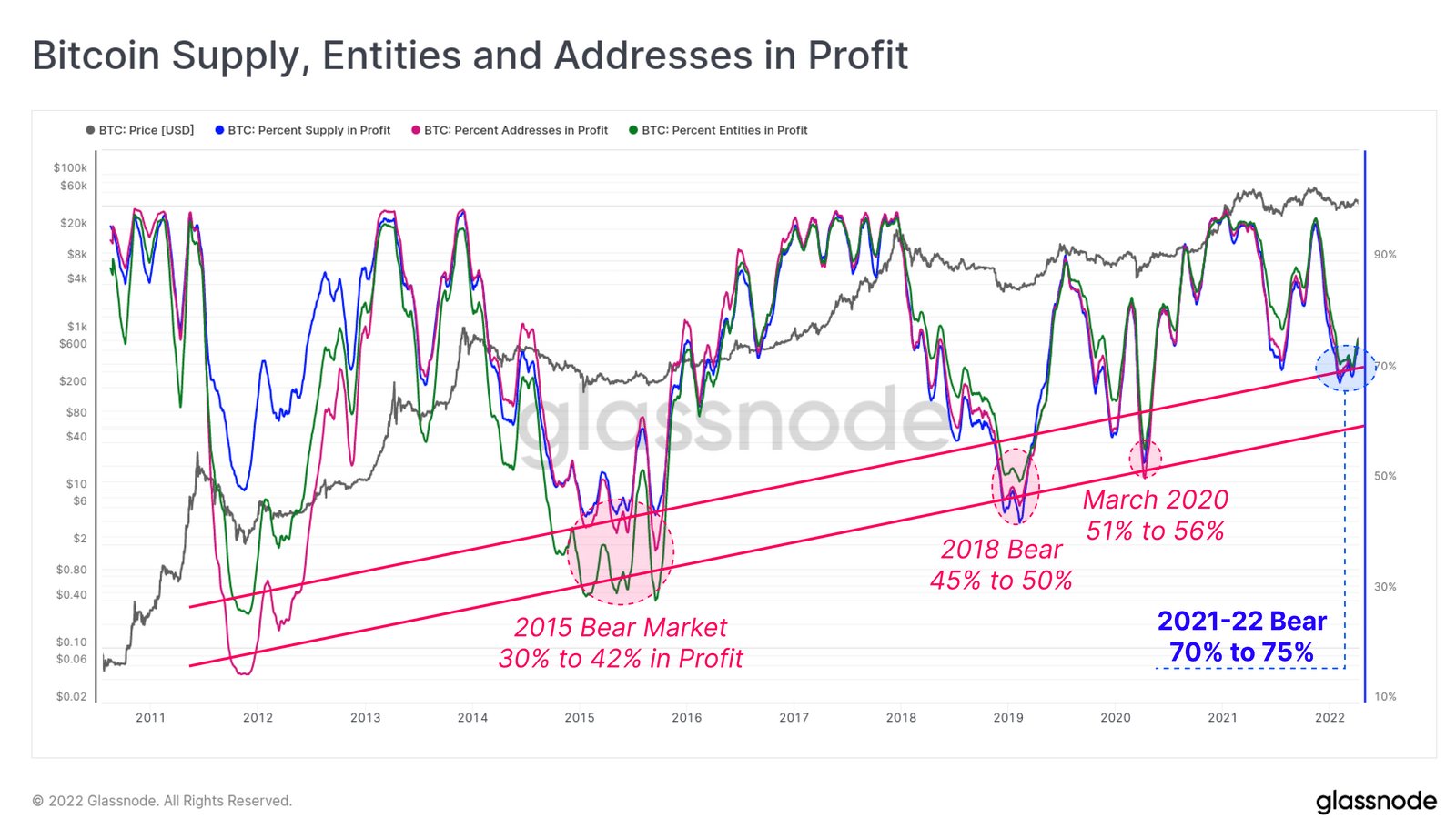

Although the selling price of Bitcoin (BTC) has continued to decline not long ago, on-chain information displays that up to 75% of Bitcoin addresses are at the moment worthwhile.

In its weekly report launched earlier this week, Glassnode analyzed the variety of Bitcoin wallets that are worthwhile and located that involving 70% and 75% of addresses nevertheless have unrealized income, a great deal greater than 45% – 50% of the prolonged-phrase bear of 2018 marketplace.

Thus, we can see that the existing correction is not as extreme as the worst of all earlier cycles.

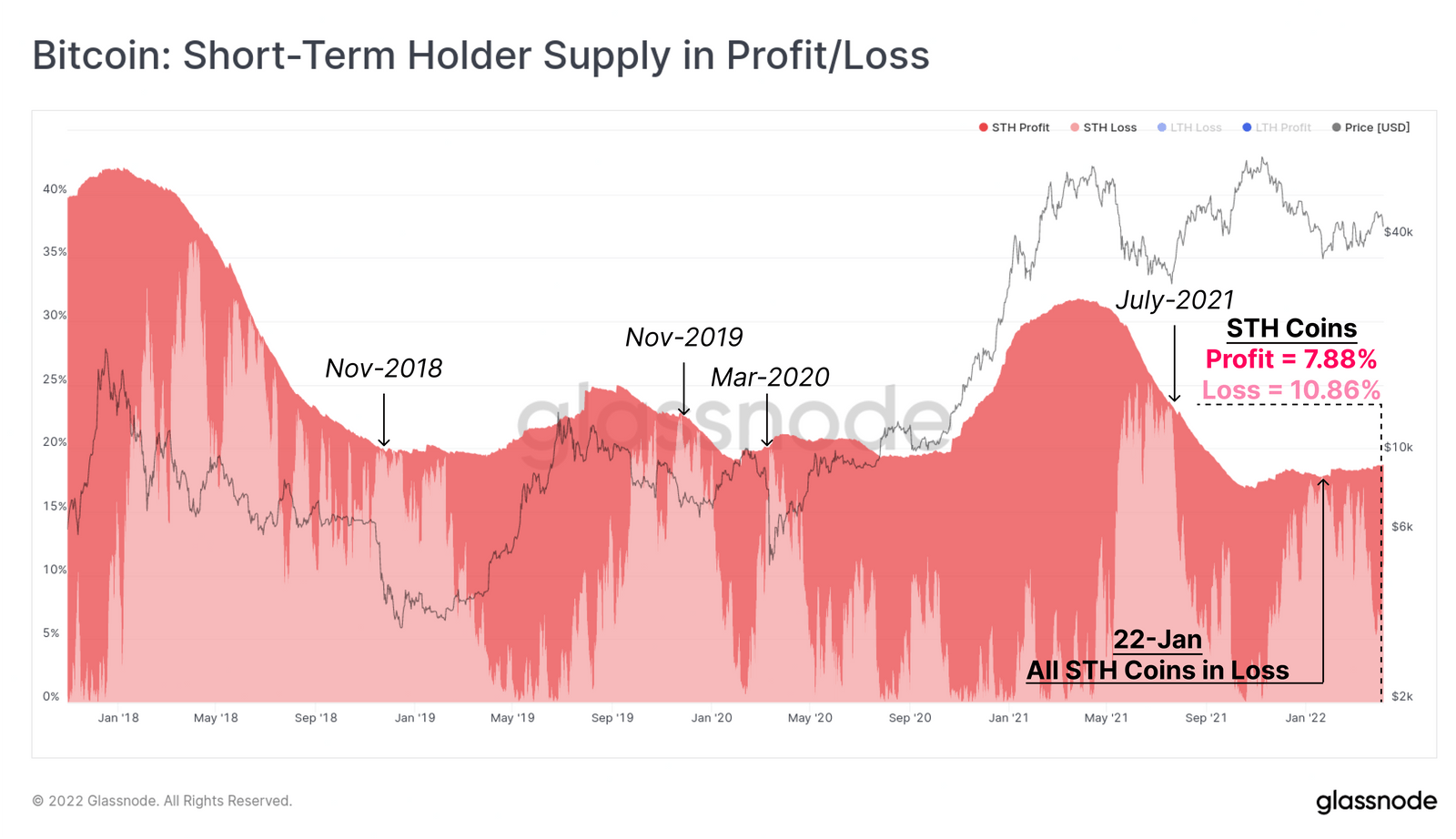

Beyond that, the information also reveals that prolonged-phrase Bitcoin (LTH) holders are much less most likely to endure losses, with far more than 67.five% of LTH sitting in unrealized gains and 13.66% creating a reduction. , although quick-phrase traders (STH) recorded only seven.88% and ten.86% respectively.

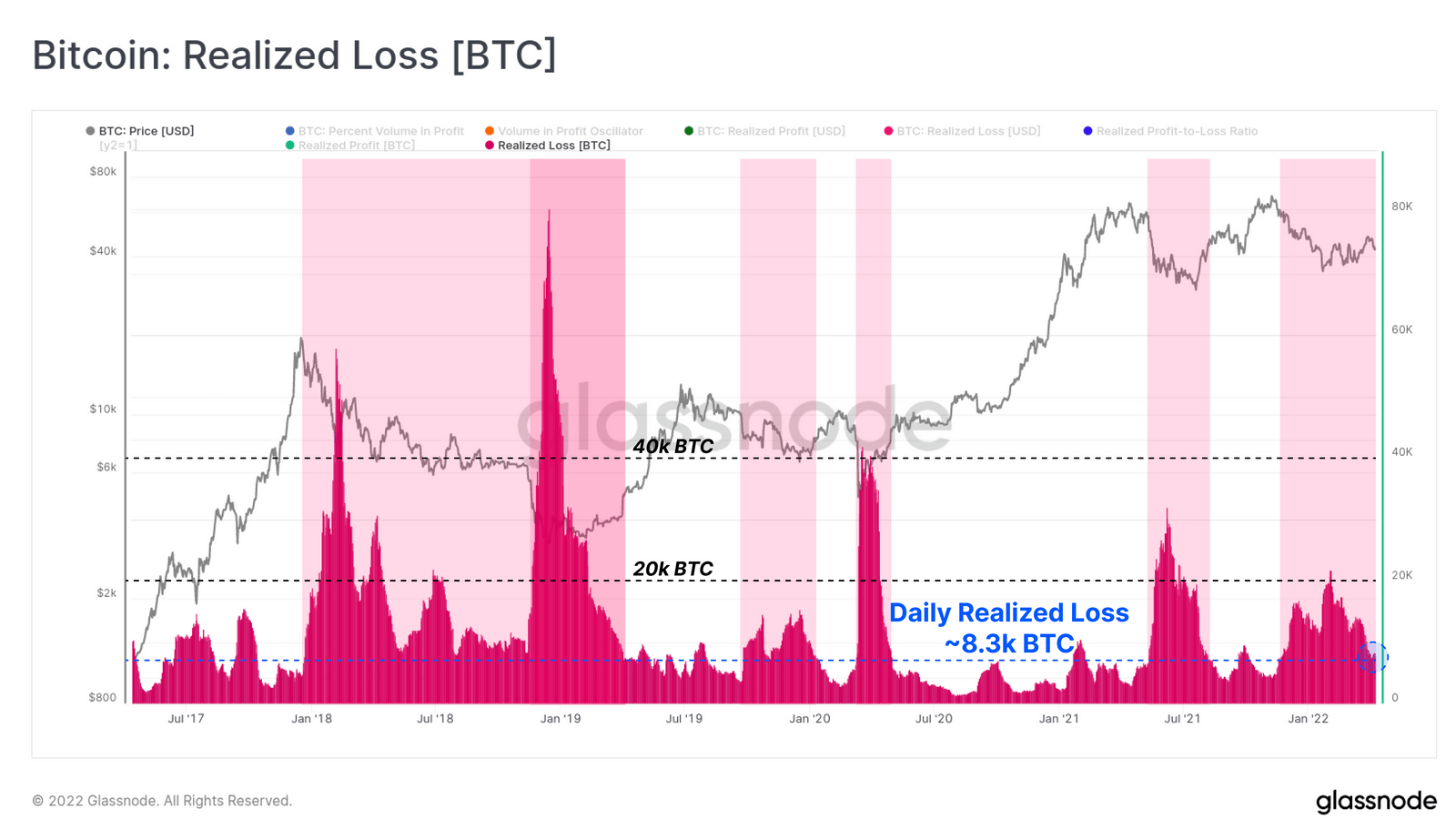

On the other hand, the marketplace has observed the day by day recognized income constantly enhance although the real losses continue to be in a downtrend. Realized day by day losses fell from twenty,000 BTC / day to a January minimal, to all around eight,300 BTC / day at press time.

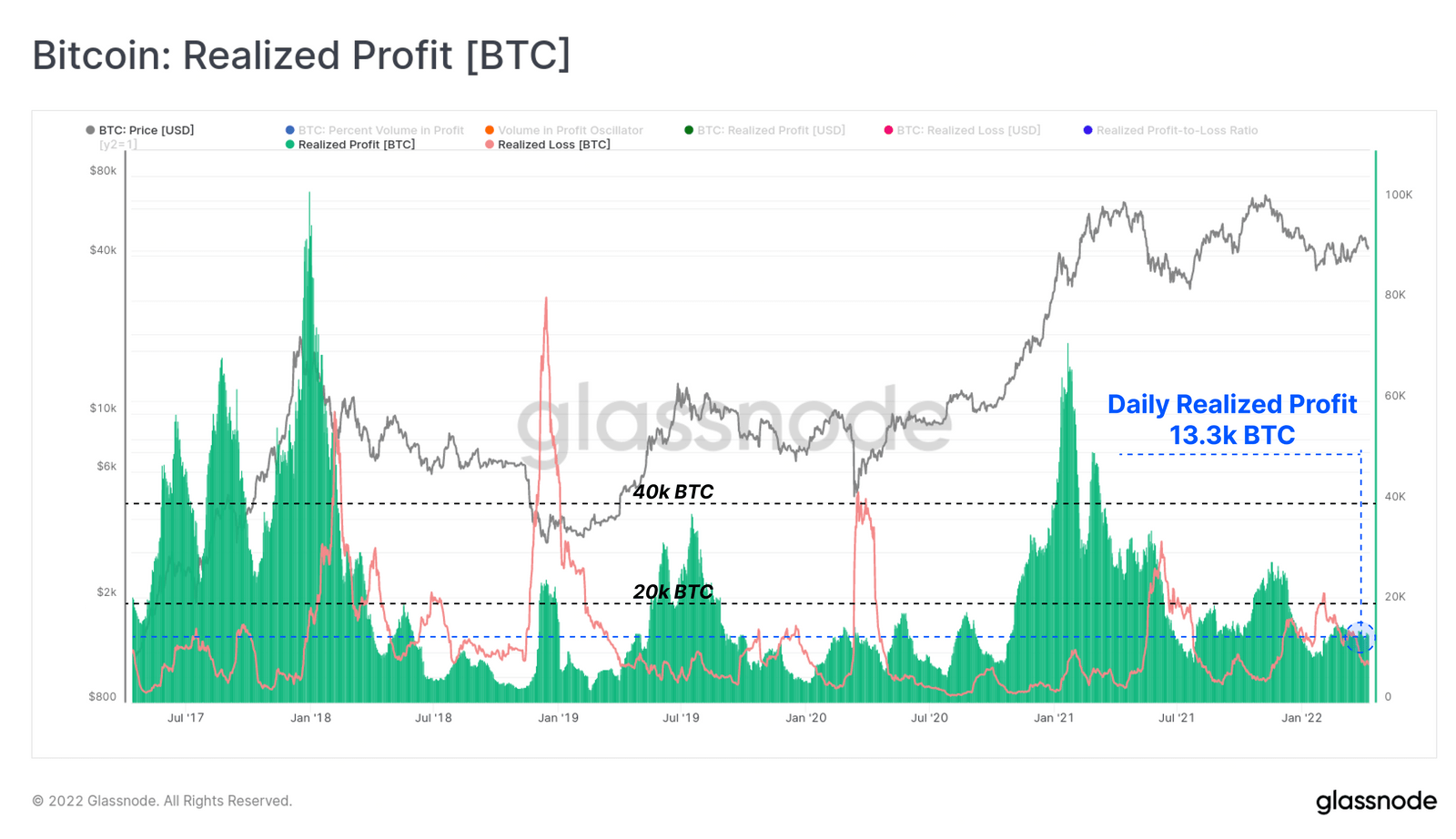

As a outcome, all around 13,300 BTC in income have been acquired each and every day due to the fact mid-February, and creating income of this magnitude is not historically poor. It is also a normal component of 1 of selected ailments that favor selling price increases as a big volume of new demand is most likely to soak up provide and push Bitcoin greater.

And eventually, we can see that the revenue per volume invested share has now shifted to a revenue trend. In other phrases, 58% of the ongoing volume is worthwhile, representing a important transform from the reduction cycle observed due to the fact December 2021.

Periods of dominance on the reduction side are a normal pattern of a bear marketplace, and a reversal of the revenue trend could signal that crowd sentiment is transforming and the will need for absorbency is higher. However, as the selling price continues to struggle to push Bitcoin to proper in direction of $ 39,200, it displays that demand is nevertheless a bit sluggish and traders are profiting from all the options they can locate.

Summary of Coinlive

Maybe you are interested: