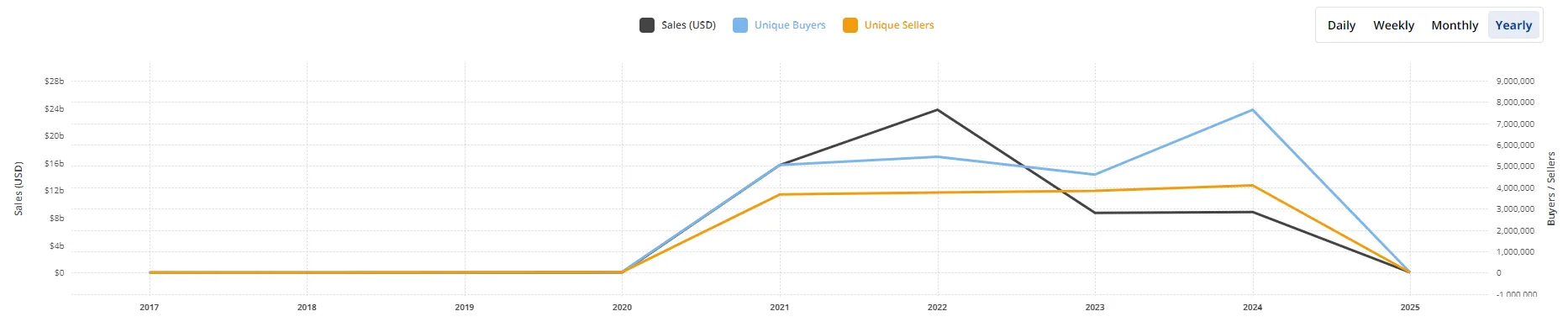

Total NFT sales in 2024 reached $8.8 billion, representing a slight increase of $100 million over the previous year.

This 1.1% year-over-year growth reflects both the potential and challenges in the digital collectibles market.

NFT sales show signs of recovery in challenging year

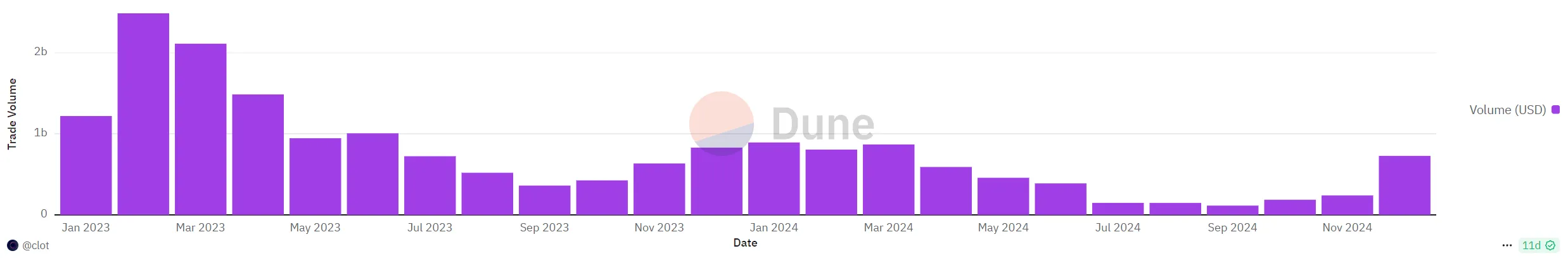

Ethereum and Bitcoin emerged as the leading blockchains in NFT sales, each generating $3.1 billion over the course of the year. Solana ranked third, recording $1.4 billion in sales volume.

In total, Ethereum maintains its lead with $44.9 billion in total NFT sales to date. Solana followed with $6.1 billion, while Bitcoin-based NFTs accumulated $4.9 billion in total sales.

The market faces significant headwinds in 2024, including a seven-month recession. September saw the lowest sales volume since 2021, reflecting reduced speculative interest and a saturated market.

However, the recovery began in October, with NFT sales rising to $353 million, up 18% month-over-month.

The momentum continued in November, with $562 million in sales marking a six-month high. December ended the year with an excellent performance, reaching 877 million USD, the 5th best month of 2024.

Ethereum collections contribute significantly, generating $482 million in December alone.

Market progress and obstacles

Outstanding collections such as Pudgy Penguins lead the market, reaching sales of 115 million USD. Platforms like Magic Eden and Pudgy Penguins have introduced their own Tokens, showing innovation in this space.

Additionally, Mythical Games and FIFA announced FIFA Rivals, a mobile soccer game that integrates NFTs. The game is likely to launch in summer 2025.

Despite these advances, challenges remain. In November, Kraken closed its NFT marketplace to focus on other projects. Users have until February 27, 2025 to withdraw their assets.

Saturation also makes it difficult for the market. About 98% of NFT collections saw little to no trading activity, and only 0.2% of NFT launches turned a profit. Most collections lost more than 50% of their value within days, reflecting a decline in speculative demand.

While the NFT market showed signs of recovery with year-end gains, broader challenges highlight the shift from speculative trading to more utility-focused applications.

As platforms innovate and adapt, 2025 will reveal whether NFTs can sustain growth amid shifting investor sentiment.