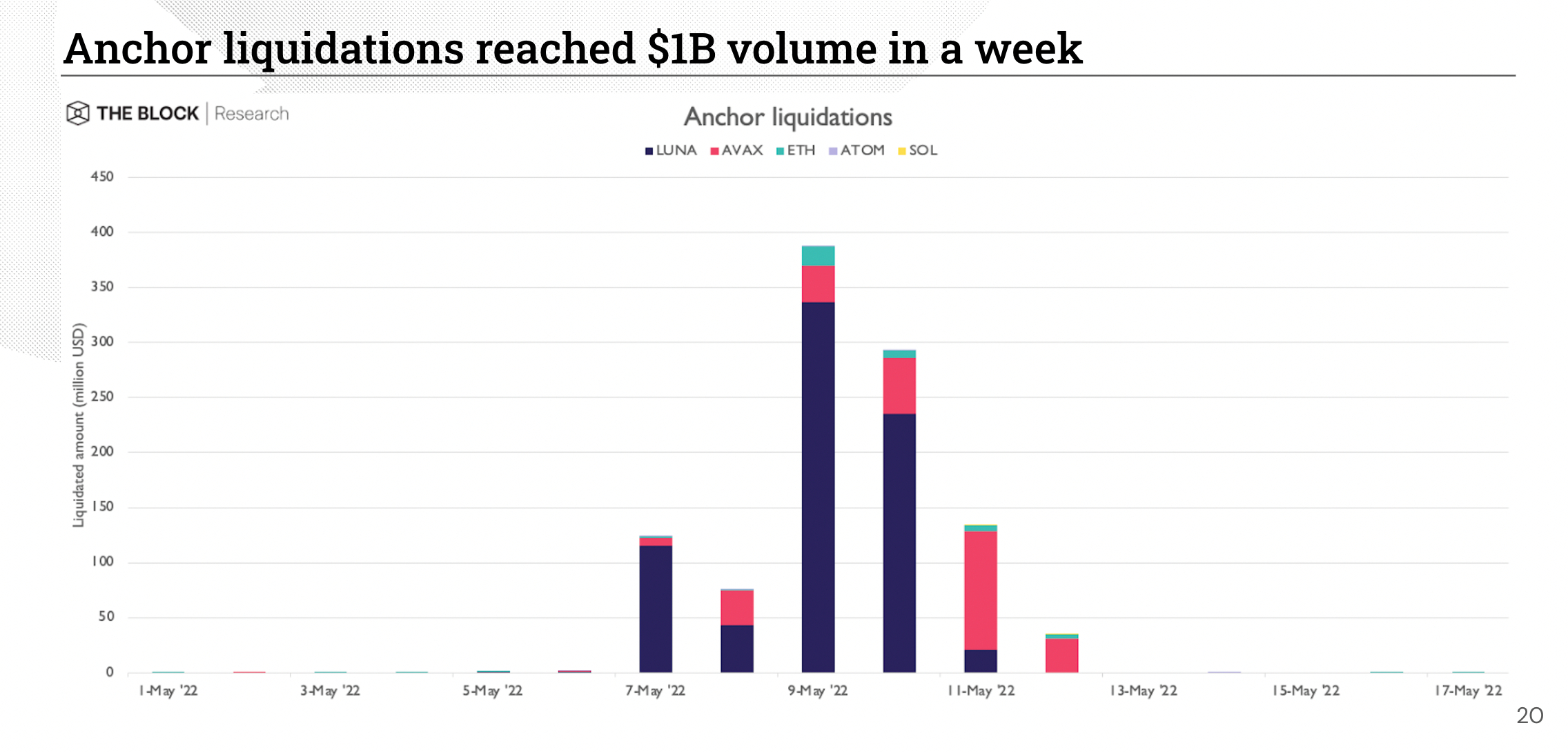

The Terra Anchor Protocol (ANC) lending protocol recorded in excess of $ one billion in liquidations final week, creating it the greatest liquidation occasion in cryptocurrency historical past for a loan venture.

According to the information compiled by The blockFrom May seven to May twelve, the crypto collateral deposited by borrowers on Anchor really worth $ one.048 billion was entirely liquidated on the platform.

Luna (LUNA) represents in excess of $ 750 million, or virtually 75% of Anchor’s liquidation. Meanwhile, Avalanche (AVAX) is in 2nd location with $ 261 million, although the rest is distributed equally among Ether (ETH), Solana (SOL) and Cosmos (ATOM).

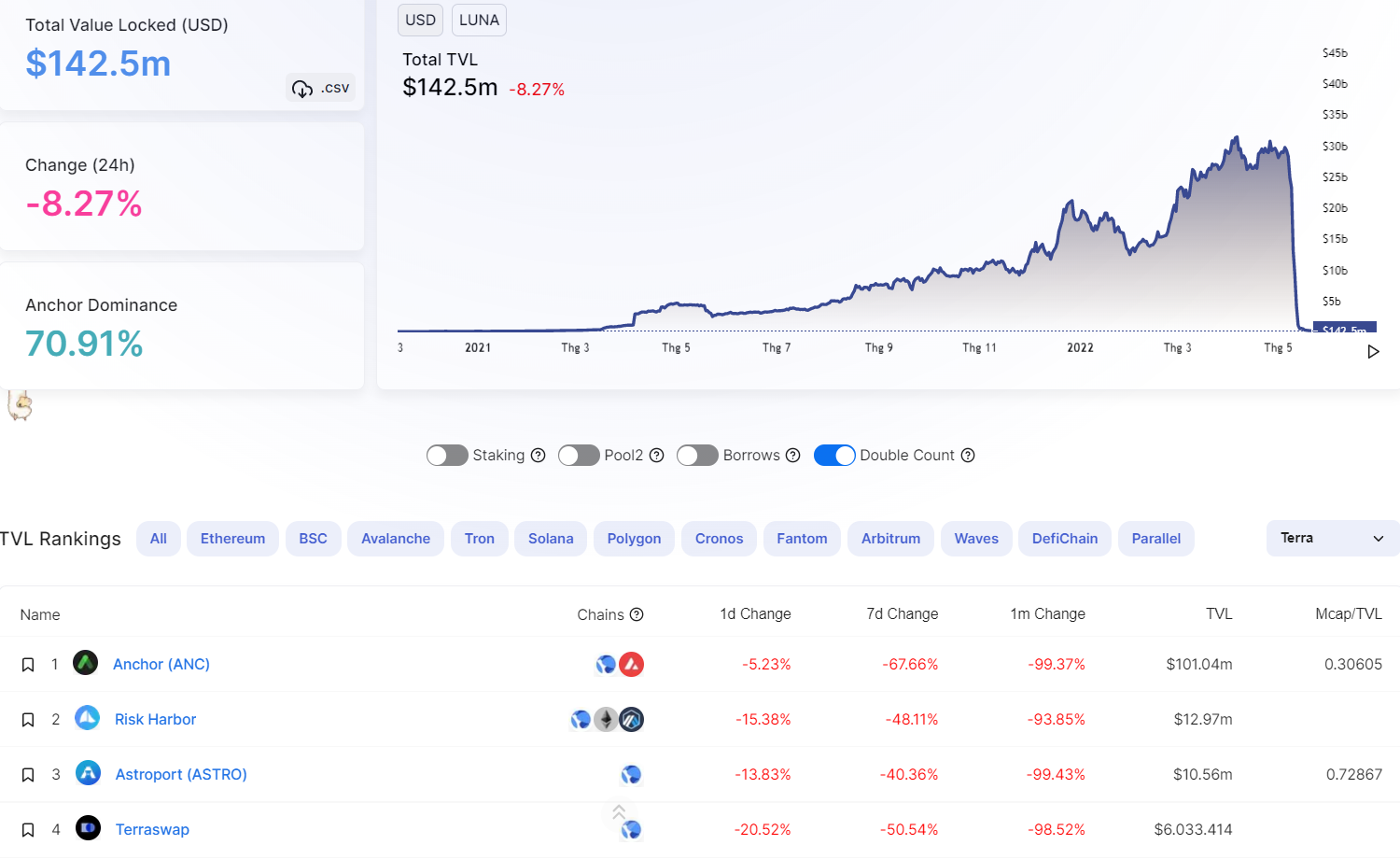

Additionally, the income that “flies without wings” to Anchor has played a key function in decreasing the TVL peak of the total Earth ecosystem from $ 26 billion in March to $ 142 million at the time of creating.

Notably, the final time this kind of a massive liquidation occasion occurred was a yr in the past. It was then that today’s most well-liked DeFi lending platforms, Compound and Aave, had to liquidate a complete of $ 633 million amid a standard marketplace crash at the time triggered by China’s cryptocurrency mining ban.

In Anchor’s situation, the LUNA-UST trouble was the major result in. To comprehend how this “snowball” rolled, we will need to comprehend a couple of factors about Anchor’s mechanism of action.

Anchor is a lending platform on the Earth ecosystem. Users can borrow from Anchor by betting collateral in the type of lots of other tokens this kind of as LUNA, ETH, AVAX, SOL and ATOM.

Users borrow on Anchor at ten% curiosity and can borrow up to 60% of the collateral worth they deposit on the platform. Anchor features these loans in the type of UST stablecoins. Settlement requires location on Anchor when the worth of the blocked collateral falls at some stage past the threshold expected to repay the loan.

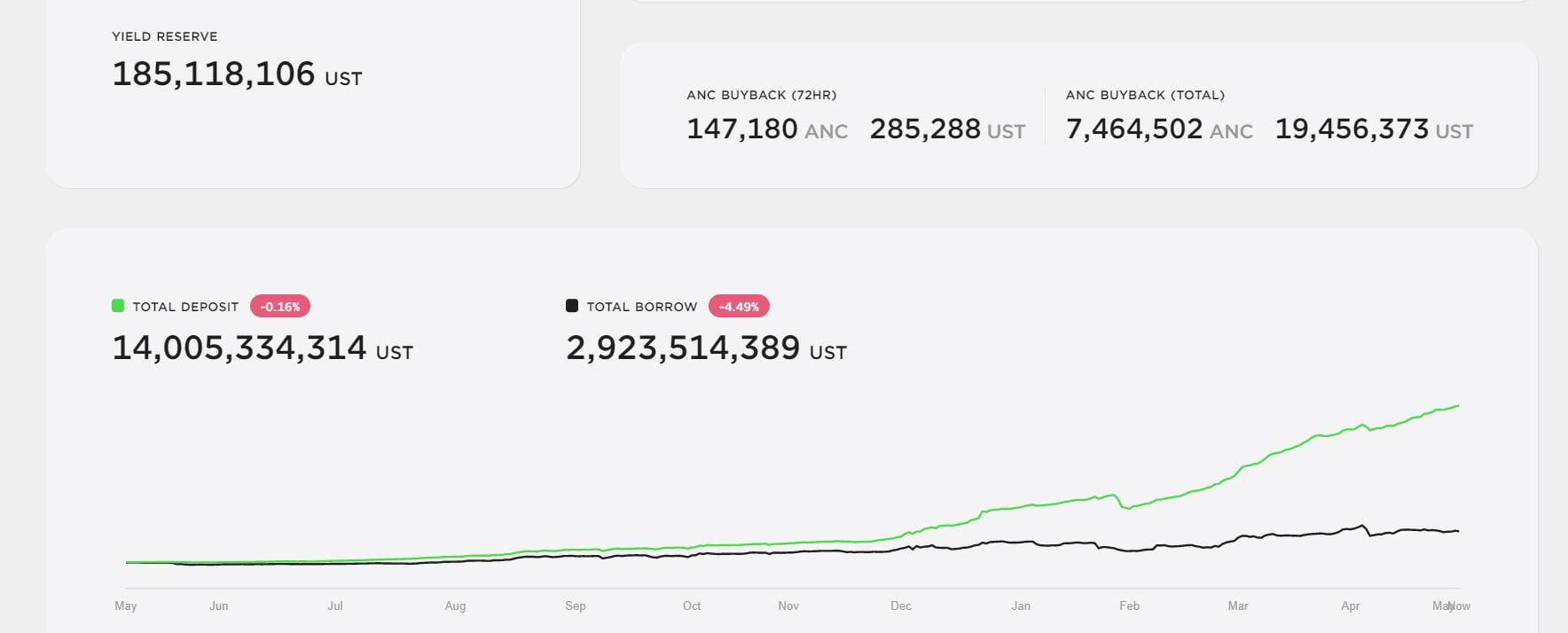

Anchor, on the other hand, features up to 18% curiosity on the UST stablecoin. Therefore, even even though it is essentially a lending protocol, with this kind of eye-catching curiosity, end users had been brief to send USTs to Anchor, prompting the volume of UST deposited in the venture ($ 14 billion) to overwhelm the loan volume (with only $ three billion). billion FSO), as mentioned by Coinlive on seven May, the day ahead of the FSO misplaced its reference stage for the very first time.

This left Anchor with no earnings to shell out curiosity and the platform chose to “cut blood” on its personal to fix the trouble. Also to keep away from the danger of resource depletion major to collapse, Anchor has even place forward the proposal to turn out to be “Curve on Terra”.

However, when almost everything collapsed quite swiftly following Bitcoin’s sudden plunge to $ 34,000 on May eight, LUNA misplaced a lot more than 99% of its worth, dropping from $ 73 to $ .83. FSO repeatedly lowers deeper thresholds than anticipated. LUNA-based mostly mortgages consequently “evaporate”. The very same is accurate for lots of other assets as the cryptocurrency marketplace landscape continues to decline on a greater scale.

Synthetic currency 68

Maybe you are interested: