PEPE’s price has dropped nearly 8% in the past 24 hours, days after reaching its highest all-time high on December 9. Momentum indicators, including RSI at 33.3, show that PEPE is approaching the oversold zone but not yet reaching the important threshold of 30, leaving the door open for further correction.

Additionally, the 7-day MVRV ratio at -9.3% points to significant losses by short-term holders, with historical data suggesting a possible decline to -12% to – 15% before recovery. Whether PEPE holds key support at $0.0000188, or breaks it, is likely to determine its next big price move.

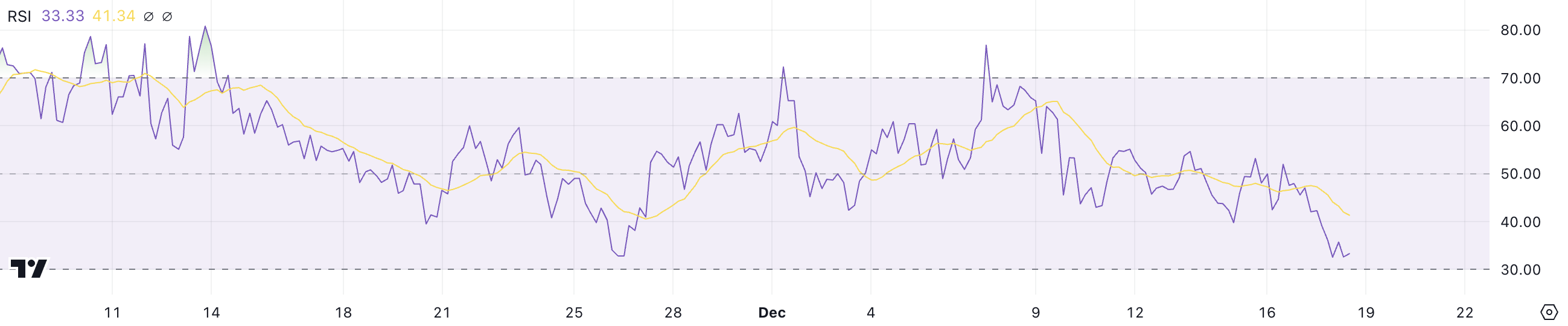

PEPE’s RSI Has Not Reached the Oversold Zone

PEPE’s RSI is currently at 33.3, reflecting a sharp decline from December 16. This shows that Meme Coin Coin is approaching oversold territory as the RSI nears the key threshold of 30.

The sharp drop in the RSI, along with a consecutive 8% correction over the past 24 hours, exposes increased selling pressure and short-term pessimism.

The RSI (Relative Strength Index) measures the speed and amplitude of price changes to assess whether an asset is overbought or oversold. RSI values above 70 indicate overbought conditions, which often signal a possible downside correction, while values below 30 indicate oversold conditions, which could lead to a recovery.

With PEPE’s RSI at 33.3 and close to oversold, the price could continue to come under downward pressure, but a potential recovery could occur if buyers start to come in at these lower levels .

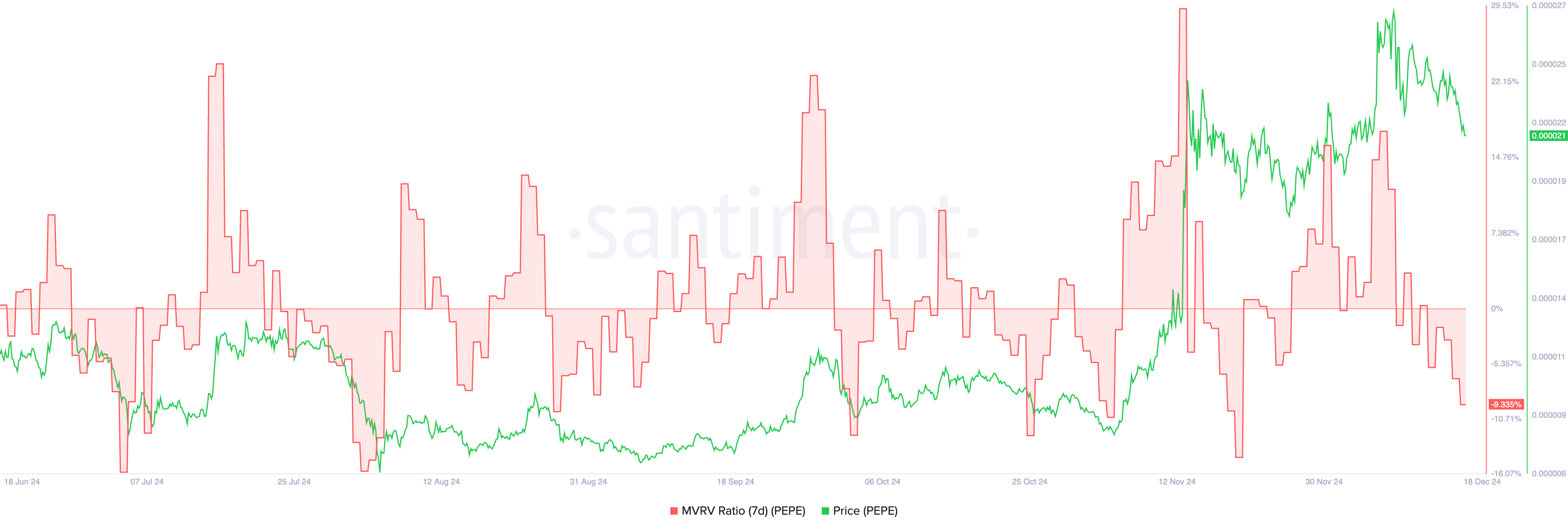

MVRV Ratio Suggests Correction May Continue

PEPE’s 7-day MVRV ratio is currently at -9.3%, a sharp decline from 17% on December 8 when its price hit a new record. This negative MVRV ratio shows that, on average, current short-term holders are suffering unrealized losses. The recent decline reflects increased selling pressure, suggesting that the current correction may last in the short term.

The 7-day MVRV ratio measures the average profit or loss of Tokens moved in the last 7 days compared to their current market value. Historical data shows that PEPE’s 7-day MVRV ratio typically reaches around -12% to -15% before price rallies occur.

If this trend continues, the current level of -9.3% suggests further declines are possible before PEPE finds a bottom and begins to recover.

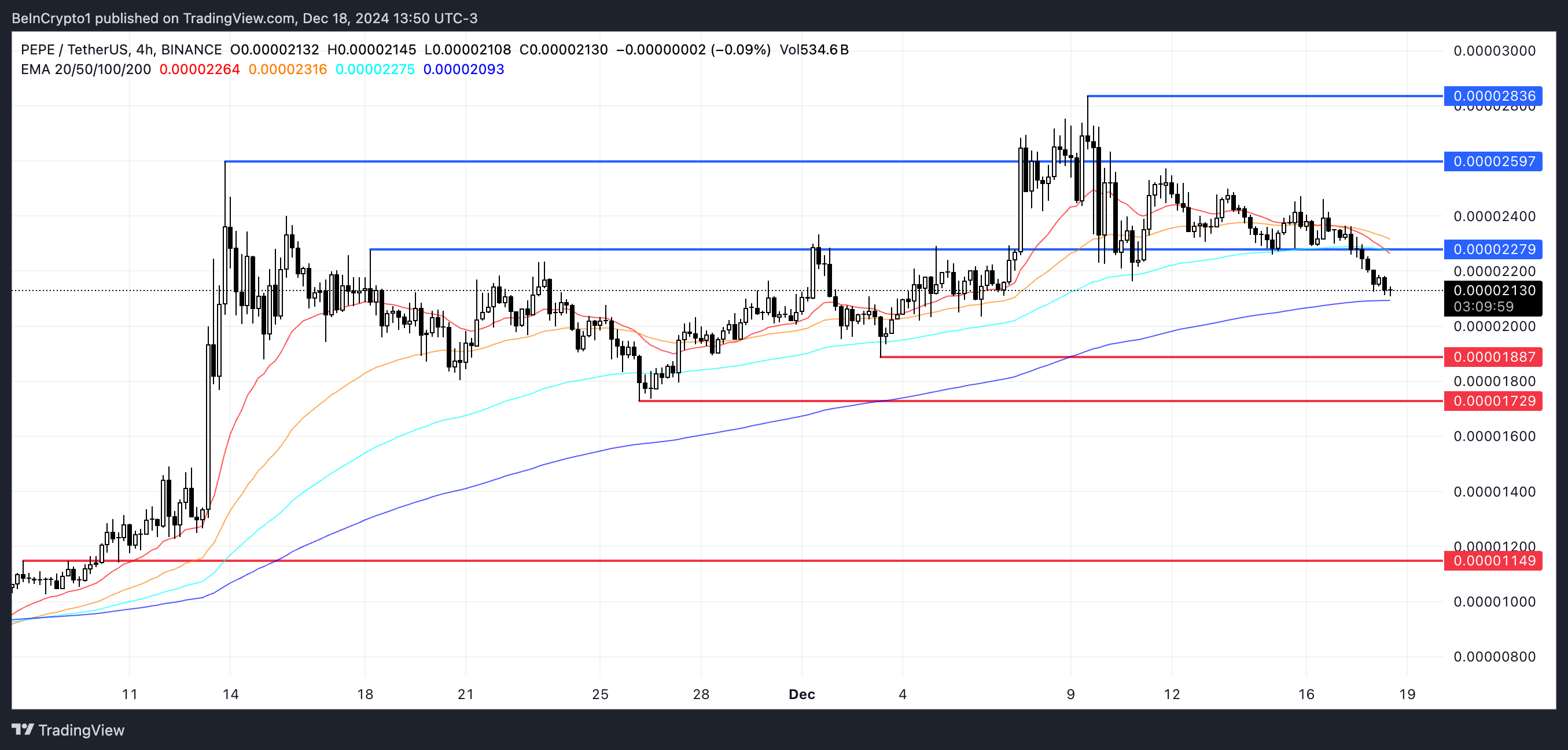

PEPE Price Prediction: Could a 47% Correction Soon Come?

The support at 0.0000188 USD is important for PEPE price, as if broken, the price could continue to decline. If this support fails to hold, PEPE could test $0.000017 and could fall as deep as $0.000011, representing a 47% correction from current levels.

This negative view is reinforced by its EMAs, as the short-term EMAs crossed below the long-term EMAs, signaling continued bearish momentum.

Conversely, if PEPE price can regain positive momentum, it could test the resistance at $0.0000227.

A break above this level could open the door for further upside, with targets at $0.0000259 and a potential $0.000028 if the uptrend consolidates.