Consider the on-chain indicators for Bitcoin, particularly the CDD-Coin Days Destroyed indicator. The indicator is analyzed to figure out the age of the traded coins and no matter if the extended-phrase holders have exited in the course of the latest value rally.

Some versions of the CDD display under typical values, an indication that older coins are not becoming traded. Therefore, extended-phrase holders are unlikely to exit the marketplace in the course of the existing exit.

CDD

CDD is an indicator that measures how extended BTC stays unused in advance of becoming traded. Every day that is not still invested, a “coin day” will be accumulated. When the coin is traded, these accumulated days will be destroyed.

The CDD reading through signifies how a lot of days the coin was destroyed. A substantial reading through exhibits that coins that had been previously inactive for a substantial time period of time are now becoming moved. This typically takes place in the course of intervals of substantial value increases and in the course of recovery intervals following sharp falls.

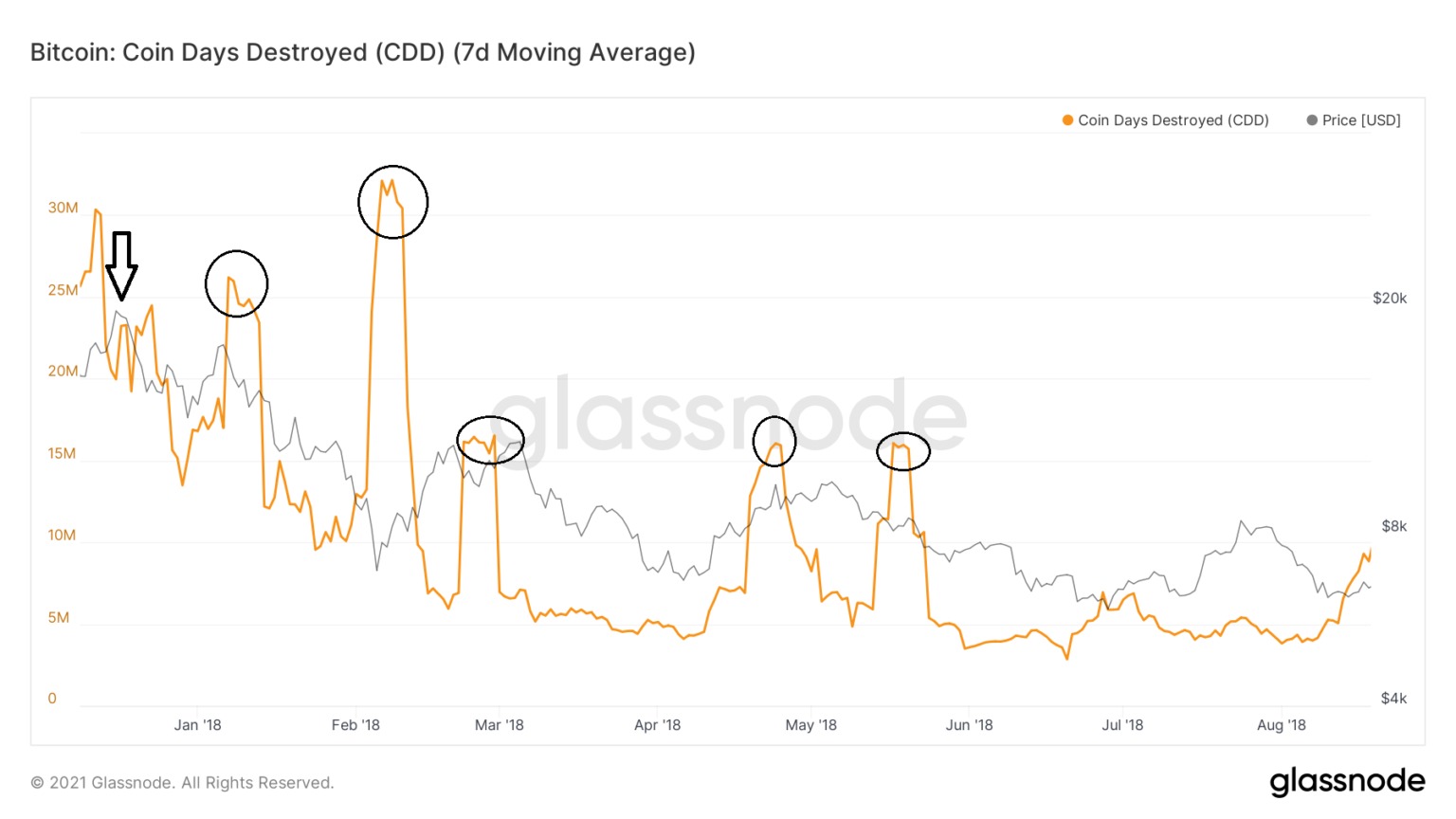

After peaking at BTC 2017 (black arrow), CDD has observed a substantial rise quite a few occasions. This is a indicator that older coins are exiting the rally in most retracements. By intuition, this suggests that older coins are applying these spikes to exit the marketplace in advance of resuming corrections.

During this time period, CDD skyrocketed fivefold (black circle), reaching values between sixteen.five million and 32.two million.

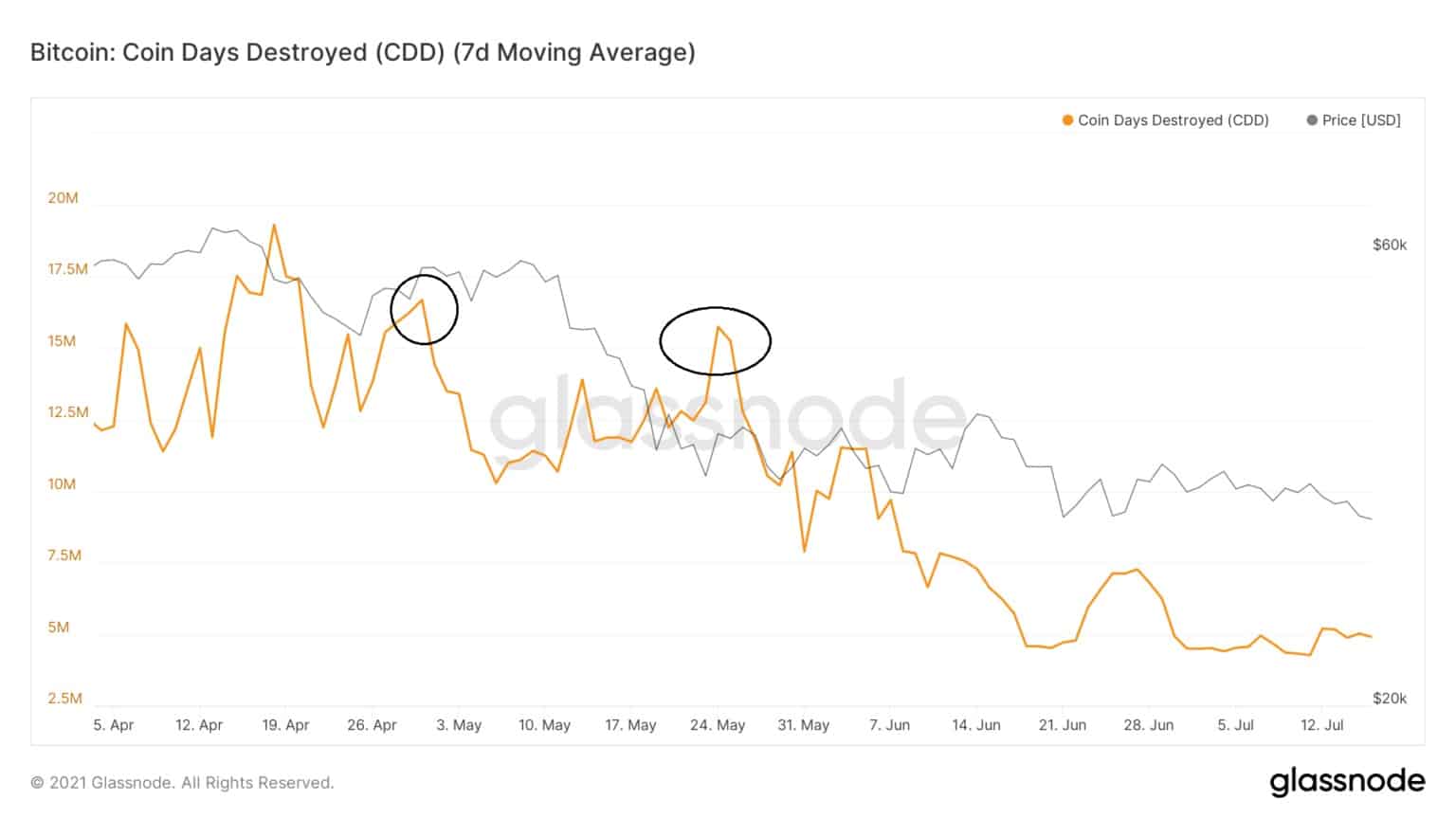

However, the similar did not transpire following the 2021 peak. While the CDD hit a substantial of 19.three million at the time of the value spike, the index rose over 15 million only twice in the course of the correction on the day. April thirty and May 24. .

Therefore, as opposed to the 2017 correction, older coins did not burst in the course of Bitcoin’s rebound, in spite of a substantial drop from its all-time highest BTC value of $ 64,437.

Binary CDD

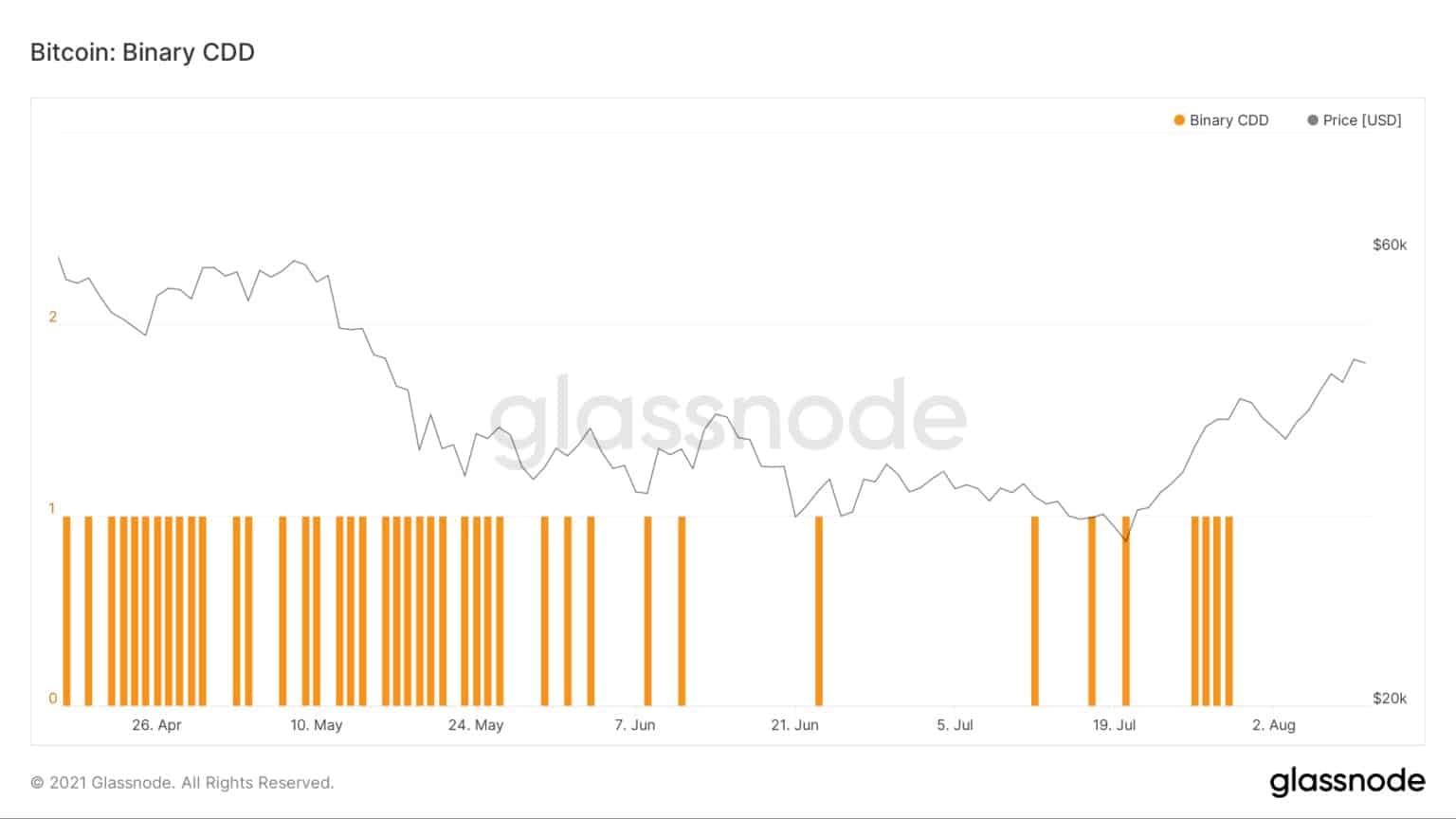

The binary CDD is an indicator that measures no matter if a provided day has an over-typical amount of coins destroyed in the course of the day. The indicator provides a worth of one particular if the intraday CDD is increased than the typical CDD. Otherwise, give the worth otherwise.

As of July thirty, no over-typical days have been destroyed, indicating that fewer and fewer older coins are becoming traded.

Also, the similar metric is provided by the 90 day coin’s destroyed day indicator, which is the complete rotating CDD. This exhibits a somewhat reduced worth of 197,975. This is under the reduce threshold of 200,000.

Furthermore, this end result is in stark contrast to people following the start out of the BTC correction in each 2013 and 2017.

Both occasions, the 90-day CDD rose appreciably, displaying wherever the rally for the previous currencies occurred in advance of falling yet again. In 2013 it reached a worth of 580,000, even though in 2017 it rose yet again to 600,000 (black arrow).

As a end result, pretty much all CDD releases display outcomes other than rallies prior to the start out of the extended-phrase correction. A related reading through is also identified in the NUPL.

Synthetic Currency 68

Maybe you are interested: