The price of Pudgy Penguins (PENGU) has skyrocketed 12% over the past 24 hours, surpassing BONK to become the largest Meme Coin in the Solana ecosystem with a market capitalization of $2.5 billion.

PENGU’s current uptrend is approaching key resistance levels, carrying with it significant profit potential if the bullish momentum continues. However, traders are also cautious about the possibility of a reversal, as the uptrend shows signs of weakness.

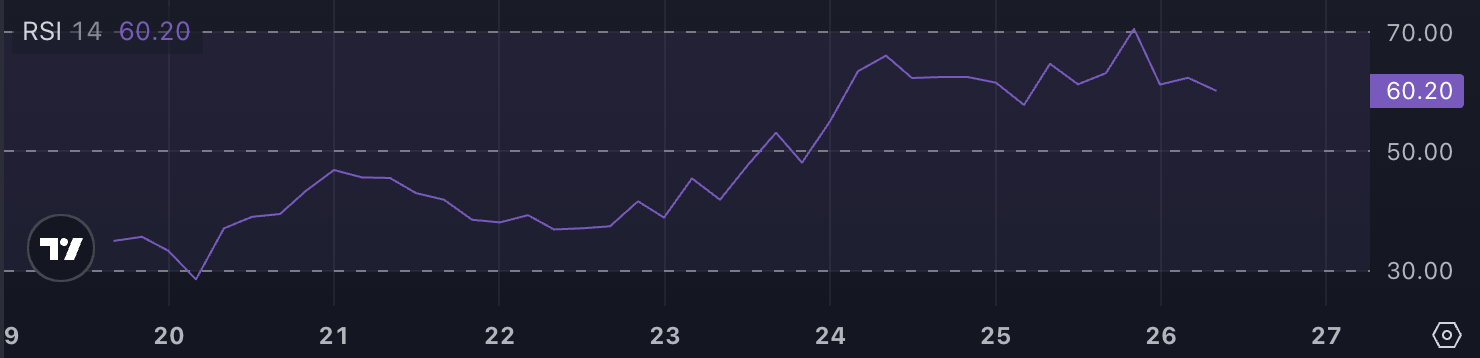

PENGU’s RSI Shows Neutral After Touching Level 70

PENGU’s Relative Strength Index (RSI) is currently at 60.2, down from 70 just a few hours ago after climbing from below 50 just two days ago. The recent movement reflects a strong burst in buying, followed by a slight correction as the token fell out of overbought territory.

While RSI remains in the neutral to bullish range, the decline suggests buying activity is cooling, possibly indicating that the market is entering a correction phase.

RSI is an indicator that measures the speed and magnitude of price movements between 0 and 100. An RSI above 70 indicates overbought conditions, often leading to a price correction, while an RSI below 30 indicates conditions oversold, signaling recovery potential.

With RSI at 60.2, the currency remains within the safe range, hinting there is still room for growth if buyers regain control. However, the recent pullback from the overbought zone implies that PENGU price is likely to stabilize in the short term, allowing the market to absorb profits before deciding on its next direction.

PENGU’s CMF Remains Very Positive

PENGU’s Chaikin Money Flow (CMF) index is currently at 0.17, down slightly from a peak of 0.21 on December 25. This is a sign that buying pressure has been building strongly for several days. via.

Although CMF is still very positive, the slight decline shows that the intensity of capital flows has diminished but still reflects an optimistic market environment.

CMF is a volume indicator that measures the accumulation or distribution of an asset over time, with values ranging from -1 to +1. Positive CMF values indicate accumulation and strong buying pressure, while negative values indicate distribution and selling activity.

With PENGU’s CMF at 0.17, positive cash flow is maintaining buying pressure, supporting the possibility of prices stabilizing or continuing to rise in the short term. However, a slight pullback from recent peaks could signal a period of correction as the market balances its recent upward momentum.

PENGU Price Prediction: Increase by 29.7%?

If the current uptrend continues, PENGU’s price could soon test $0.43, a key level that could pave the way for further gains.

A market break out of this resistance could see PENGU rise to $0.45 and even $0.50, marking a potential 29.7% upside from current levels. This will solidify PENGU’s position as the largest Meme Coin on Solana even more.

However, as stated by RSI and CMF, the uptrend may be weakening, indicating a possible reversal. If this happens, PENGU could test the $0.37 support level, and if this level fails to hold, the price could drop to $0.30.

In the worst-case scenario, a prolonged downtrend could push PENGU price as low as $0.229.