Neiro on Ethereum (NEIRO) is up nearly 10% over the past week, driven by increased holding times and whale accumulation.

This trend demonstrates growing optimism as investors hold NEIRO longer, showing confidence in the future value of the token.

NEIRO Price Soars Thanks to Whale Accumulation and Increased Holding Period

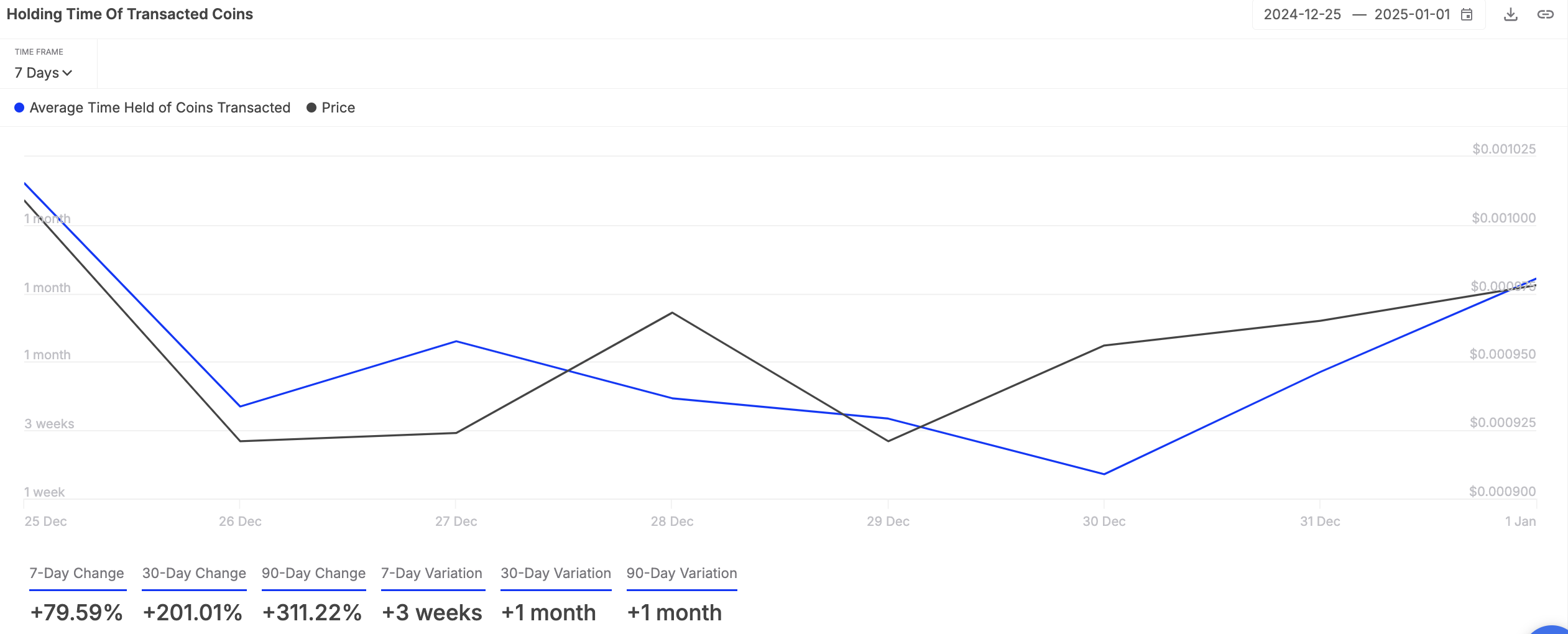

NEIRO’s analysis of on-chain activity reveals that coin holding times have increased sharply over the past week. According to data from IntoTheBlock, this index increased by 80% during the period under review.

Trading Token Holding Time measures the average length of time a Token is held in a wallet before being sold or transferred. When this index increases, it means investors have stronger confidence because they reduce selling and hold the currency for longer periods of time. This change indicates increased confidence or more optimistic market sentiment towards this asset.

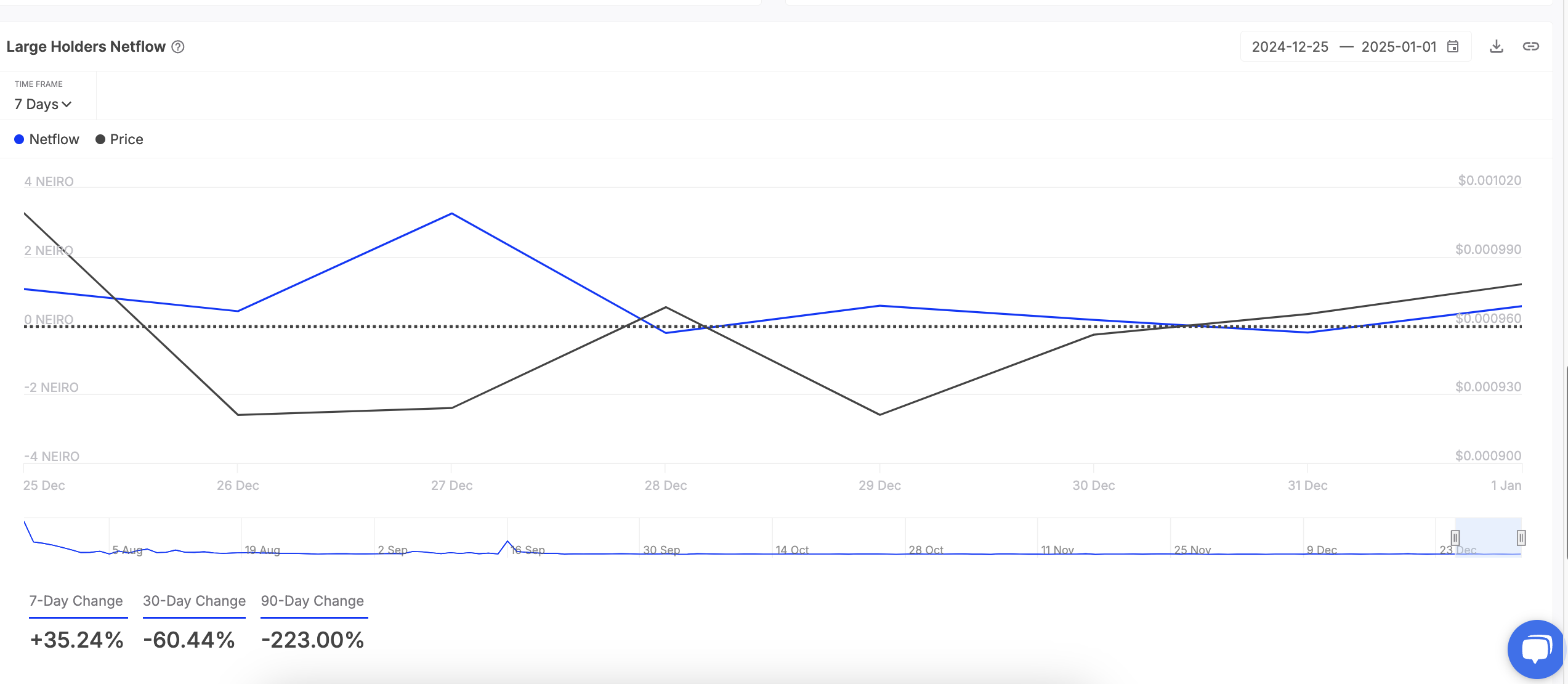

In addition, NEIRO “whales” or large investors have also increased their accumulation. Over the past week, net flows of large NEIRO holders increased by 35%.

Large holders are whale accounts that hold more than 0.1% of the asset’s circulating supply. When their net flows have a positive increase, this means that large investors are accumulating more assets than selling or moving out. This is a sign of bullish market sentiment, as increased whale accumulation represents confidence in the asset’s future price performance.

NEIRO Price Prediction: Whale Movement Could Push Prices Even Higher

Currently, NEIRO is trading at 1.0 USD. If investors increase their holding period and whales step up their accumulation, this altcoin could surpass the $1.1 resistance level. A break above this resistance could push NEIRO price to an all-time high of $3.10.

Conversely, if traders start taking profits and whales accumulate losses, this bullish prediction will be invalidated. In this case, NEIRO Token price could drop to 0.53 USD