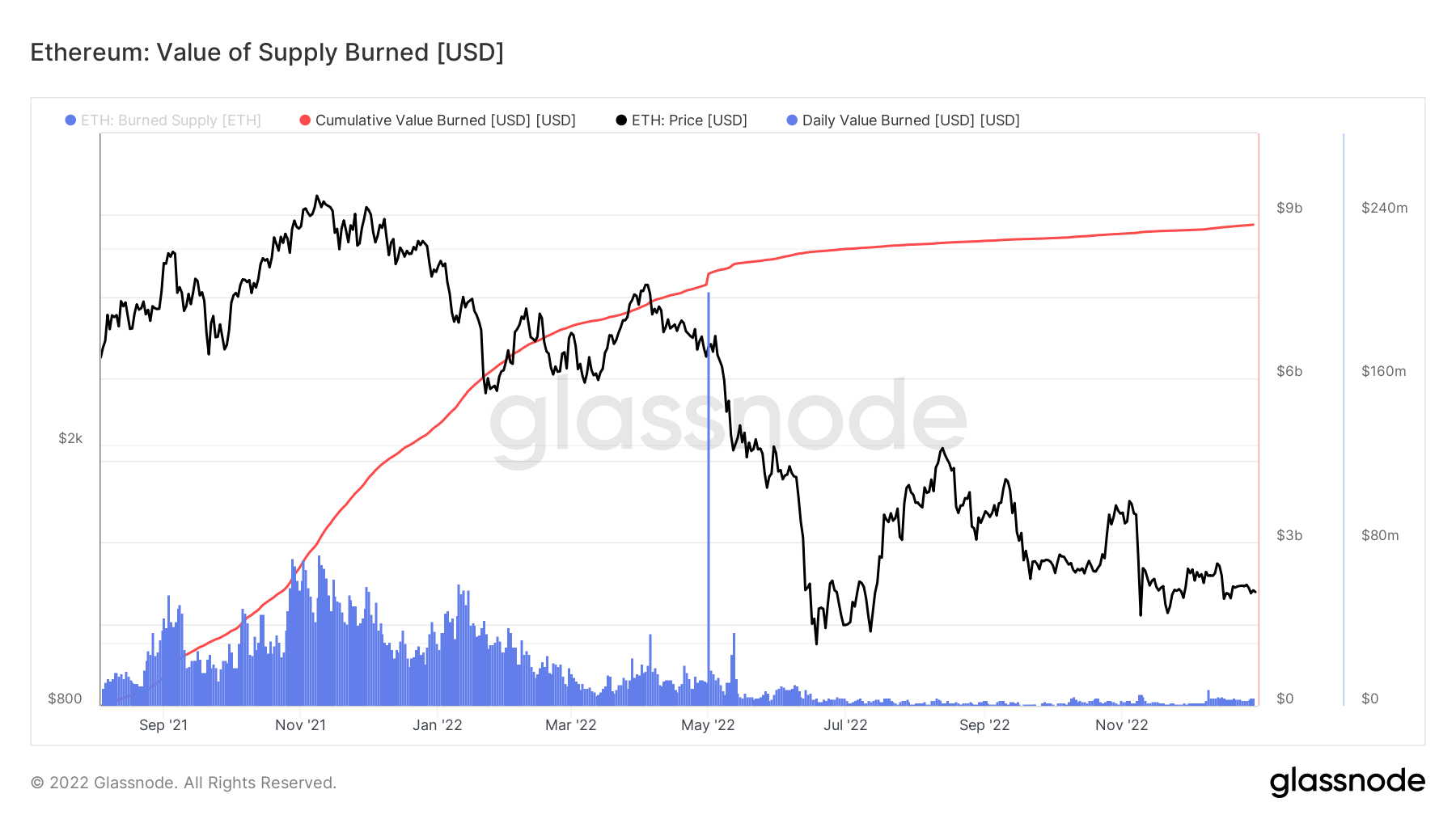

The 2nd greatest cryptocurrency by marketplace capitalization, Ethereum (ETH), implemented a burn up mechanism token on August five, 2021, by way of the Ethereum Improvement Proposal (EIP) 1559 improve. Since then, practically $9 billion in tokens have been burned cumulatively, information from Glassnode demonstrates.

According to information from ultrasound.money.

In the chart over from Glassnode, blue displays the every day provide of ETH burned at spot costs, whilst red represents the cumulative worth of ETH burned in excess of time. An evaluation of Glassnode’s information CryptoSlate suggests that Ethereum’s every day burn up price has dropped drastically and has just about stagnated due to the fact the demise of Terra-Luna in May 2022.

During the 2021 bull run, $twenty million to $75 million really worth of ETH was destroyed on a every day basis. This has dropped to only about $two million to $four million in ETH burned just about every day by December 2022. According to supersonic.income, one,896.thirty ETH, really worth close to $two.two million, was burned. burned in the previous day.

It must be mentioned that the reduce in Ethereum’s every day burn up price immediately displays the drop in Ethereum action amid the recent bear marketplace.

Understand the significance of burning ETH

Token buring refers to sending a token to an tackle from which the token turns into untraceable. Also identified as token destruction, token burning minimizes the circulating provide of the asset and shrinks the all round provide in excess of time. The burning mechanism aims to regulate Ethereum gasoline costs — costs paid for executing transactions on Ethereum.

Before there was a burning mechanism, Ethereum customers had to guess the costs they had to shell out to get their transactions on the blockchain. This leads to large volatility in Ethereum gasoline costs, primarily through occasions of large network congestion.

With hundreds of thousands of customers complaining about the gasoline charge gradient, the Ethereum network incorporates a token burning mechanism. Under the EIP 1559 improve, customers have to shell out the base charge and tip. This is equivalent to the consumer paying out the essential delivery charge and tip to the delivery personnel if the delivery is on time or in advance of the deadline. While the network burns by way of all the base costs, the tip is rewarded to the miners.

A deep dive into the every day ETH provide burned and gasoline costs information from Glassnode signifies that the normal worth of gasoline costs has dropped drastically to close to 15-twenty Gwei from close to a hundred Gwei prior to EIP 1559 implementation. For instance, the normal gasoline charge price ranges from a hundred to 200 Gwei in between January and April 2021, whilst it spikes to a lot more than 200 Gwei through occasions of network congestion.

In other phrases, the normal of Ethereum gasoline costs decreased by about 80% due to the fact the implementation of the burning mechanism.

Ethereum normal gasoline costs was twenty.fifty five Gwei on December thirty, in accordance to Etherscan data. Furthermore, information from supersonic.income signifies that Ethereum normal gasoline costs stood at sixteen.two Gwei in excess of the previous thirty days.

In addition to regulating gasoline costs, an ETH burning mechanism was launched to exert deflationary stress on the token. In other phrases, the burning mechanism minimizes the provide of ETH, which can trigger the cost of ETH to improve in excess of time. This is for the reason that the cost of any asset is influenced by the law of provide and demand, wherever the law of provide decreases triggering the cost to rise.

At the time of creating, Ethereum’s inflation price or net issuance price stands at .013% per 12 months, in accordance to supersonic.income information. If Ethereum does not move to a evidence-of-stake (POS) consensus, its issuance price will be at three.588% per 12 months. With the move to POS, Ethereum’s inflation price has dropped a whole lot in contrast to Bitcoin (BTC), which challenges new coins at a price of one.716% per 12 months.

According to estimates by supersonic.income, close to one.9 million ETH tokens are anticipated to be burned just about every 12 months, whilst only 622,000 ETH tokens are anticipated to be launched just about every 12 months.

The cost of Ethereum is presently struggling through crypto winter — ETH is trading at $one,196.52 at press time, down 67.88% on the 12 months. However, with a burning mechanism token, ETH is anticipated to develop into deflationary, which could lead to an improve in its worth in the lengthy phrase.