Binance is confirmed to have numerous profound alterations below the leadership of new CEO Richard Teng, who replaces the just lately resigned Mr. Changpeng Zhao.

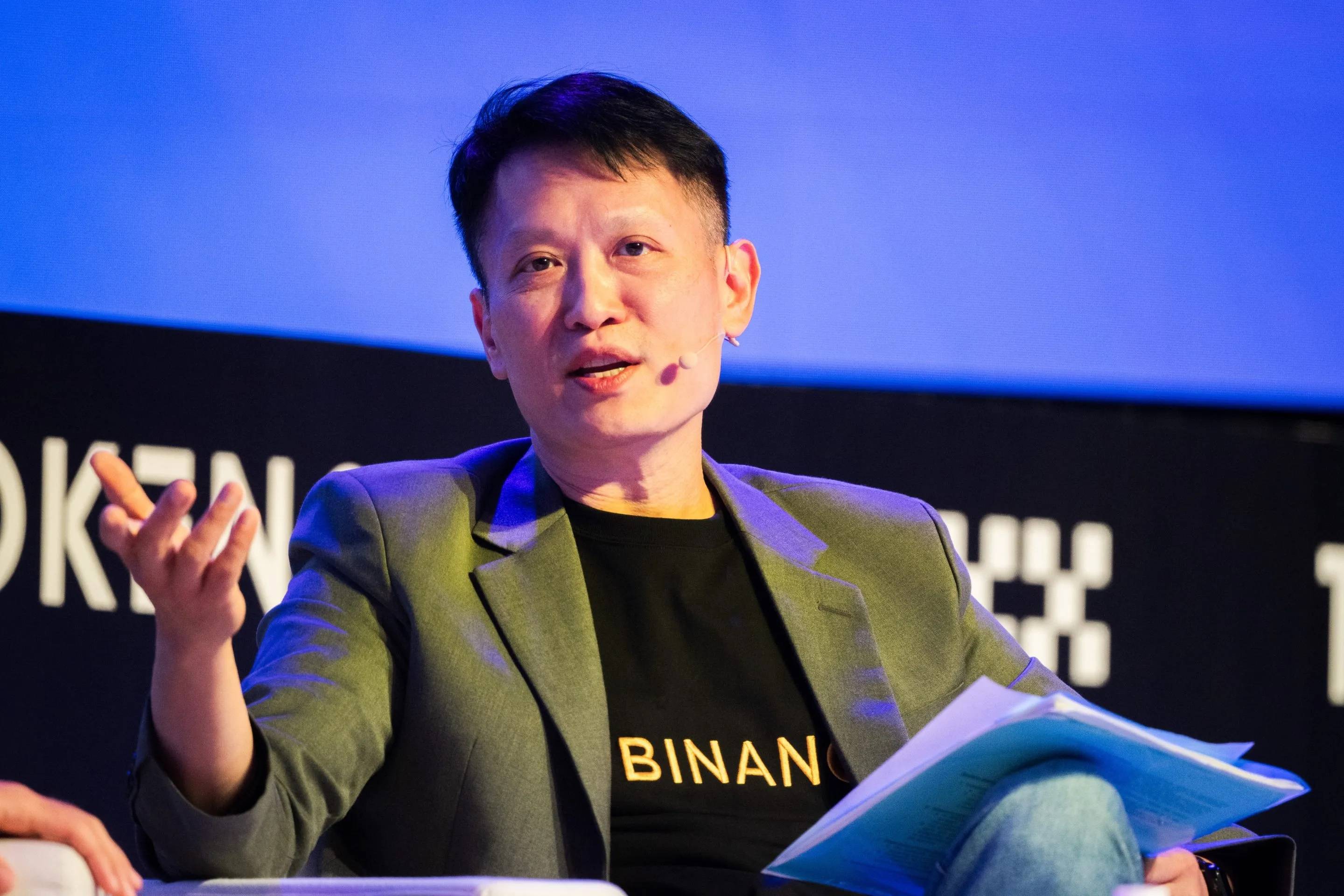

New CEO Richard Teng desires to flip Binance into a “normal financial company.” Photo: Fortuna

New CEO Richard Teng desires to flip Binance into a “normal financial company.” Photo: Fortuna

Answer the interview FortuneNew CEO Richard Teng of cryptocurrency exchange Binance desires to carry a main reform to the way the exchange operates and its management apparatus.

As reported by Coinlive, Binance accepted on November 22 Record fine of four.three billion bucks by the United States Department of Justice soon after a lengthy investigation due to the fact 2020. Founder Changpeng Zhao (CZ) also had to phase down as CEO, paid a fine of $50 million and was banned from holding management positions at Binance for three many years. The Czech Republic also faces an 18-month prison sentence for failing to impose anti-revenue laundering measures.

Soon soon after the announcement of Changpeng Zhao’s resignation, the identity of his substitute as Binance CEO, aka Director of Global Markets, was unveiled Riccardo Teng. Indeed, Teng has lengthy been rumored to substitute CZ, due to his legal background and decades of working experience in public positions in Singapore and the United Arab Emirates.

In his inauguration announcement, Teng outlined 3 fast duties that want to be achieved: strengthening consumer believe in in the exchange, functioning with worldwide authorities to make certain legal compliance, and continuing to encourage the Web3 marketplace. Furthermore, Binance representatives are assured that they are prepared for the long term “next 50 years” with the new “captain” of the exchange.

Let’s go back to the interview with Fortune, new CEO Richard Teng admitted that Binance manufactured “a lot of mistakes” in its to start with number of many years of operation, but mentioned the exchange has only been all-around for six many years, a tiny quantity in contrast to numerous other lengthy-established organizations. Thanks to these problems Binance has realized numerous items.

Teng predicts that Binance’s hard work to reinvent itself as a regulated corporation will shell out off in the lengthy phrase, positioning the corporation to declare its share of a developing pie as institutional revenue brings about the share of people owning cryptocurrencies to rise to twenty% from all-around five% Today.

— Wu Blockchain (@WuBlockchain) November 27, 2023

The CEO reiterated the moment once more that Binance has not been accused by the US government of misappropriating consumer assets, promising that Binance’s 150 million present consumers will normally come to feel safe and sound if they pick out the exchange as a area to keep their assets. items.

With numerous many years of legal working experience, Mr. Richard Teng believes that he can assist Binance in individual and the cryptocurrency marketplace in standard to comply with the worldwide legal laws that are about to be imposed in the cryptocurrency area, related to the present ones. does it take place in the banking sector?

Furthermore, Teng also confirmed that Binance will quickly set up a unique corporate framework, such as a board of directors, enterprise registration and transparent monetary info, therefore turning into a accurate monetary corporation. . This is a 180-degree transform from Binance below former CEO Changpeng Zhao: at the time, though this platform was recognized as the greatest cryptocurrency exchange in the planet, it did not announce in which it was headquartered or its area. He has refused to reveal significantly info concerning inner routines.

CEO Richard Teng mentioned:

“Once we stabilize the corporate framework, we will begin sharing monetary info. We know that not only audit units but also regulators will call for this info. We are committed to transparency as an truthful corporation.”

However, the new CEO refused to give Binance a unique time frame to put into action the over statements.

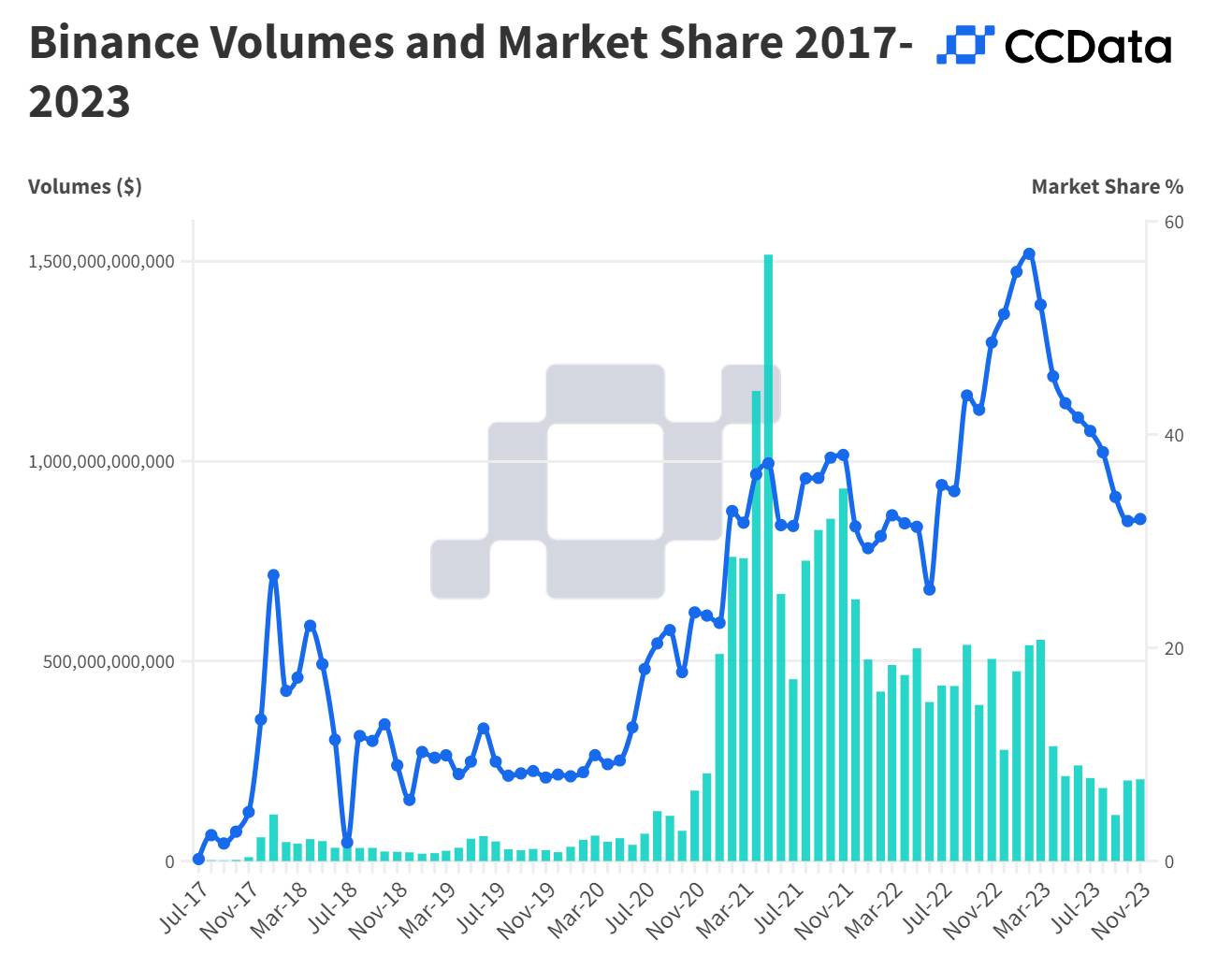

In the close to long term, CEO Richard Teng’s job will be to assist Binance restore its industry share, which has obviously declined in 2023 due to the legal challenges the exchange has encountered in numerous nations, particularly the United States. According to information from CCDataBinance’s spot and futures trading industry share declined from fifty five% and 62% in January 2023 to just 32% and 50% in October. Soon soon after the US announced the sanction, the sum of revenue was withdrawn from the industry. Even Binance at occasions crossed the billion dollar mark.

Fluctuations in Binance’s trading volume and spot industry share. Source: CCData (23 November 2023)

Fluctuations in Binance’s trading volume and spot industry share. Source: CCData (23 November 2023)

However, CEO Richard Teng is nevertheless optimistic about the exchange’s prospective customers:

“We are nevertheless in a powerful place. The basic pillars that make up our enterprise continue to be unshakable. The fund has no debt and the supply of income and income is nevertheless abundant.”

Mr Teng is assured that turning Binance into a regulated monetary corporation will carry lengthy-phrase advantages to the exchange, therefore growing industry share in the eyes of each retail traders and huge organisations.

Coinlive compiled

Join the discussion on the hottest problems in the DeFi industry in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!