- NIL token faces price crash due to unauthorized sell-off.

- Nillion initiates legal action to counter the market maker’s actions.

- No impact on other cryptocurrencies; treasury funds used for recovery.

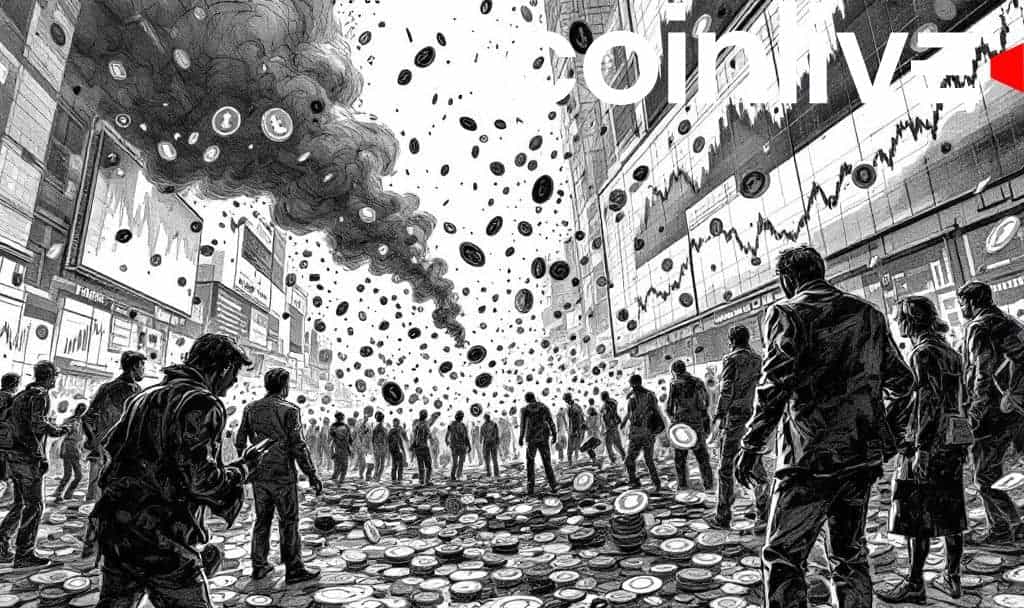

Nillion’s NIL token experienced a drastic 65% price crash after an unauthorized market-maker sell-off, leading to significant legal and market responses.

The event highlights vulnerability in crypto markets impacting trust and liquidity, prompting immediate legal action and demonstrating the sector’s volatility.

The Nillion network recently experienced a sharp price drop in its NIL tokens due to an unauthorized sell-off by a market maker. The incident led to a significant value decrease, impacting token holders and prompting immediate action.

The Nillion Association and an unnamed market maker are at the center of this event. The unauthorized sell-off led the team to freeze related accounts and begin legal proceedings to address the situation and reassure stakeholders. As stated by the Nillion Association team, “If you were surprised by yesterday’s price action, you’re not alone. The sell-off was executed without authorization by a market maker who then refused all communication. This type of behavior unfortunately happens in crypto. But we will not simply give you ‘nice words of hope.’ We are taking immediate action.” source

The NIL token’s value plummeted from $0.23 to $0.08, demonstrating the severe impact of the unauthorized action on the market. Despite the price crash, Nillion’s network functionality and security measures remain unaffected, according to the leadership.

The financial implications were swiftly mitigated by deploying treasury funds for token buybacks, aiming to stabilize the market. The leadership confirmed that no team or treasury wallets were tampered with during this event, ensuring stakeholder confidence.

The incident underscores the vulnerability inherent in cryptocurrency markets where market makers can inadvertently influence token stability. Such occurrences spotlight the necessity for strong legal frameworks and market oversight to safeguard investor interests.

Historical events in crypto markets have highlighted the importance of prompt action by project teams in preserving investor trust. The Nillion team’s immediate response showcases a commitment to protecting assets and engaging with necessary legal mechanisms.