OpenSea, one of the largest NFT marketplaces, has reportedly established a fund in the Cayman Islands.

This development has sparked speculation about the possibility that the platform intends to issue a Token.

OpenSea Registration in the Cayman Islands Stimulates Token Speculation

On December 13, Mike Dudas, founder of 6th Man Ventures, shared a screenshot showing that OpenSea registered its fund in the Cayman Islands in August.

While OpenSea has not confirmed or commented on the registration, industry observers believe that the platform may be positioning itself to benefit from the country’s crypto-friendly policy for issuance Tokens.

Earlier this year, the Cayman Islands introduced amendments to the Virtual Assets (Service Providers) Act, strengthening anti-money laundering measures and introducing licensing of virtual asset platforms. These updates position the region as an ideal location for crypto businesses looking for legal certainty.

However, it is unclear how the platform plans to leverage registrations in the islands. Still, members of the crypto community are calling on OpenSea to reward pioneers in any potential Token airdrop. Some users hope the platform will consider transactions from 2021 and early 2022 when the NFT market peaks.

“Will OpenSea return their Token airdrop? Imagine if they pulled deals from 2021/2022. After seeing Blur and Magic Eden do the airdrop, I don’t think OpenSea won’t follow the same path to improve their volume and revenue in V2,” crypto user Wawkem recommended.

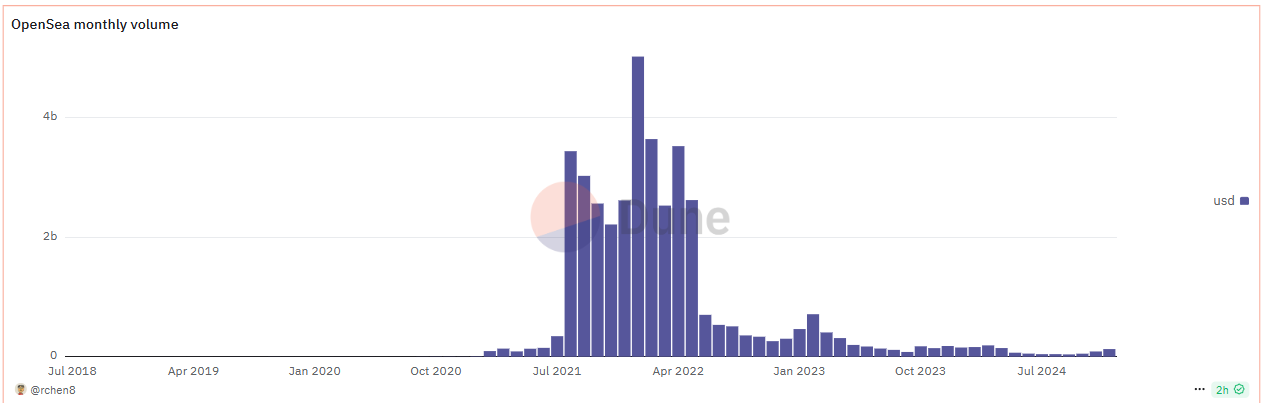

Meanwhile, rumors of a Token launch come at a challenging time for OpenSea. Data from Dune Analytics shows that at its peak, OpenSea averaged more than $2 billion in monthly trading volume. By contrast, the platform’s peak volume this year was just over $120 million, as it gave way to rivals like Magic Eden and Blur.

Observers comment that the Token launch could give OpenSea the boost it needs to regain its competitive edge in the NFT market. Furthermore, it could also be a lifeline for this market as the company is facing regulatory pressure, including Wells’ announcement from the US Securities and Exchange Commission (SEC).