New York’s money regulator needs licensed crypto companies to be far more transparent about the procedure of listing and delisting cryptocurrencies.

NYDFS Requires Crypto Firms to Increase Coin Listing Standards

NYDFS Requires Crypto Firms to Increase Coin Listing Standards

Second Wall Street Journal, New York State Financial Services Authority (NYDFS) launched a new legal framework, requiring cryptocurrency firms to come up with a set of policies to set up “coin listing and delisting regulations” to strengthen the criteria for evaluating a coin on the trading marketplace.

New York’s money regulator is raising its expectations on the criteria a cryptocurrency corporation should think about in advance of listing or delisting a coin https://t.co/Tkwcp7cP4E

— The Wall Street Journal (@WSJ) September 18, 2023

For “Coin Listing Policy”requested the NYDFS calls for cryptocurrency firms to depend on three aspects when drafting, which includes:

- Manage the listing procedure

- Currency danger evaluation procedure

- Coin monitoring procedures.

Additionally, the “Listing Policy” should be continually adapted to match the Company’s enterprise model and consumer operations, amid other aspects.

For the “Coin Delisting Policy”New York Financial Regulatory Authority request Companies should detail what led them to make their choices, which includes:

- Reasons for cancellation

- What occasions led to the delisting

- Estimated time to delist: Must contain prior notification to shoppers and pre-preparing to analyze impacts.

Once accepted, the corporation can self-assess whether or not a coin meets the criteria devoid of needing NYDFS authorization. But firms should nonetheless constantly update the Agency in creating on the record of coins they provide or use.

NYDFS Director Ms. Adrienne Harris explained:

“This guideline is vital to strengthen requirements prior to coin offerings and deficiencies found in the course of inspections will be up to date accordingly.When we find a coin that traders feel is fantastic, or when we find hazards and misuse of that coin, we want firms to have a answer to delist it. That coin is meant to defend customers in a healthier and secure way.”

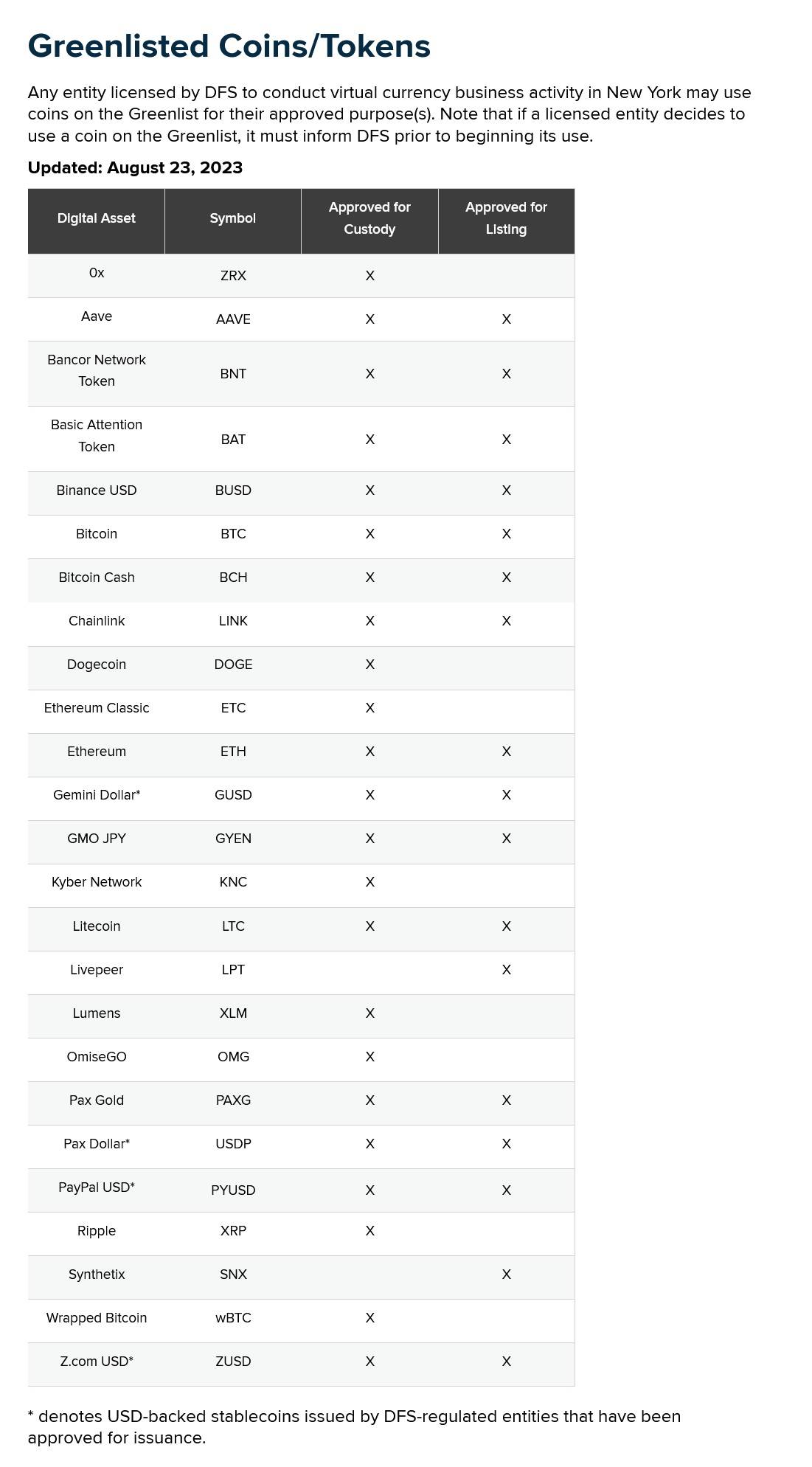

List of cryptocurrencies authorized for trading and custody by the NYDFS as of June 2023. Source: NYDFS site

List of cryptocurrencies authorized for trading and custody by the NYDFS as of June 2023. Source: NYDFS site

The new regulatory frameworks come as Harris celebrates two many years as head of New York’s biggest money regulator. NYDFS has persistently sought to place New York as a leader in regulating the insurance coverage, banking, and money sectors to set up a nationwide cryptocurrency governance system.

Over the previous two many years, below the leadership of the NYDFS director, the company has taken many legal actions towards cryptocurrency firms, which includes: fining the Coinbase exchange $50 million for lax KYC and forcing the cryptocurrency trading platform on the web cryptocurrencies Robinhood to shell out a fine of thirty million bucks. on various fees which includes “not respects the principles of the law on banking secrecy and anti-cash laundering”.

The company also serves as the supervisor of the closing procedure Signature financial institution and flip it in excess of to the Federal Deposit Insurance Corporation (FDIC) to take care of and refund all deposits to shoppers..

At the time of the collapse, in March 2023, Signature Bank has assets of $118 billion and is the third biggest financial institution failure in US background, with the aforementioned names which includes Silicon Valley Bank and Silvergate Bank happening in the similar month.

This is the following growth of the NYDFS in April 2023, when they program to concern it a new set of rules on how cryptocurrency firms will be valued. As announced at the time, the legal framework calls for firms to meet rigorous capital, cybersecurity safety and anti-cash laundering requirements.

Since early 2023, the United States has constantly taken legal actions to oversee the cryptocurrency field, which includes:

- April 2023The US House of Representatives has launched a new bill on stablecoins, which includes a proposal to ban stablecoins backed by other cryptocurrencies and direct analysis into central financial institution digital currencies (CBDCs).

- August 14, 2023, The United States Federal Deposit Insurance Corporation (FDIC) delivers a assortment of supervisory measures and advice to handle these cryptocurrency hazards.

Coinlive compiled

Join the discussion on the hottest difficulties in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!