The bitcoin-intensive NYDIG Digital Investment Group is laying off substantial numbers of staff members to reduce fees.

Bitcoin company NYDIG laid off about a third (thirty%) of its workforce final month to reduce fees, the report stated. Wall Street newspaper news yesterday 13/ten.

Bitcoin trading and financial institution company NYDIG laid off about a third of its workforce final month, folks acquainted with the matter stated. https://t.co/KAtHwnmrKf

– The Wall Street Journal (@WSJ) October 14, 2022

The firm is identified to have laid off all over 110 folks on September 22, inside of weeks of changing two of its CEOs. Earlier this month, NYDIG had nominate Tejas Shah as CEO and Nate Conrad as President.

United States of AmericaThis was uncovered by a former NYDIG worker CoinDesk That:

“You can disappear and no 1 will know for months. It’s a bit like trading psychology, exactly where no person talks to any individual. ”

NYDIG is identified for offering cold custody remedies to institutional traders and higher net well worth persons. It claims to be a “Bitcoin company” and pays staff members in BTC, in spite of getting rejected quite a few occasions by the SEC for its program to make an ETF.

NYDIG is a subsidiary of Stone Ridge Holdings, A multi-billion dollar asset management enterprise that also owns Stone Ridge Asset Management LLC, which final month filed a program to liquidate and dissolve its strategic Bitcoin fund with the SEC.

Last yr, NYDIG raised $ one billion in a funding round led by venture capital company WestCap with the participation of Bessemer Venture Partners, bringing the company’s valuation to above $ seven billion. The main Bitcoin speculator also effectively raised $ 720 millionas offered by Coinlive final week.

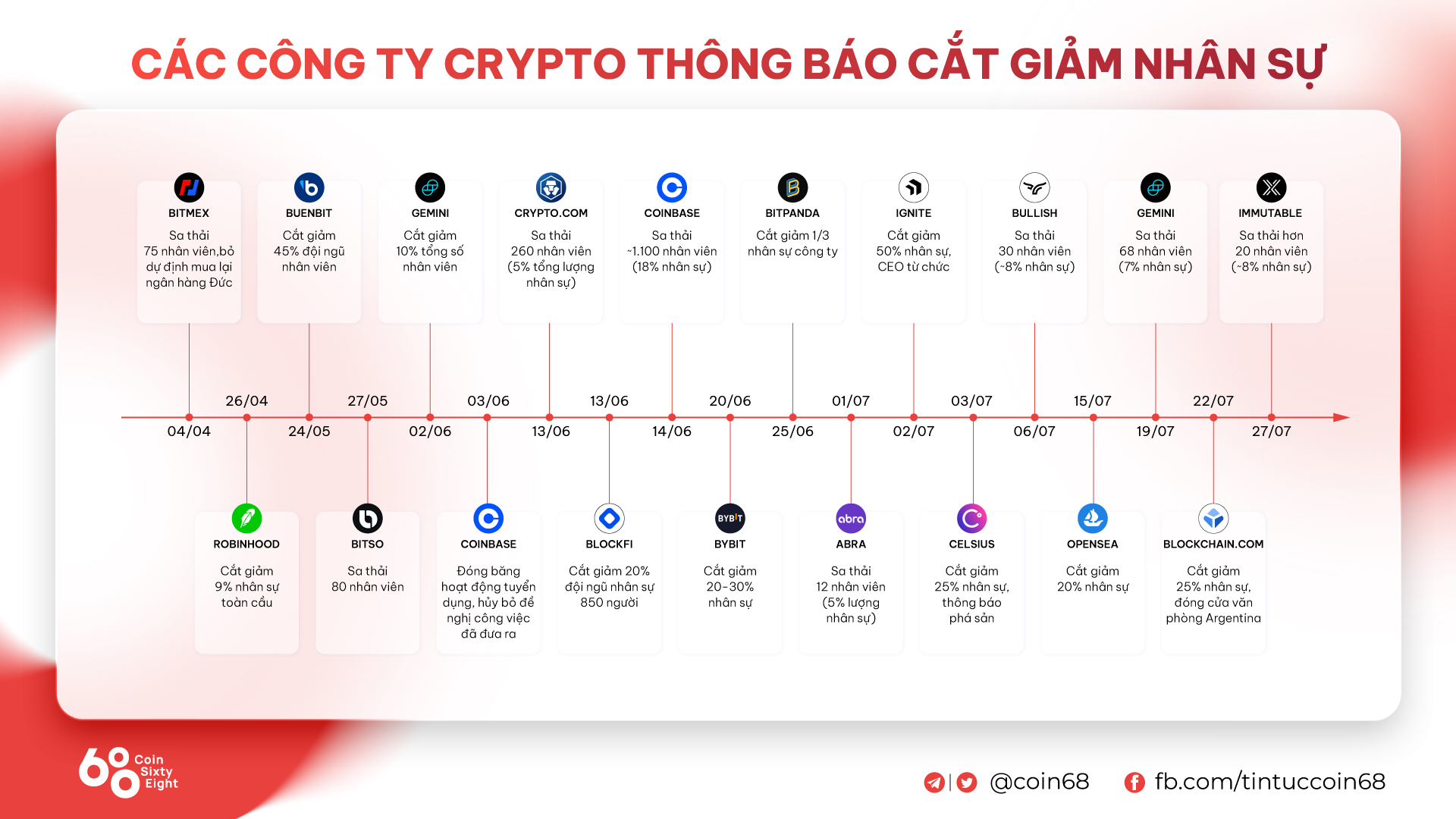

The latest crisis would seem to deliver down a firm that currently does double holdings in BTC compared to 2021 and is on the verge of establishing a new ATH peak, along with quite a few other names in the “austerity” trend this kind of as Coinbase (twenty% workers reduce), Crypto.com (260 worker layoff), BlockFi (260 worker reduce), BlockFi (twenty% workers reduction), 850 folks misplaced their jobs), Blockchain.com (25% workers fired, workplace closed in Argentina), Cosmos (50% workers separated, CEO resigned) …

Synthetic currency 68

Maybe you are interested: