Much of Bitcoin’s provide has been untouched given that August of this yr, a indicator that traders anticipate the rate of BTC to carry on to rise.

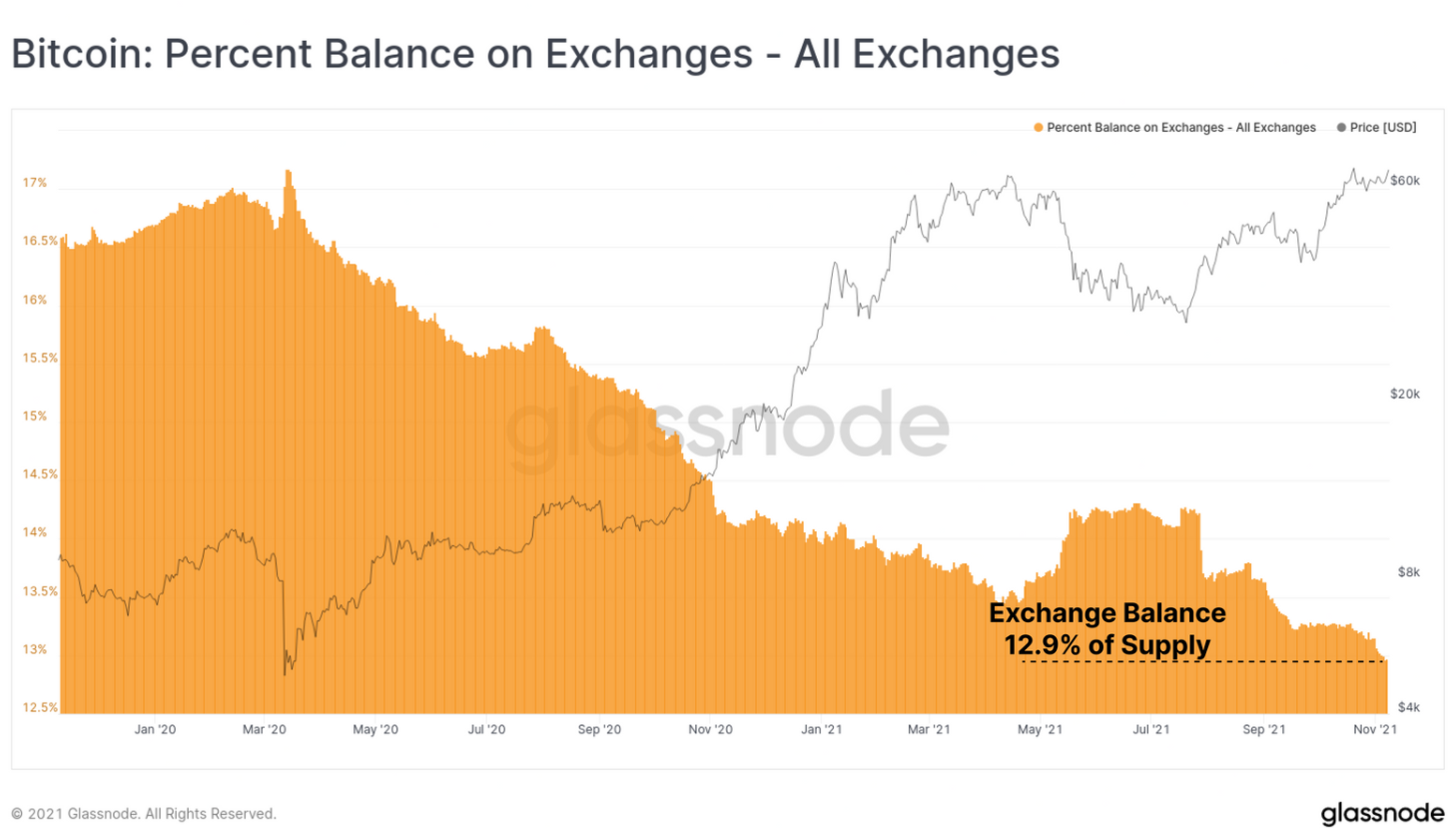

According to an examination by Glassnode, as the rate of Bitcoin produces a new ATH, the velocity at which traders withdraw their BTC from cryptocurrency exchanges also increases swiftly. Currently, only twelve.9% of the provide of Bitcoin is held in reserve on exchanges, or somewhere around $ 163 billion. The shortage trend started in August as Bitcoin steadily acquired some upward momentum following the May 19th “slump”.

– See much more: The whales are purchasing Bitcoin “massively”, pushing the accumulation of BTC to a higher of 2021

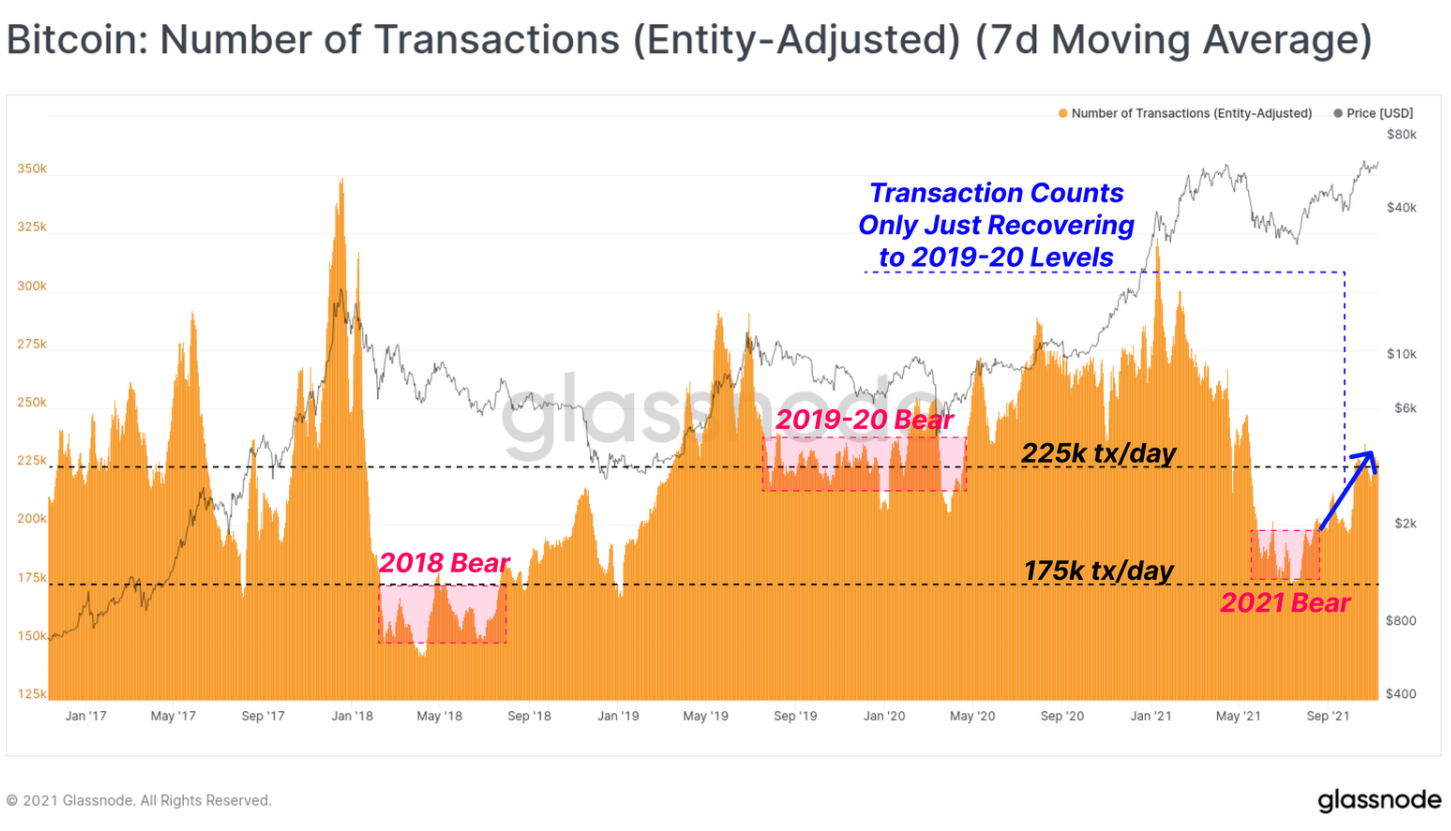

Daily net withdrawals from exchanges averaged five,000 BTC. Even however the rate of Bitcoin is $ 64,000, on-chain exercise is nevertheless recovering, even somewhat under what the marketplace hibernates in 2017-2018. The volume of transactions is nevertheless far under the peak recorded in the very first half of 2021, at present all around 225,000 transactions / day. Coinciding with the 2019-2020 time period.

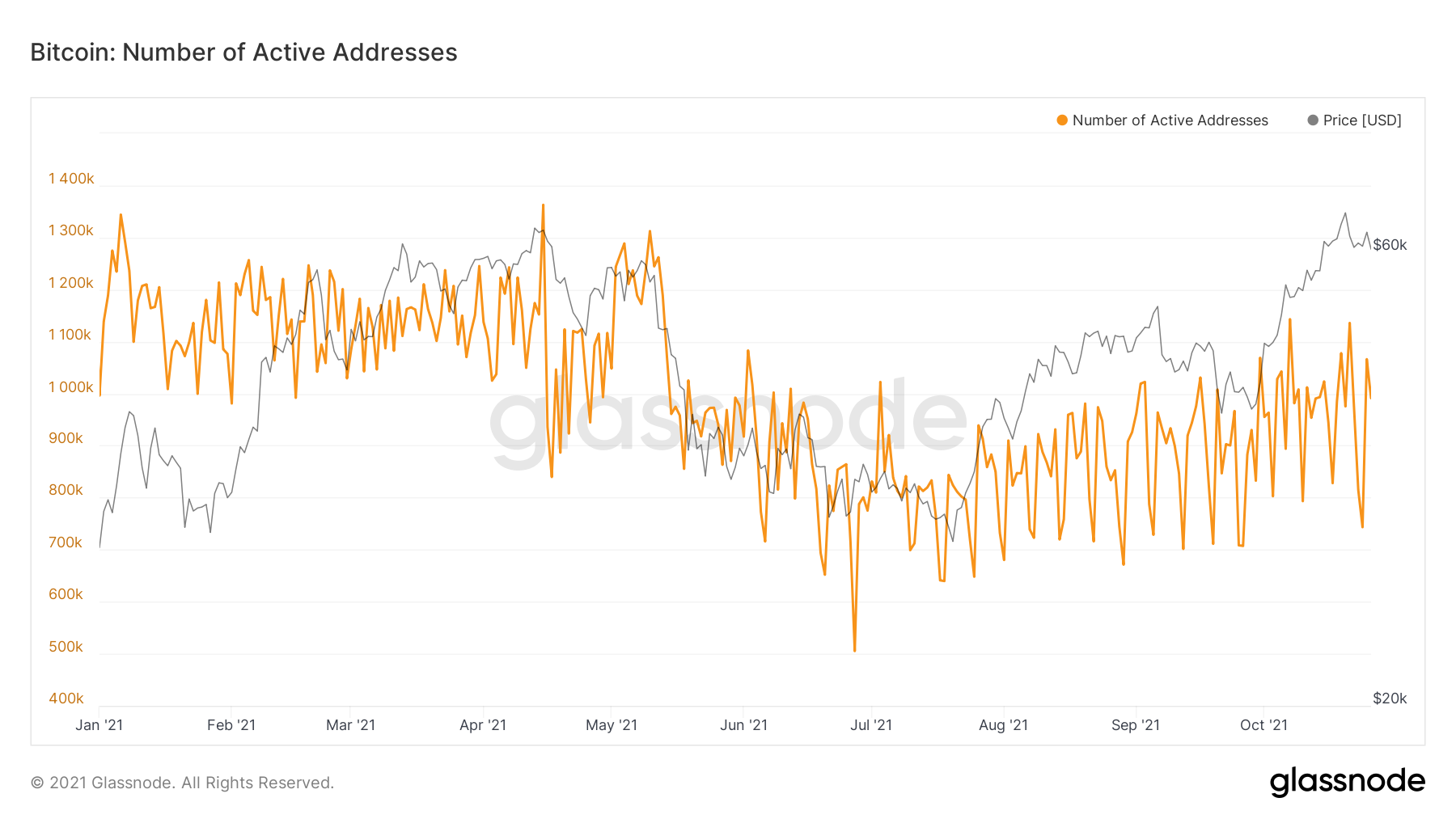

In other phrases, BTC’s record rate did not encourage several sellers. Most traders are joyful with their extended-phrase holdings. This is a quite great indicator that the vast majority anticipate the rate to carry on to rise. Meanwhile, the velocity at which new wallet addresses send or acquire Bitcoin has enhanced considerably.

On November 9, statistics demonstrate that 516,914 new addresses had been concerned in a transaction. That’s a 72% boost above the variety of newcomers in early August – on November twelve alone, the complete variety of Bitcoin addresses surpassed 900,000 for the very first time.

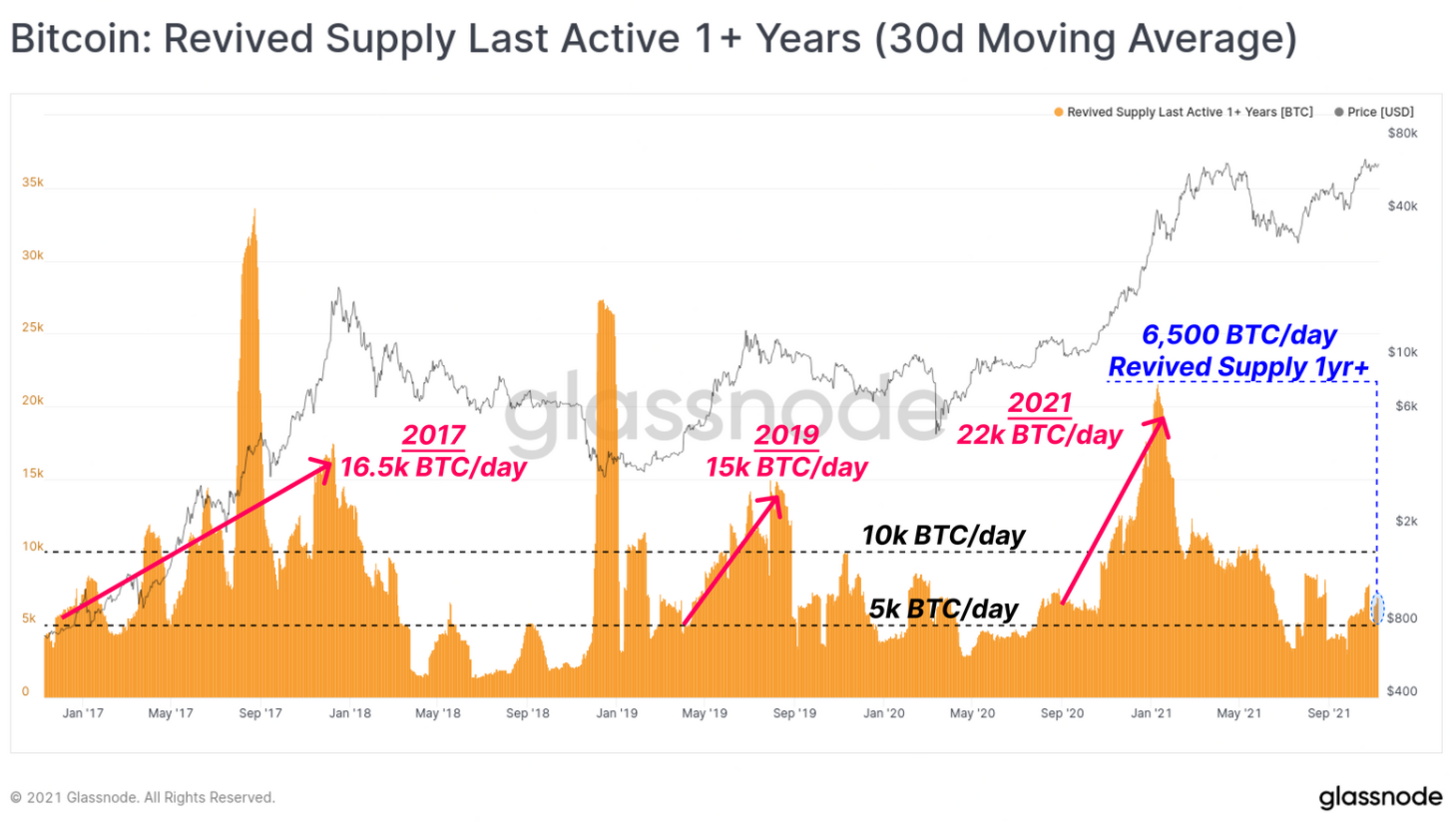

To give a quantitative estimate for sellers, we can search at the recovered provide index, which tracks the variety of Bitcoins older than one yr that are returning to liquid circulation. All in all, traders have resisted Bitcoin’s volatility for twelve months.

Currently all around six,500 BTC are recovered per day. This is rather very low in contrast to the bull run of 2017, 2019 and 2021, with twenty,000 BTC / day up. In truth, the latest providing is very similar to BTC’s marketplace pattern among late 2019 and 2020, which is displayed at the finish of a bearish marketplace cycle.

Overall, Bitcoin had an extraordinarily robust week, consolidating among $ 59,743 and $ 64,242, sustaining just about all of its October gains. Market mirroring information continues to demonstrate power in provide dynamics, although on-chain exercise stays. under the bull marketplace highs.

Combined with macro elements this kind of as inflation in the US hitting a thirty-yr higher and the concentrate of a spot Bitcoin ETF possessing a ultimate selection by the finish of the week from the SEC, Bitcoin (BTC) has a best probability to attain the $ one hundred,000 milestone as predicted by several specialists this yr. Go even even more when estimated in accordance to the PlanB model in 2022.

Synthetic Currency 68

Maybe you are interested: