[ad_1]

In June 2022, following the collapse of Terra, demand for place selections enhanced whilst implied volatility decreased, just like in the course of the current crypto bear market place following the crash of FTX.

Options market place efficiency and implied volatility the two reflect a solid correlation with the demise of the Terra blockchain. These things can give essential insights into the conduct of the crypto markets, together with when to anticipate sudden rate movements, area halt-reduction orders, or make ample margin for lucrative trades. lever.

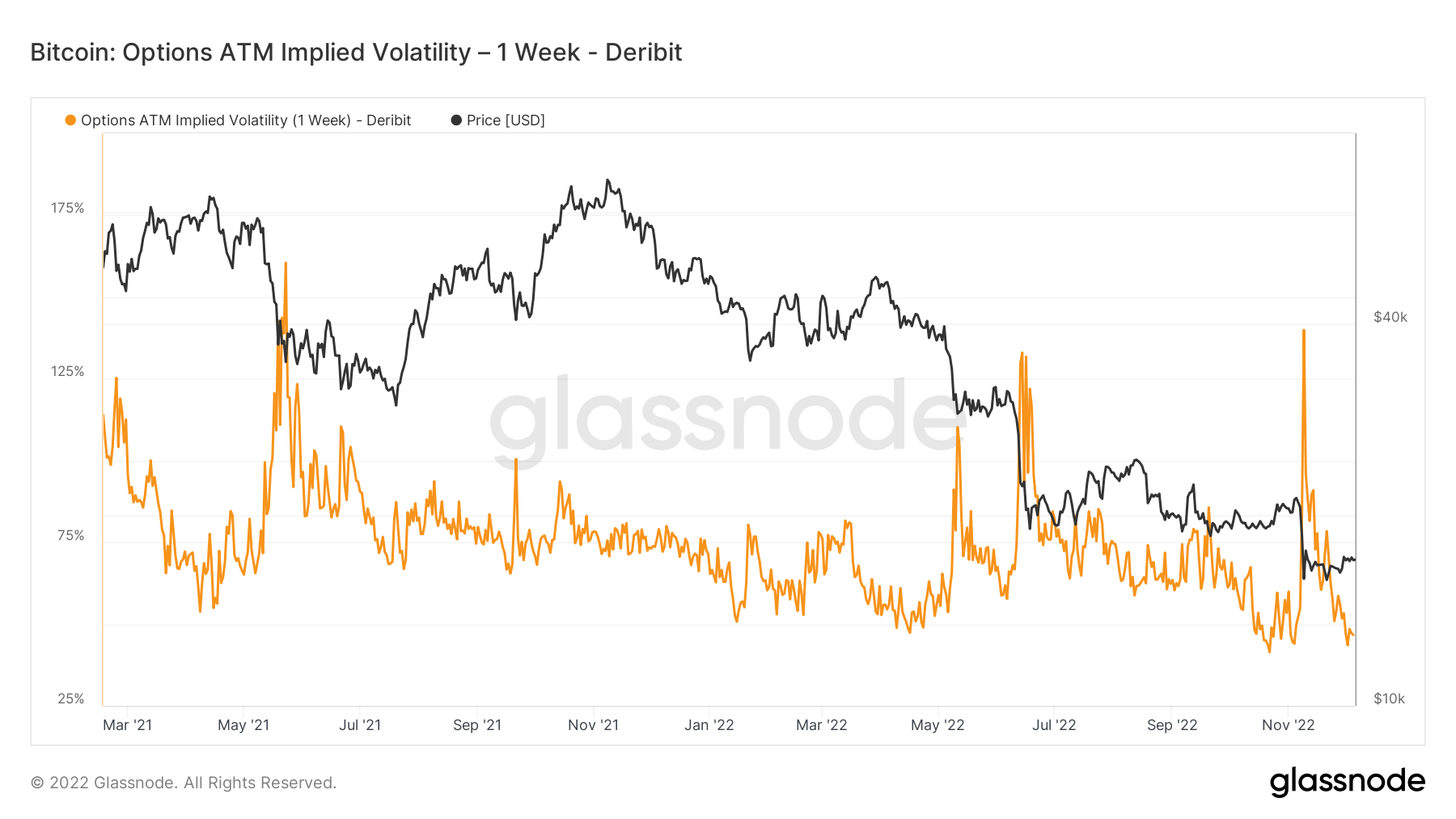

Data supplied by Glassnode demonstrates that Bitcoin’s seven-day implied volatility dropped to 50% yr-on-yr in December, reaching a very similar degree to implied volatility right after Terra collapsed. The chart under demonstrates this details:

Luna’s demise is characterized by an raise in implied instability. This is witnessed as a indicator of market place dread and uncertainty with cryptocurrency rates, creating the rates of the underlying assets to drop.

The selections market place has turn into a way for analysts to measure possible rate swings by identifying dread and approaching volatility by way of larger premiums.

If the market place goes up, the alternative will be exercised and the investor will make a revenue based mostly on the option’s strike rate. Conversely, if the market place goes down, the alternative will not be exercised and the investor will not shed revenue.

Another approach that can be employed to guard towards a market place decline is to purchase a place. A place alternative provides an investor the appropriate to promote a safety at a predetermined rate.

If the market place goes down, the investor can physical exercise his or her alternative to promote the safety at a predetermined rate, yielding a revenue. Conversely, if the market place goes up, the alternative will not be exercised and the investor will not shed revenue.

Options market place efficiency is a measure of market place sentiment for a certain asset. The bearish sentiment forces traders to promote off the underlying assets, as proven on the current Option 25 chart over.

Conversely, when sentiment is upbeat, the selections market place is extra most likely to rally in the rate of the underlying asset. Conversely, when the analyst information a substantial degree of implied volatility, the market place anticipates extra volatile rate movements, and vice versa.

Overall, selections market place efficiency and implied volatility the two give necessary insights in conduct of the cryptocurrency market place, primarily when predicting a sudden drop. However, the metric does not signify an up or down trend when employing volatility oscillators as it only displays the uncertainty and doubts of traders.

[ad_2]