According to information analyzed by Glassnode, futures open futures curiosity and estimated leverage index have hit their highest ranges in in excess of a month, which demonstrates Bitcoin volatility ( BTC) coming. Electronic cash.

Open curiosity futures

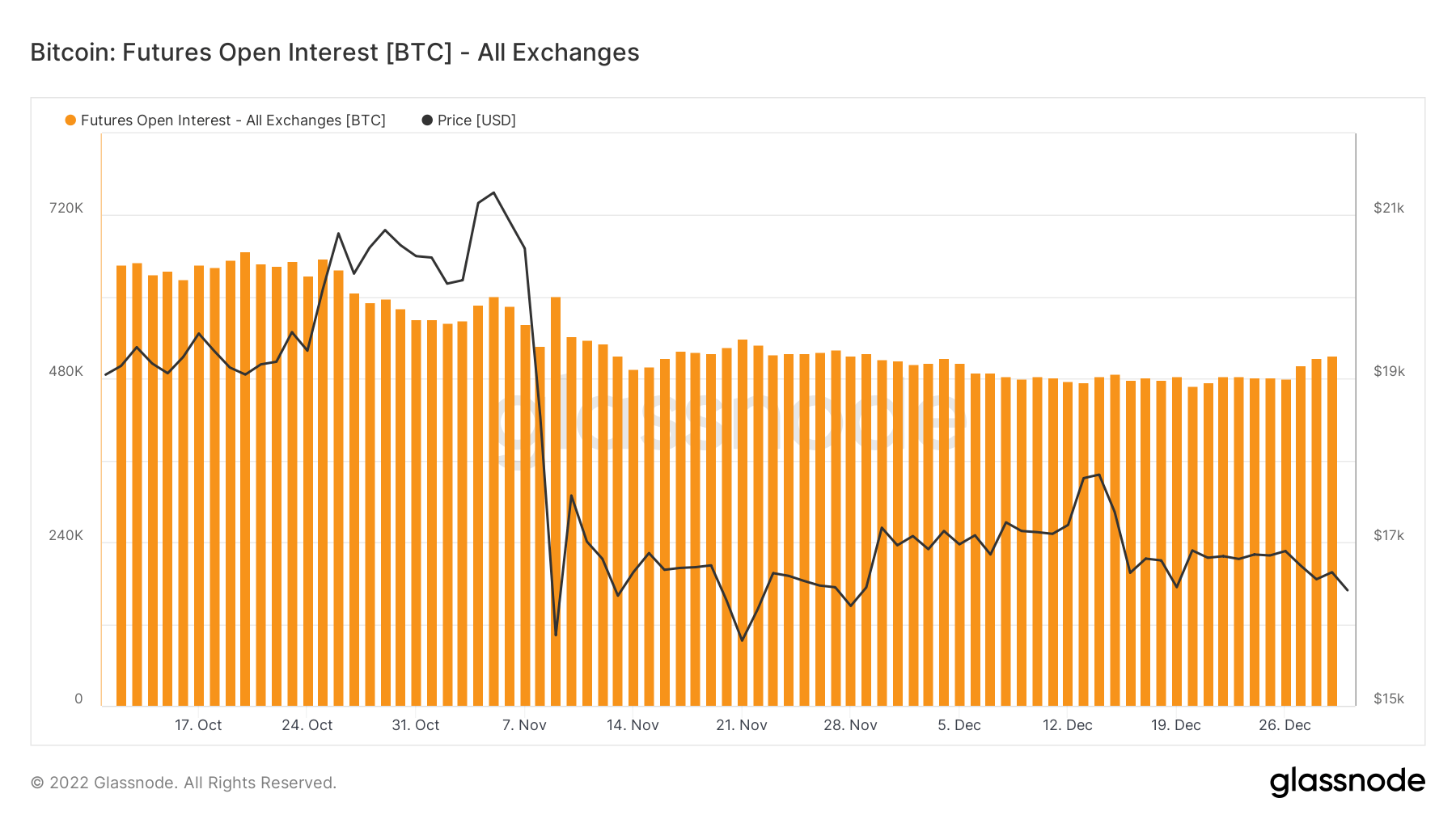

Open curiosity futures figures reflect the USD worth of the complete quantity allotted in open futures contracts.

The chart over demonstrates BTC futures open curiosity on a day-to-day basis considering the fact that October 17. As of December thirty, the metric has exceeded 500,000 BTC, marking its highest degree in in excess of a month.

Estimated leverage ratio futures.

Futures Estimated Leverage Ratio is a metric that represents the ratio involving open curiosity in futures contracts and the stability of the respective exchange.

The estimated leverage ratio fell to as very low as .three on Dec. five right after the crash of FTX. However, it promptly began to recover right after December 12th. This fee nearly enhanced by about ten% in twenty days to attain .34 on December 30th.

Liquidation of Binance

In addition to metrics that signal volatility, information from Binance signifies that Binance will contribute to value swings.

A cluster of brief-phrase liquidations has formed on Binance involving charges involving $sixteen,650 and $sixteen,940. The existing BTC value hovers close to $sixteen,547 at press time, just $a hundred additional to enter the cluster zone.