PENGU price has dropped about 10% in the past 24 hours after becoming the largest Meme Coin on-chain Solana. Despite generating significant traction recently, the asset’s momentum has slowed. Technical indicators point to the possibility of further consolidation or decline.

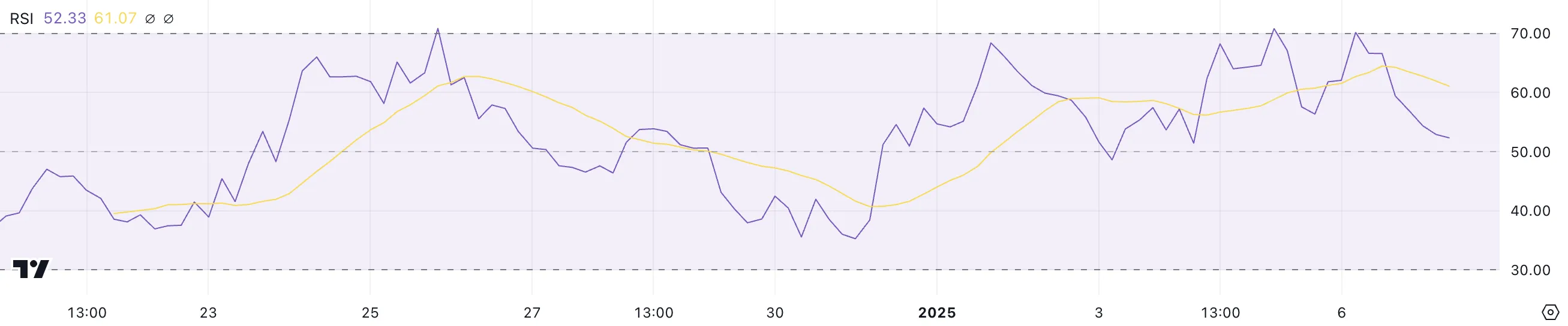

The relative strength index (RSI) has dropped sharply from 70 to 52.3, showing that buying pressure is waning. However, if attention to PENGU revives, the coin could rebound and test key resistance levels.

PENGU’s RSI dropped sharply

Currently, PENGU’s relative strength index (RSI) is at 52.3, a significant decline from yesterday’s overbought level of 70. RSI is a popular momentum index that measures speed and level Price changes on a scale from 0 to 100.

Values above 70 typically indicate overbought conditions, which could lead to a downside correction, while values below 30 typically imply a recovery. RSI around 50 indicates neutral momentum, where buying and selling pressure are balanced.

With PENGU’s RSI at 52.3, the index suggests a short-term accumulation period. This level reflects buying activity that has eased from recent peaks but still maintains a slight uptrend. If RSI remains stable or moves higher, it could signal a continuation of the upward momentum.

Conversely, a drop below 50 could indicate the uptrend is weakening, leading to consolidation or further minor declines. If it happens, PENGU could be surpassed by BONK and become the largest Meme Coin on Solana.

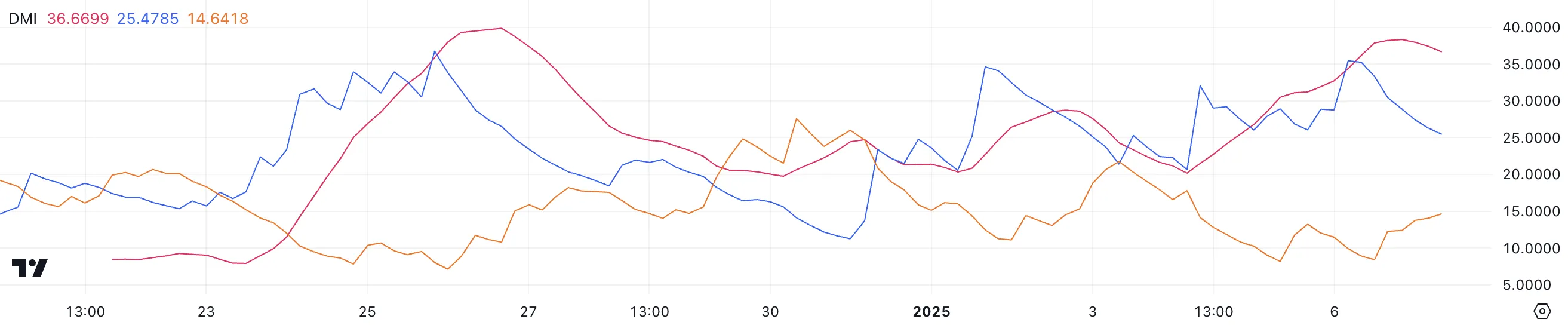

PENGU’s DMI chart shows that the downtrend could be stronger

PENGU’s Average Directional Index (ADX) is currently at 36.6, up significantly from 20 just three days ago. ADX measures the strength of a trend, with values above 25 indicating a strong trend and below 20 suggesting weak or no momentum.

A rising ADX indicates increasing trend strength, regardless of whether the trend is bullish or bearish.

Meanwhile, directional indicators provide deeper insight into the nature of the trend. +DI, which represents buying pressure, fell to 25.4 from 35 a day ago, suggesting bullish pressure is weakening. Conversely, -DI, which reflects selling pressure, rose to 14.6 from 8.4, suggesting bearish activity is increasing.

If +DI continues to decline and -DI continues to rise, PENGU price could come under increased selling pressure, confirming a short-term bearish reversal.

PENGU Price Prediction: Will it fall below $0.03 again?

Currently, PENGU’s EMAs indicate a bullish setup, but recent price action indicates that the coin may be entering a downtrend. If the bearish momentum strengthens, PENGU could test support at $0.034.

Failure to hold this level could lead to further declines, with the $0.0296 and $0.0251 levels emerging as key points to watch. The latter is close to PENGU’s historic low.

PENGU, on the other hand, has attracted significant attention in recent weeks, entering the top 10 on the list of Biggest Meme Coins. If attention around the coin recovers, PENGU could retest the resistance at $0.0439.

A break above this level, accompanied by renewed bullish momentum, could push PENGU price above $0.05 for the first time.