- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Cody Maynard led the failed initiative.

- BTC prices remained stable post-vote.

The event highlights the challenges facing state-level cryptocurrency investments, with no immediate impact on Bitcoin markets.

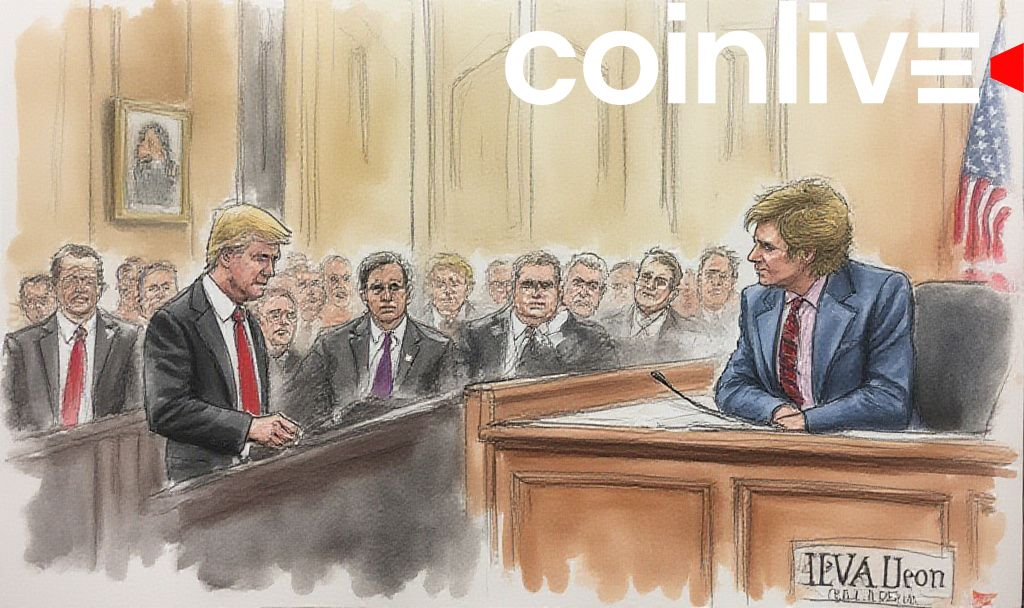

Oklahoma’s Senate vote rejected the Strategic Bitcoin Reserve Act, which proposed allocating up to 10% of state funds to Bitcoin. Rep. Cody Maynard and Sen. Brian Guthrie were prominent advocates for this initiative. Maynard argued that Bitcoin could provide financial freedom and act as a hedge against inflation.

The proposal aimed to diversify state investments by including digital assets, emphasizing Bitcoin, which met the bill’s criteria due to its market capitalization.

The move demonstrates our need for adaptive financial strategies. “Bitcoin represents freedom from bureaucrats printing away our purchasing power. As a decentralized form of money, Bitcoin cannot be manipulated or created by government entities. It is the ultimate store of value for those who believe in financial freedom and sound money principles.” — Cody Maynard

The Senate’s decision halted any state-level Bitcoin acquisitions, a move that followed similar rejections by other states. There was little impact on cryptocurrency markets, with Bitcoin prices showing minimal fluctuation after the announcement. Failed initiatives like this raise questions about the feasibility of state-sponsored digital asset reserves amidst volatile markets. Potential outcomes include reevaluations of cryptocurrency legislation at state levels, with other states like Arizona and Texas continuing exploration of Bitcoin reserves. Regulatory discussions may increasingly influence national strategies on digital asset accumulation.