[ad_1]

Bitcoin is exhibiting indicators of going up when it hit the help space on June 22 when it peaked at $34.881 the subsequent day.

Whether help is discovered on the present worth stage or rejected will probably decide the course of the long run Bitcoin worth pattern.

BTC has popped up

Bitcoin has been on the rise since June 22 after hitting a low at $28,805. The rally was then initiated by a bullish divergence in each the RSI and the MACD sign line (blue line). The subsequent day, BTC hit a excessive of $34.881.

However, the Bitcoin worth has additionally gone down since that point. While bullish divergences have emerged, technical indicators are bearish. MACD and RSI are each declining. The first worth is detrimental whereas the latter has dropped beneath 50. Also, the Stochastic oscillator may be very shut to creating a bearish cross (pink circle).

The nearest help and resistance ranges are at $31,300 and $41,500.

On the verge of a breakout?

The H2 chart exhibits BTC breaking out of a descending resistance line, which has been in place since June 15. However, Bitcoin was rejected by the 0.5 Fib retracement resistance at $35,070.

Currently, BTC is within the strategy of confirming help (inexperienced icon). This line additionally coincides with the 0.382 Fib retracement help (white).

Even so, technical indicators will not be exhibiting any bullish indicators. The RSI has dropped beneath 50 and the MACD is exhibiting a bearish reversal sign.

Increase or lower?

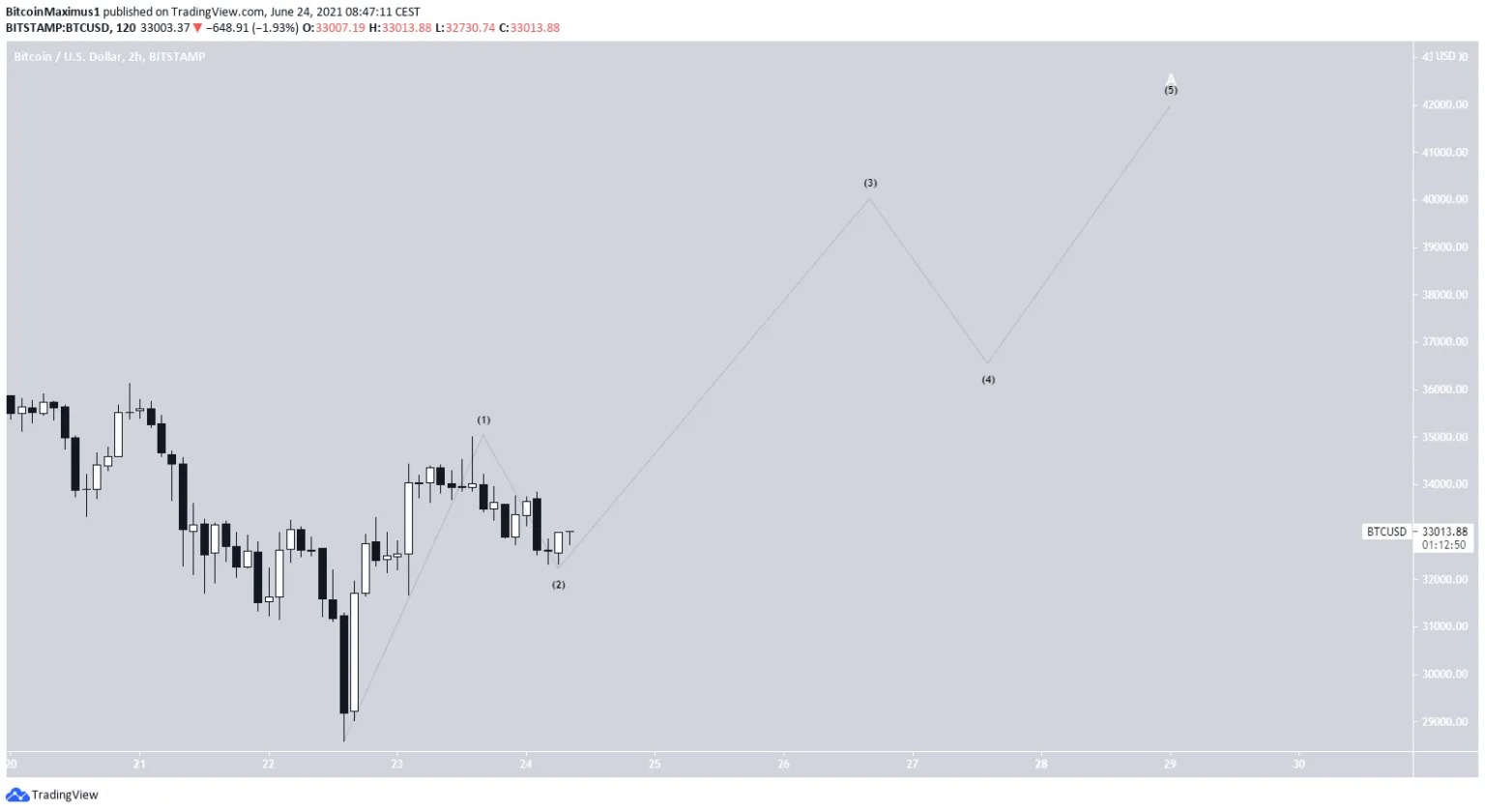

It is just not but clear whether or not the wave rely is bullish or bearish. However, yesterday’s drop beneath the $33,367 low (pink line) signifies a second decline. The rise from the low appears to be like like a 3 wave construction as a substitute of a bullish impulse.

For that to be true, the continued decline must be a 1-2/1-2 wave construction. Therefore, the worth will drop sharply.

A transfer above the descending resistance line and the excessive of $33,869 would point out that this isn’t true and the quantity is bullish as a substitute.

If BTC breaks, it might imply that the present motion kinds waves one and two (black) of a bullish impulse, which might full the longer-term wave A (white).

Therefore, the actions within the subsequent few hours are decisive in figuring out the course of the pattern.

Synthetic

Maybe you have an interest:

.

[ad_2]