Optimism (OP) price has increased by 43.40% in the past seven days, demonstrating strong bullish momentum in the market. This uptrend is supported by rising trend strength, with ADX confirming rising momentum and EMAs showing a clear bullish configuration.

Despite the explosive increase, the downward trend in the number of daily active addresses suggests caution, as this could indicate reduced network activity and potential pressure on OP prices. Whether OP can maintain this momentum to test resistance at $3 or face a deeper correction depends on the level of buyer interest in the coming days.

OP’s Current Uptrend Is Very Strong

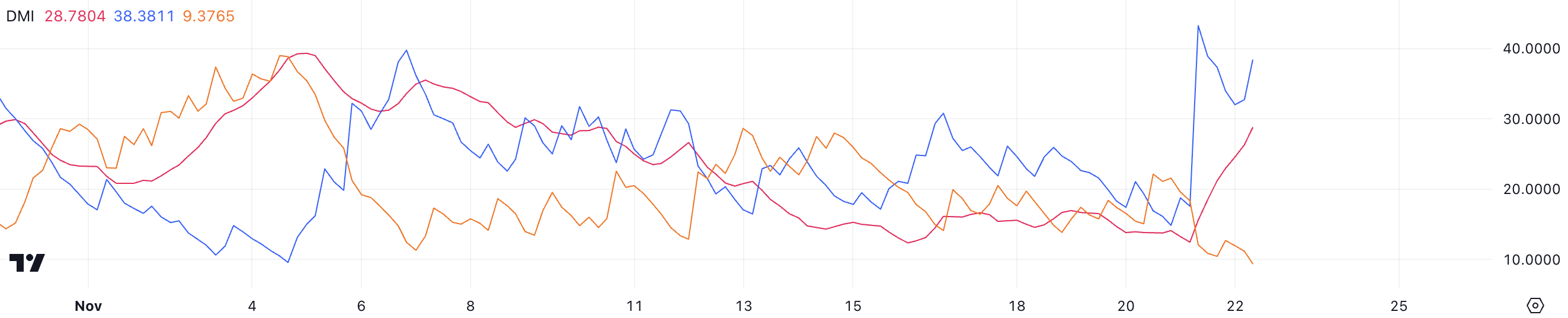

Currently, Optimism has an ADX of 28.7, up sharply from under 15 just a day ago. The rapid rise of ADX shows that the strength of OP’s current trend is increasing rapidly, signaling that the momentum behind the price movement is increasing.

The ADX index measures the strength of a trend, with values above 25 indicating a strong trend and below 20 suggesting a weak or non-existent trend. At 28.7, OP’s ADX confirms that its uptrend is gaining momentum and could sustain further upward momentum if this strength is sustained.

The positive index (D+) is at 38.8, while the negative index (D-) is 9.37, showing that upward price pressure outweighs selling activities. The large gap between D+ and D- reflects the strong dominance of buyers, reinforcing the uptrend.

The combination of rising ADX and high D+ suggests that OP prices could continue to climb if market conditions continue to be favorable and buying pressure remains.

OP’s Daily Activity Addresses Provide Important Signals

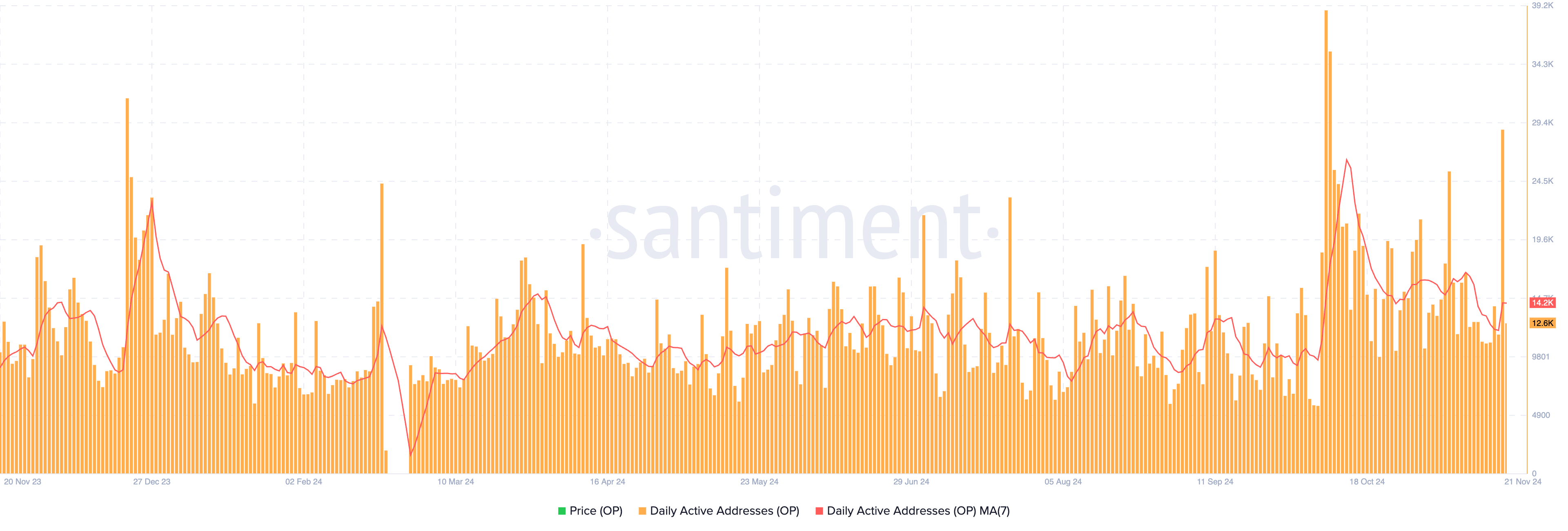

OP’s 7-day average daily active addresses was 14,200 as of November 21.

This measure reflects the number of unique wallet interactions with the network, which points to continued strong activity but is down from its yearly peak of 26,300 on October 13.

Daily active addresses are an important metric because they provide insight into overall network usage and demand. A downward trend in this index could signal waning interest or reduced activity online, which could translate into lower buying pressure for OPs.

If this trend continues to decline, it could put downward pressure on OP as market enthusiasm fades. However, a reversal in this index could reignite bullish sentiment and support future price growth.

Optimism Price Prediction: Can OP Hit $3 By October 1?

If Optimism price maintains its uptrend, it could test the next resistance levels at $2.55 and potentially $3.04. A break above $3.04 could pave the way for OP price to challenge $3.41, the highest price since April.

This bullish scenario is supported by the EMAs, which show a favorable configuration with the short-term lines above the long-term lines, indicating strong momentum strength.

However, if the trend reverses, OP price could face significant downside pressure, with the next support levels at $1.82 and $1.53.

If these levels fail to hold, the price could fall further to $1.06, which would represent a sharp 51% correction.