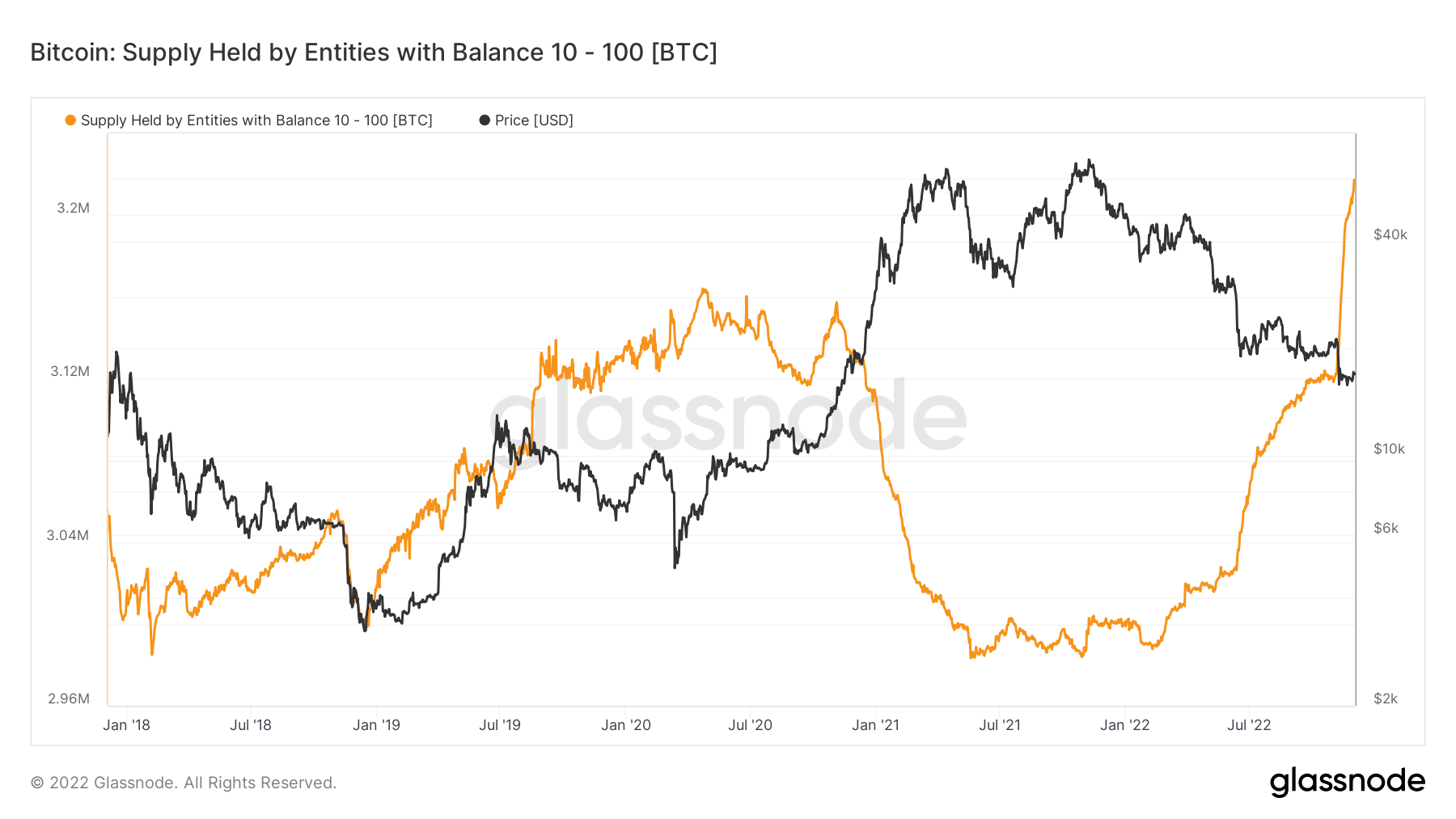

Data compiled by CryptoSlate demonstrates the amount of Bitcoin wallets containing in between ten and a hundred BTC whose provide greater from two.98 to above three.26 million coins in between 2018 and 2022.

However, in terms of accuracy, there are some caveats to this information. It is unclear how quite a few of these wallets belong to exchanges, above-the-counter desks, or other entities rather than men and women. Furthermore, the Bitcoin aSPOR trend information also depicts excessive capitulation across the all round industry.

It is also unclear regardless of whether new end users or present end users will hold wallets. However, the information gives some intriguing insights.

First, the amount of Bitcoin wallets holding non-whale BTC has greater drastically in current months. This signifies a increasing demand for BTC amongst modest holding traders and a increasing appetite for Bitcoin as an investment.

It need to also be mentioned that the development of wallets holding ten to a hundred BTC is a great deal bigger than the development of wallets holding in between one and ten BTC. This demonstrates that Bitcoin holders are more and more investing in electronic income. The dataset could indicate that Bitcoin is getting much more common and much more men and women are realizing its prospective as an investment. Below is a representative chart of Bitcoin entities holding ten – a hundred BTC:

The figures reflect two sorts of retail Bitcoin holders amassing record quantities of BTC following the FTX crash.

Traders use derivatives and leverage to trade cryptocurrencies. This group has been accumulating BTC given that the starting of November.

While the 2nd group consists of smaller sized, non-whale traders, these traders have been obtaining BTC in bulk given that mid-October when the industry started to crash. These retail traders are unlikely to be impacted by the FUD surrounding the FTX crash and the bear industry.

Furthermore, the information demonstrates that the amount of lively non-whale traders has greater drastically given that mid-October, suggesting that modest traders truly feel much more assured in the crypto industry.

Based on electronic income reports, non-whale traders are most likely to purchase when rates drop and have accumulated record quantities of BTC above the previous handful of weeks. This could signal an impending bullish sentiment in the industry and lead to a attainable recovery in the close to phrase.