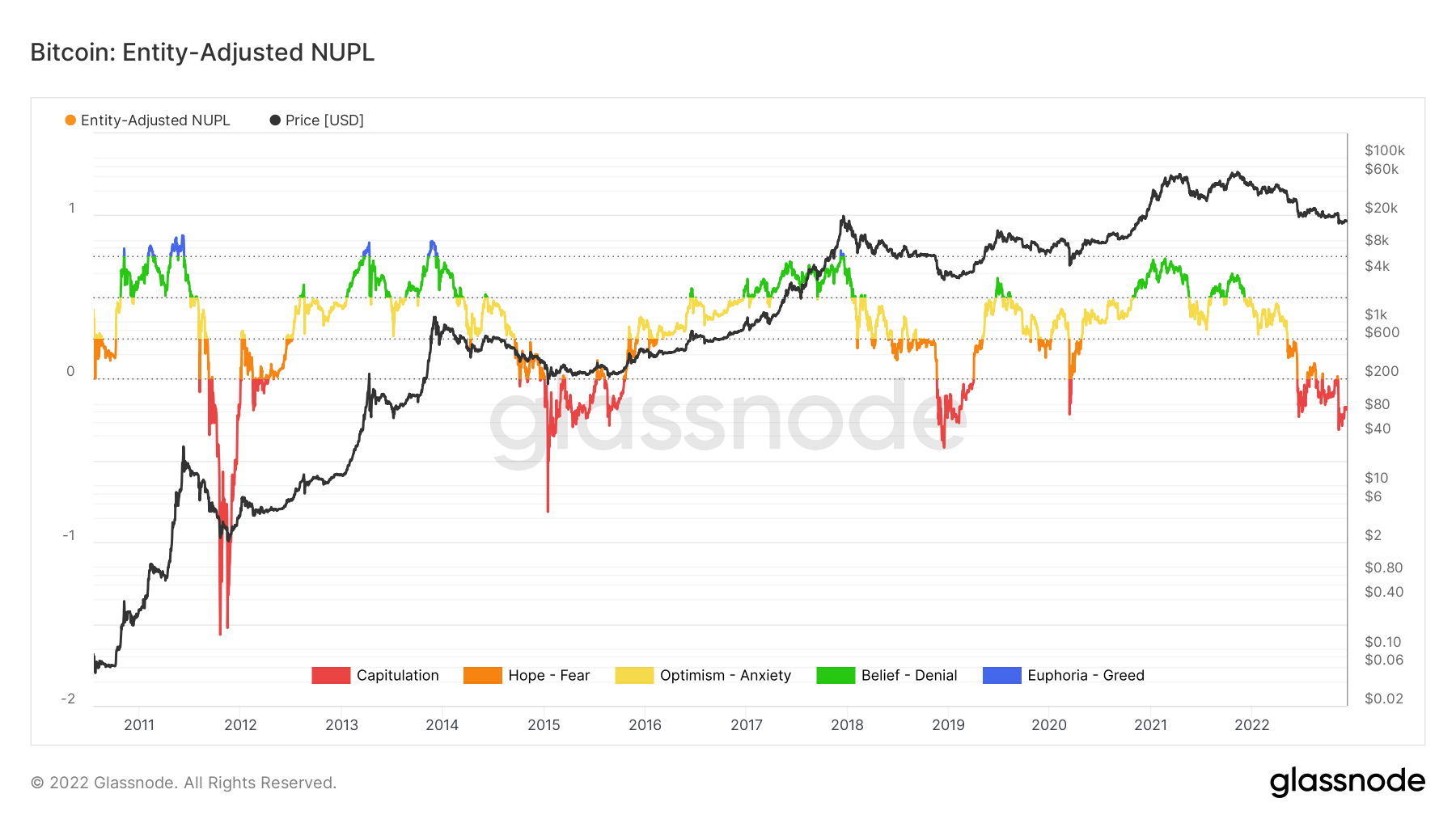

Since June, Bitcoin (BTC) – and the basic market place thereafter – has been capitulated, in addition to some of the rallies viewed above the summer time of this ongoing bear market place in accordance to on the net information supplied by Glassnode. and analyzed by Electronic dollars.

Both bull and bear markets reveal on-chain sentiment information, from ‘Surrender’ to ‘Excitement – Greed. At the height of a bull market place, the historically indicated peak is when the Euphoria grips. Capitulation, on the other hand, normally signals a bottom.

Surrender is taking place

The chart beneath demonstrates BTC has sunk deep into a Surrender sentiment as on-chain net unrealized revenue/reduction (NUPL) information demonstrates a drop to the red territory previously viewed in 2012, 2015 and 2019 .

Bitcoin: Circulating Supply Decreases

Bitcoin Metrics: Supply Percentage in Profit (seven-Day Moving Average) demonstrates that at the moment, only 54% of BTC’s circulating provide was final moved on-chain for a revenue. Through the crash of FTX, this metric depicts a BTC circulating provide falling beneath 50% – a degree that takes place only for the duration of bear market place lows.

Bitcoin: Overvalued or Undervalued?

Analysis of the MVRV Z-Rating (Seven-Day Moving Average) demonstrates that we are extra than 170 days beneath the real cost.

Although Bitcoin has moved over the real cost as a outcome of bear market place rallies, the background of prior bear market place days beneath the real cost suggests the prospective for more capitulation.

Past bear markets:

- 2019-2020: 134 days reduced than real cost

- 2015-sixteen: 384 days reduced than real cost

- 2011-twelve: 215 days reduced than real cost

To summarize all the indicators stated in this examination, the indications of a market place bottom are analyzed in line with other bear market place cycles. However, when we assess and examine this bear market place with prior bear markets, we could effortlessly remain beneath the real cost for one more 6 months to a 12 months.

With the addition of geopolitical difficulties, macro uncertainty and headwinds, calling a bottom in an unprecedented time like this can only be speculation led by historical information. .