Bitcoin (BTC) continues to struggle with sideways movement, preventing the cryptocurrency from reclaiming the $100,000 mark as solid support.

Amid this fluctuating price landscape, veteran trader Peter Brandt pointed out a similarity to Bitcoin’s 2018 pattern, sparking speculation about the cryptocurrency king’s next move.

Reshaping Bitcoin Strategy

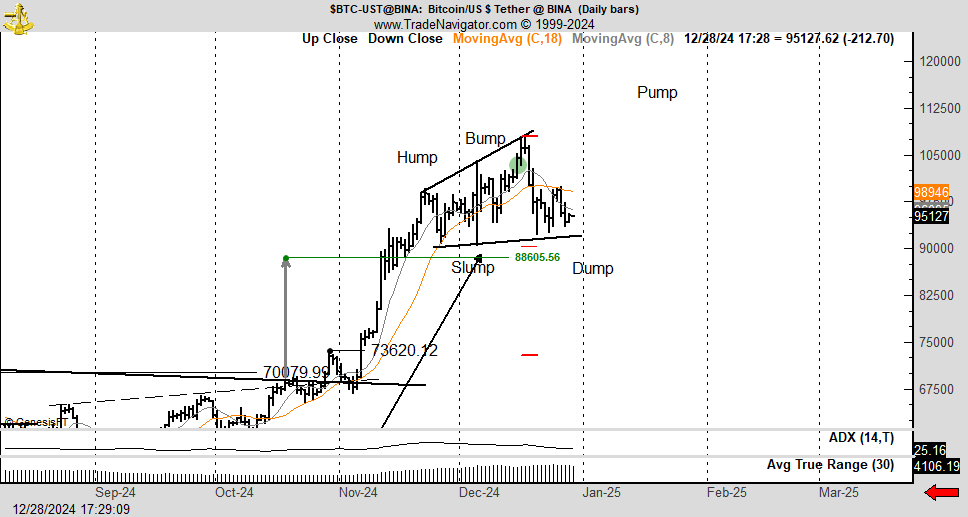

Peter Brandt commented that Bitcoin resembles an old pattern from 2018, which occurred before BTC broke its Parabolic Advance. This pattern, known as BHLD (Bump, Lump, Hump, Dump), has a variation called Hump-Slump-Pump-Dump, which appears to be consistent with Bitcoin’s current trajectory and could be its direction. Its next go.

“If you’re a Bitcoin fan, check out this post from a few years ago. It describes the famous structure Hump Slump Bump Dump Pump in that, the same situation could happen right now,” Brandt declared.

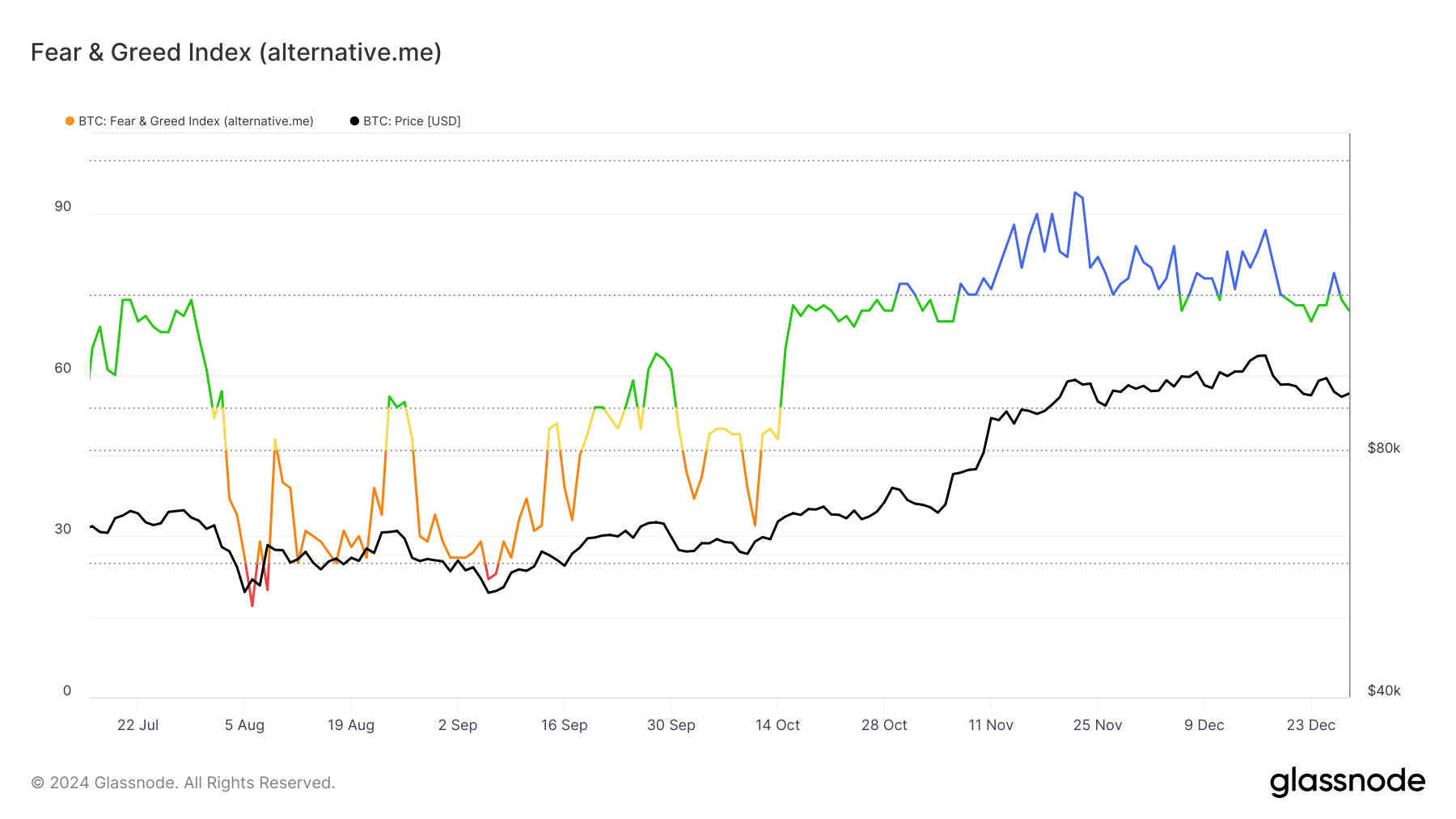

Bitcoin’s macro momentum, as reflected in the Fear and Greed Index, is shifting from Extreme Greed to lower greed territory. History shows that BTC has corrected sharply during periods of peak greed, making this change a positive sign for its value stabilization.

Current greed levels suggest a recovery as long as it does not escalate into excessive selling pressure. While selling remains a possibility, moderation in market sentiment could give Bitcoin the opportunity to make short-term gains.

BTC Price Prediction: Support Strengthens

Bitcoin is trading at $94,224, trying to consolidate $95,668 as support. For this to happen, investors must resist profit taking, allowing BTC to stabilize and restore lost momentum.

If Bitcoin can retake $100,000 as support, this could signal a short-term uptrend. This will be the driving force to help BTC recover recent losses and continue its upward trajectory, strengthening investor confidence.

On the contrary, if it fails to hold $95,668, Bitcoin could fall deeper, testing the support level at $89,800. This price drop would negate the bullish view and push back BTC’s recovery to January 2025, prolonging uncertainty for investors.