, with momentum coming from the prospect of a Bitcoin ETF from Wall Street monetary giants. BTC even set a new peak for 2023 on November 9 at USD 37,972, the highest worth threshold because May 2022, in advance of the LUNA-UST crash occurred.

1h chart of the BTC/USDT pair on Binance at 08:00 on November 15, 2023

1h chart of the BTC/USDT pair on Binance at 08:00 on November 15, 2023

There is no certain information that led to the aforementioned downward motion in Bitcoin costs. The most pertinent facts is that on the evening of November 14, the United States announced the client selling price index (CPI) information for October 2023, with the outcome that the inflation scenario has not modified significantly, but has has moved, nevertheless remaining all over the three% region.

US CPI: +three.two% Yr (EST. +three.three%)

US CORE CPI: +four% Yr (EST. +four.one%)— Tree News (@News_Of_Alpha) November 14, 2023

Other main altcoins are also impacted by Bitcoin’s decline. Ethereum (ETH) fell to $one,936 right after setting a new 2023 substantial of $two,136 on Nov. ten on information that BlackRock announced a proposal to build a spot ETF.

1h chart of the ETH/USDT pair on Binance at 08:00 on November 15, 2023

1h chart of the ETH/USDT pair on Binance at 08:00 on November 15, 2023

Solana (SOL), the foremost coin which has grown up to 190% in the final thirty days, nevertheless stays steady all over the USD 57 selling price assortment.

four-hour chart of SOL/USDT pair on Binance as of 08:00 November 15, 2023

four-hour chart of SOL/USDT pair on Binance as of 08:00 November 15, 2023

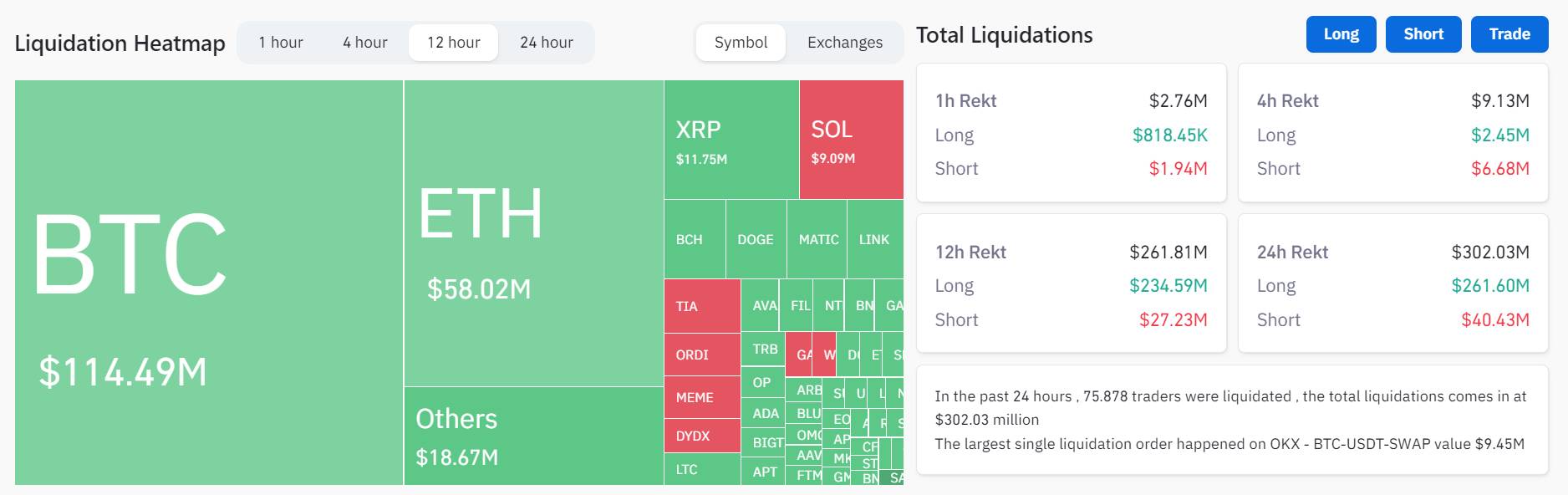

Settlement information from Coinglass demonstrates that a lot more than $260 million in derivative orders have been settled in the previous twelve hrs, of which BTC and ETH account for the vast majority. Of which, the percentage of extended orders is 89.62%.

Long-brief purchase settlement information on the cryptocurrency industry as of 08:00 on November 15, 2023. Photo: Coinglass

Long-brief purchase settlement information on the cryptocurrency industry as of 08:00 on November 15, 2023. Photo: Coinglass

Coinlive compiled

Join the discussion on the hottest problems in the DeFi industry in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!