Data from CryptoQuant statistics clean reserve of OKX, Binance and Huobi exchanges are one hundred%, 94% and 61% respectively.

According to the statistic Backup check Released on the afternoon of February twenty, the OKX exchange elevated the sum of assets held on behalf of consumers to $eight.six billion, continuing to raise from the previously announced 3 occasions.

🚨 Fresh off the press#OKX is proud to publish our February #ProofOfReserve partnership.

TLDR:

one. OKX continues to have the biggest reserves of one hundred% clean assets in the market.

two. Over a quarter of a million exceptional consumers have previously verified the PoR.Details: https://t.co/3Jp3Ht52rC pic.twitter.com/H45KwQLitV

—OKX (@okx) February 20, 2023

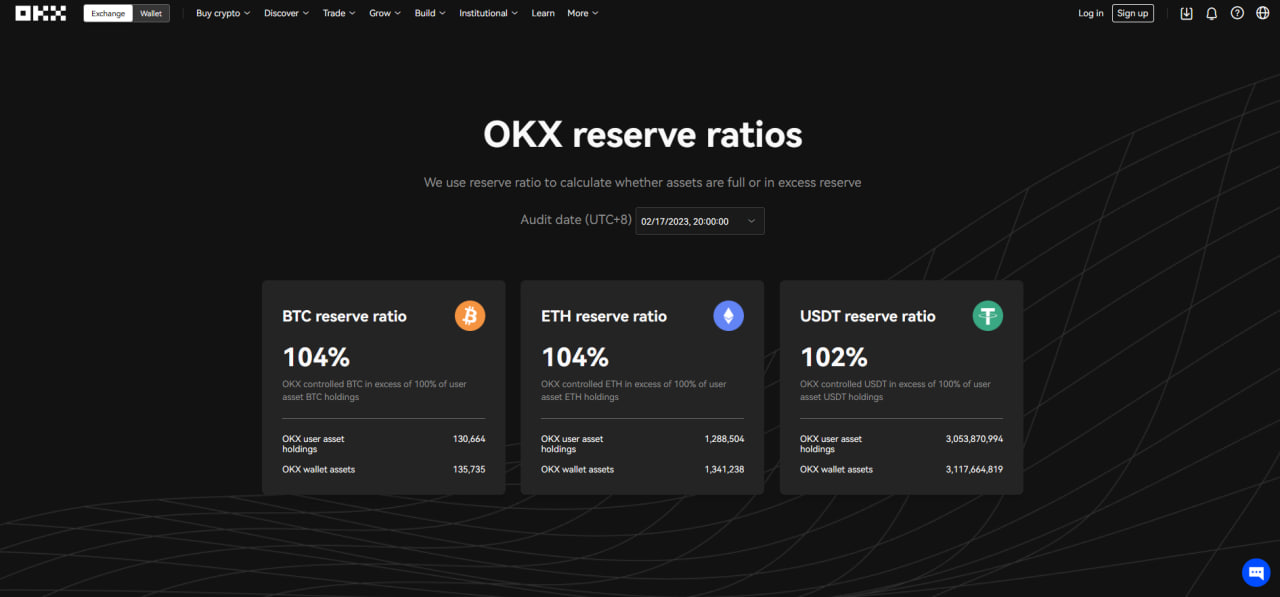

Specifically, OKX informs that it is managing 130,664 BTC, one,288,504 ETH and three billion USDT as of February 17th. Compared to the real sum deposited by clientele on the exchange, the over figures are two-four% larger, guaranteeing a margin ratio constantly larger than one hundred%.

The exchange claims that much more than 175,000 consumers have visited the Proof-of-Reserves web site due to the fact its launch final 12 months. OKX Financial Markets CEO Lennix Lai mentioned in a statement:

“Proof of reserve is critical to building user trust and we guarantee that OKX will continue to lead this trend in the industry.”

Last month, OKX announced that the sum of consumer assets on the platform had elevated from $six.four billion in December 2022 to $seven.five billion.

Furthermore, the collapse of FTX, largely due to illiquid token holdings, has offered birth to a new idea of “clean reserves”, designed by CryptoQuant to measure an exchange’s dependence on its very own currency. percentage of the price range.

Follow also Latest information from CryptoQuantOKX continues to lead this index with a ideal score, though Binance’s “cleanliness” is only 94% and Huobi 61%.

Recently, OKX announces the approaching launch of the blockchainresonate with the report on optimistic capital transparency a short while ago constructed OKX’s OKB Token rate sees spikes all the time and is trading at $52.9.

Synthetic currency68

Maybe you are interested: