Since 2022, Tether has constantly lowered its industrial paper holdings to maximize the percentage of safer collateral assets. To date, 58% of the collateral for the USDT stablecoin is manufactured up of US Treasury expenses.

According to Tether CTO Paolo Ardoino, US Treasury expenses at the moment signify 58.one% the complete collateral reserves of USDT stablecoins.

#bind portfolio update. Tether as of September thirty, 2022 holds somewhere around 58.one% of its assets in US Treasury bonds. Up from 43.five% on June thirty, 2022.

CP publicity is <50 million now.@Tether_to—Paolo Ardoino (@paoloardoino) October 3, 2022

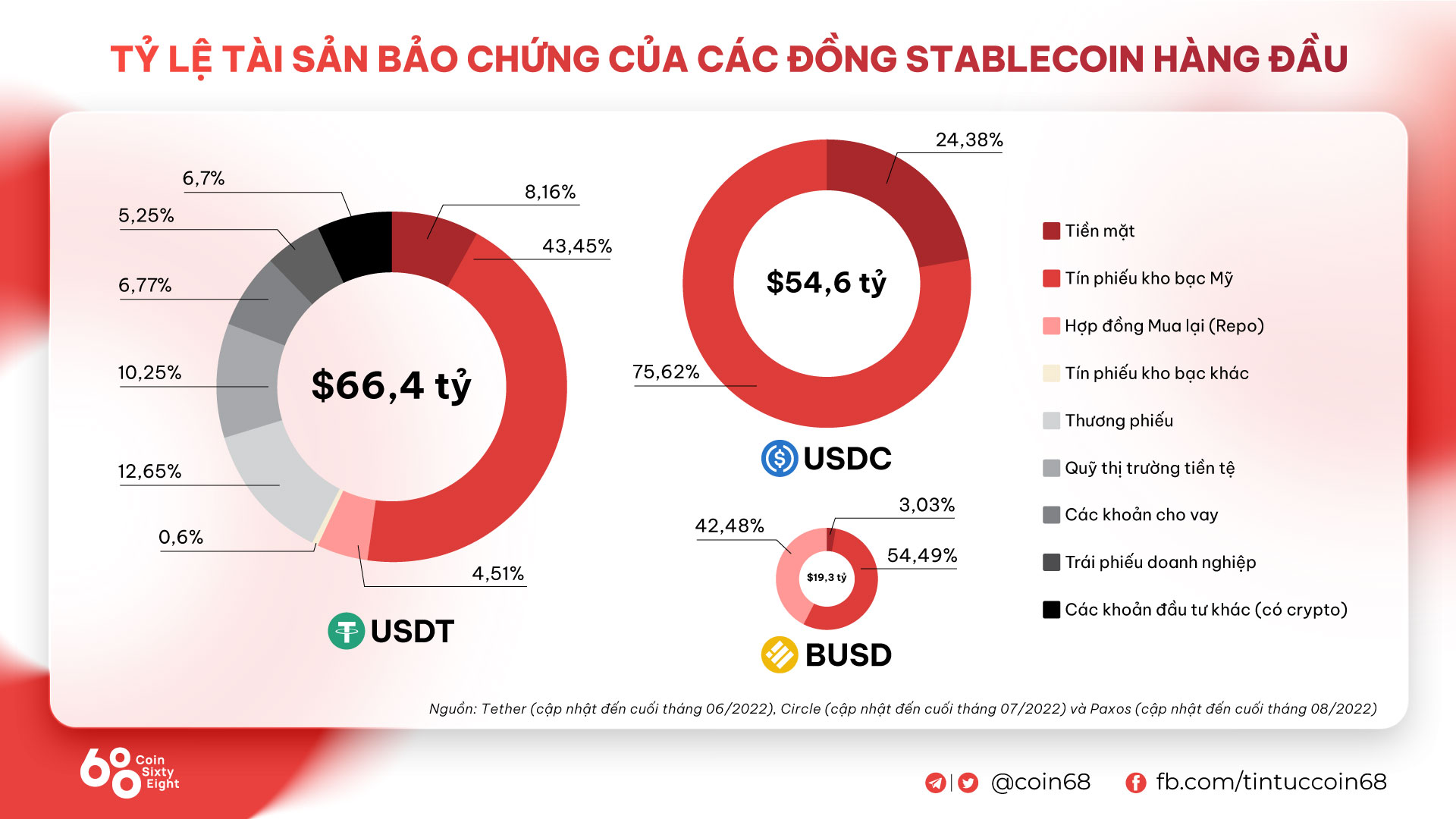

According to the second quarter escrow report, as of June 30, 2022, Tether holds total assets of $ 66.4 billion, of which cash and bank deposits increased 32%, from $ 4.1 billion to $ 5.4 billions. The amount of commercial paper held is $ 8.5 billion, or 12.65%. The amount of US Treasury bills represented 43.45%.

You can see the visual chart in the image below.

Commercial paper is short-term unsecured debt issued by a company. This is the holding that worries the most, given that Tether’s short-term loans are tied to Chinese real estate. Therefore, in the past, Tether has continuously reduced this stake to build customer confidence.

According to information from the CTO Paolo Ardoino, since 1 September the reserves of commercial paper have fallen below 50 million dollars, down by more than 58% compared to 30 June, and the amount of treasury bills has increased by more than 14%.

Therefore, US Treasuries now account for 58.1% of USDT’s reserves, giving the stablecoin a greater degree of credibility.

This appears to be the information that will be published in Tether’s third quarter margin report. However, due to the audit process and paperwork, it took several days for the report to be made public. Currently, the new security update is only shared by CTO Tether on Twitter.

Synthetic currency 68

Maybe you are interested: