In the to start with element, we have been presented with the huge image of the puzzle pieces that exist in the NFTFi marketplace. In this post, let us join the AntiAntiNFTs Club (AANC) to delve deeper into an very possible marketplace niche identified as Fractional NFT – Fragmented NFT.

What is fractional NFT?

With the existing bleak marketplace condition, investing a substantial quantity of capital to obtain NFT as a hoarding asset is really risky. Also, due to the (indivisible) “originality” of conventional ERC-721 tokens, it is hard for customers to invest in NFTs with a DCA approach.

Therefore, a answer to this dilemma was born, identified as Fractional NFT – NFT fragmentation. This was initially a answer to make it a lot easier for ordinary customers to entry blue-chip NFT collections, which had a pretty higher beginning price tag. Basically, tasks present this answer by converting NFTs into fungible tokens with the ERC-twenty conventional (related to DeFi venture yield tokens like AAVE’s aToken or SushiSwap’s xToken).

Fractional NFT tasks

Unic.ly and Fractional.artwork (renamed.) Card)

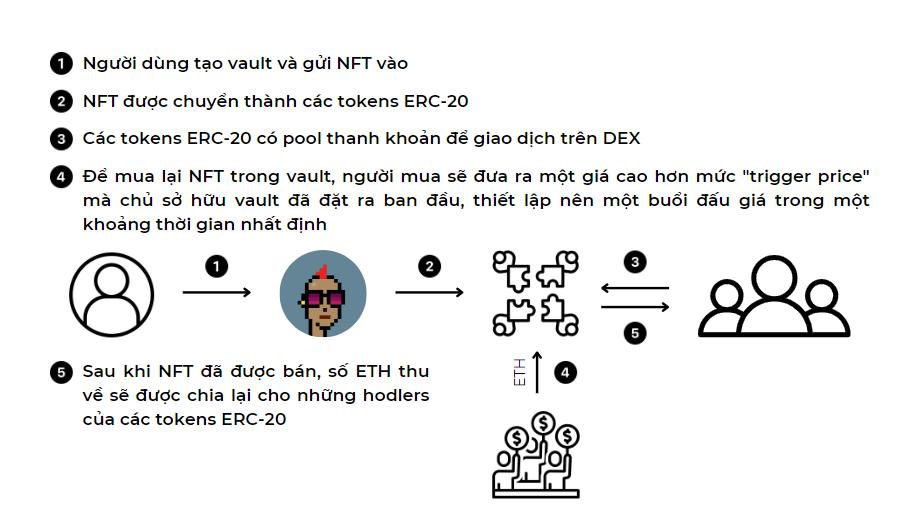

Users can produce a vault for one particular or extra NFTs in the very same assortment and split it into several fungible ERC-twenty tokens. When a further investor desires to redeem NFTs in the Unic.ly vault, he will have to shell out a increased price tag than a price tag (identified as the set off price tag) that the vault proprietor set in the to start with spot. At this stage, the auction procedure will get spot and the all round winner will order one particular (or extra) intact NFTs (in accordance to ERC-721 or ERC-1155 specifications) and return the ETH to the vault. Initial traders will be eligible to obtain this ETH primarily based on the percentage of their ERC-twenty tokens in the vault (as proven in Figure one).

Fractional.artwork has a related mechanism of action, but the activation price tag will not be predetermined by the creator of the vault. Instead, co-owners will have to vote to establish the reserve price tag, the lowest price tag a purchaser who desires to repurchase the authentic NFT has to shell out. The reserve price tag is modified only when extra than 50% of the complete provide of fragmented NFTs (e.g. ERC-twenty token) is utilised for voting. The reserve price tag will be calculated primarily based on the weighted common of all votes: for illustration, 75% of the votes vote for a reserve price tag of 150 ETH and 25% of the votes vote for a reserve price tag of 200 ETH, the finish outcome of the reserve price tag will be 162.five ETH.

NFT20 and NFTX

These tasks also produce pools and let customers to deposit NFTs in them as Unic.ly, but the variation is that the purchaser should order ample ERC-twenty tokens in the pool to repurchase any NFTs in that pool. .

Not only that, ERC-twenty tokens that are fragmented from the authentic NFT can also staking these tokens to obtain an more transaction charge reward (like AMM’s LP in DeFi) or to home loan and borrow stablecoins for l execution.

Szns.io

Szns is also a venture on the fragmentation of NFTs, but with a various technique exactly where the NFTs in just about every assortment act as the government token for the assortment: the token holders will collectively participate in the procedure, control and use the NFTs in the assortment via the vote.

Bridgesplit

Operating on the Solana blockchain, Bridgesplit is a venture with a lot of goods all around NFT, generally fractionation, yield farming with fragmented NFTs, index money, and so forth. Like prior tasks, decentralized NFT shards can also be traded on AMM Solana this kind of as Raydium. Token holders will also have the appropriate to vote on the sale price tag and timing of the NFT.

Evaluate

Precision

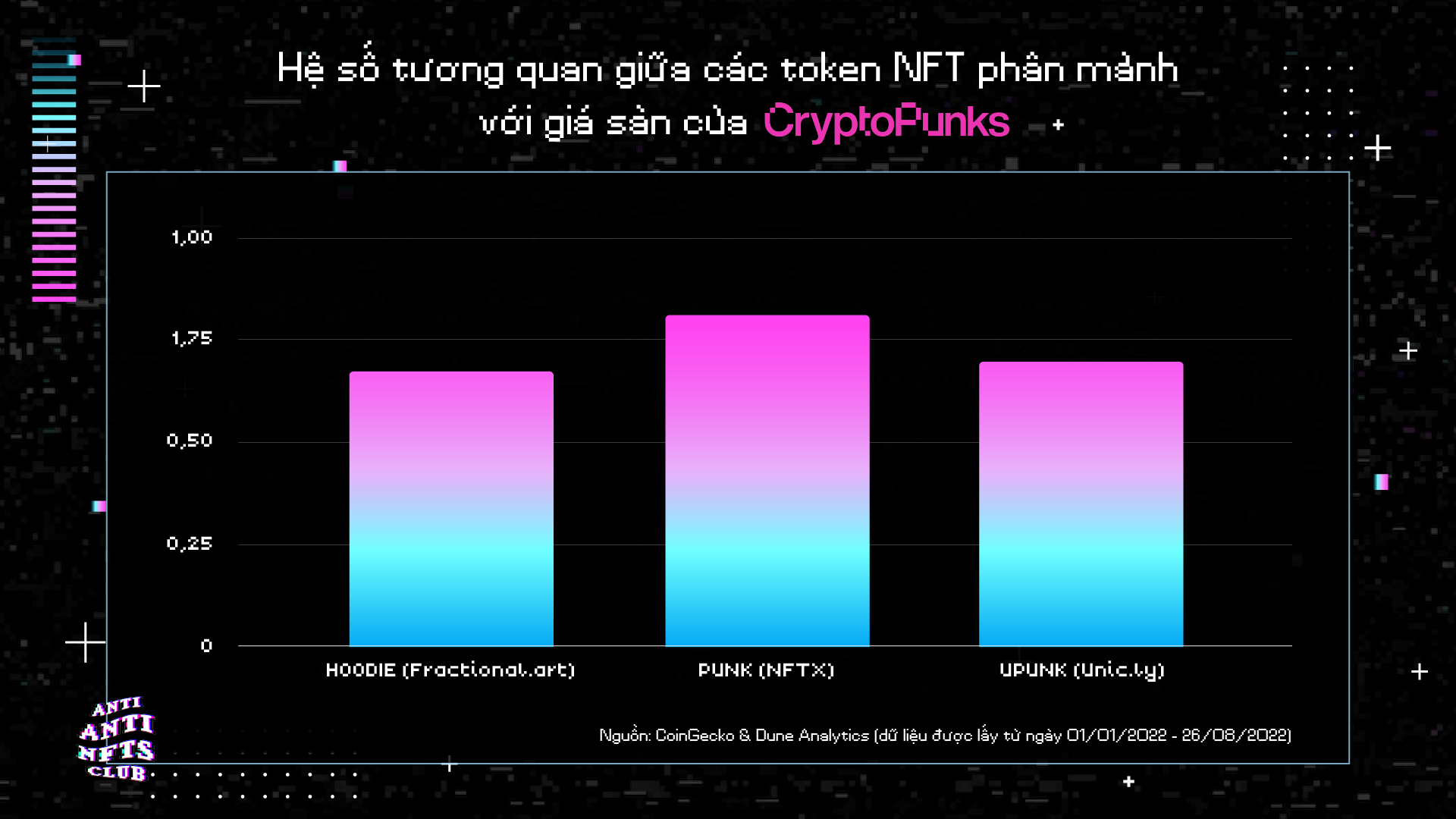

The explanation fragmented NFTs are correlated with native NFTs is simply because arbitrageurs, for illustration, when CryptoPunks minimal price tag rises, they will order ERC-twenty tokens in the NFTX pool for exchange. Get an authentic CryptoPunks, then listing this NFT CryptoPunks on exchanges on OpenSea (which has a minimal price tag increased than the complete order price tag of ERC-twenty tokens) to make a revenue.

Precision right here can be understood as the correlation of the fractionated tokens with the NFTs they signify in the pool. The increased the correlation coefficient, the extra accurately the fractional token displays the returns of the authentic NFT.

Looking at Figure two, it can be viewed that all fragmented tokens have a optimistic correlation coefficient (higher than ) with the minimal assortment price tag on NFT exchanges. NFTX’s PUNK token demonstrates the highest correlation (.81), followed by Unic.ly’s UPUNK (.seven) and Fractional.art’s HOODIE (.68).

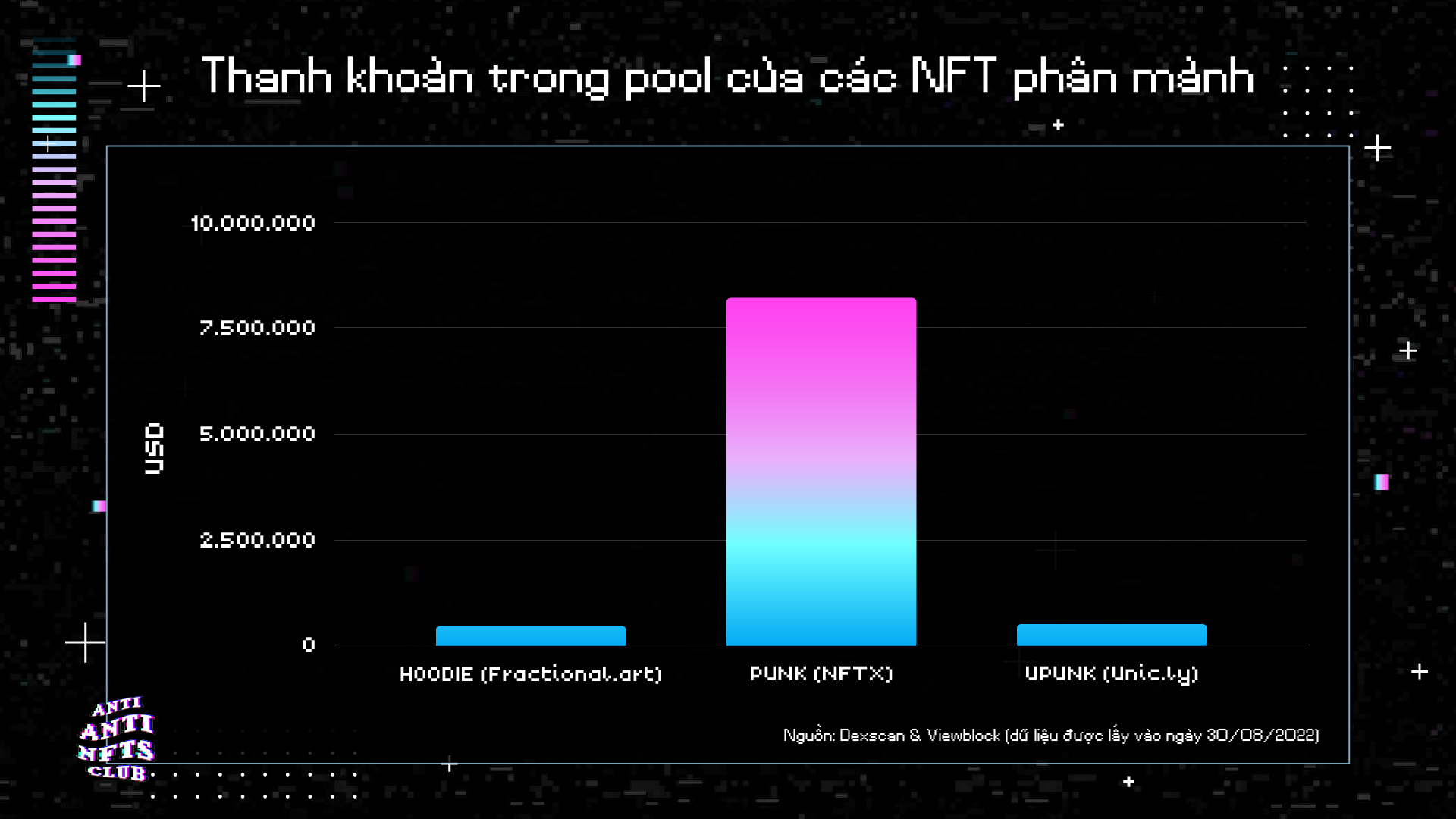

The explanation for this correlation variation is due to the variation in liquidity in the fragmented token swap pool (PUNK and HOODIE are largely trading on DEX whilst UPUNK is trading on MEXC and DEX exchanges). Unique one of a kind to Unic) (Figure three). Additionally, Fractional.art’s HOODIE token is fragmented by a single NFT, Punk # 7171, rather than a pool of a lot of NFTs like NFTX, so liquidity is also somewhat decrease.

The MeebitsDAO pool of SZNS consists of 92 NFTs of which the correlation coefficient to the Meebits minimal price tag is .36, the liquidity in the ERC-twenty token pool is somewhere around $ 82,540.

The MeebitsDAO pool of SZNS consists of 92 NFTs which have a correlation coefficient with the Meebits minimal price tag of .36, the liquidity in the ERC-twenty token pool is somewhere around $ 82,540 (at press time).

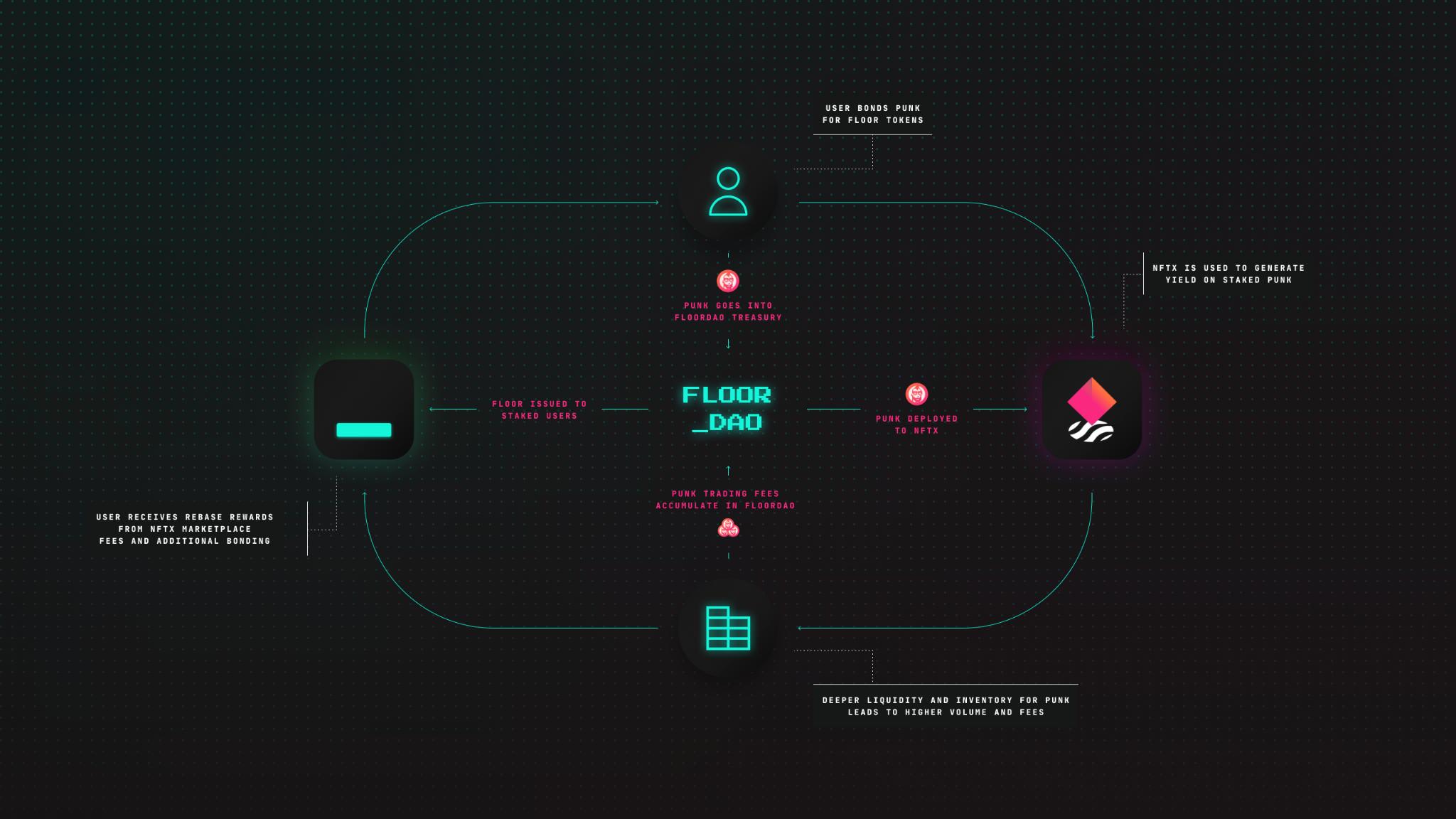

There is also to include, it is thanks to the higher liquidity of the PUNK token that was utilised as a token in the reserve fund of FloorDAO – a protocol that operates in a related way to Olympus DAO (Figure four):

- First, customers will deposit PUNK in FloorDAO to obtain FLOOR tokens back at a discounted price tag

- FloorDAO will use the PUNK acquired to carry on distributing on NFTX to obtain rewards from offering liquidity

Right to manage

Fragmented NFT tokens have been developed mainly to meet investment desires, so ownership of these tokens is not higher. One significant disadvantage of holding these fragmented tokens is that customers do not have complete authority to choose exactly where to obtain / promote with the NFT fragment they hold and the NFT in a normal deposit are not able to be rented for sale. owners (except if members of the DAO in accordance to the SZNS organization vote for lease), generating revenue optimization from pooled assets pretty smaller.

Fragmented NFT tasks, albeit underactive, are nevertheless a handy instrument for traders who want to allocate capital to the NFT marketplace but are nevertheless concerned about the illiquidity of this asset class. Therefore, when picking out to invest in the fragmented NFT section, traders should pick trustworthy, higher liquidity and lively trading volume tasks to reduce the chance to the portfolio.

About AntiAntiNFTs Club (AANC)

AntiAntiNFTs Club (AANC) is a neighborhood of NFT collectors and traders in Vietnam. Born out of really like for NFT, AANC constantly desires to spread that really like to anyone by setting up a excellent neighborhood, a spot accurate to our slogan “I can’t help falling in love” with NFTs.

Join the AANC Community on: Telegram | Twitter

See other prior AANC posts: